They’re selling options to traders looking for big wins, and when those options expire worthless, the seller of the option gets to keep the premium he collected.

Many traders use these spreads to trade range-bound markets, where there’s a sustained technical range with well-defined support and resistance levels. These are winning trades should the market remain within the defined range through the life of the trade.

While Iron Condors and Iron Butterflies both take advantage of the same market dynamics, there are situations where it makes sense to use one over the other.

Selling Options: Shorting Volatility

Both Iron Condors and Iron Butterflies are non-directional, limited risk option spreads. Instead of trying to profit by being bullish or bearish, these option spreads are tools to make money from options you think will expire worthless.

If you had the chance to look at the options market during the GameStop madness in 2021, you witnessed insane option prices. So many traders wanted to bet against the stock but didn’t want to get destroyed in a short squeeze, so they preferred to buy puts. This made put options insanely expensive to the point where you could be right on the trade and still lose money.

As a result, selling puts was a prevalent strategy to take advantage of overpriced options. These situations occur every day to varying degrees.

When you short an option, you’re selling it to another buyer. For example, let’s say you sell a call with a strike price of $20 on a $15 stock for $1. The stock is still at $15 at expiration, and the option expires worthless. You get to keep the entire $1.

It’s well-known that most options expire worthless, so this is a compelling trade to many traders. However, the downside is your unlimited risk when shorting options. Suppose the stock in the example above was $30 at expiration. The option is now worth $15, and you’re $14 in the hole.

For this reason, many traders use spreads like Iron Condors and Iron Butterflies to cap their downside. These spreads involve shorting options but buying further OTM options to limit risk.

What is an Iron Condor?

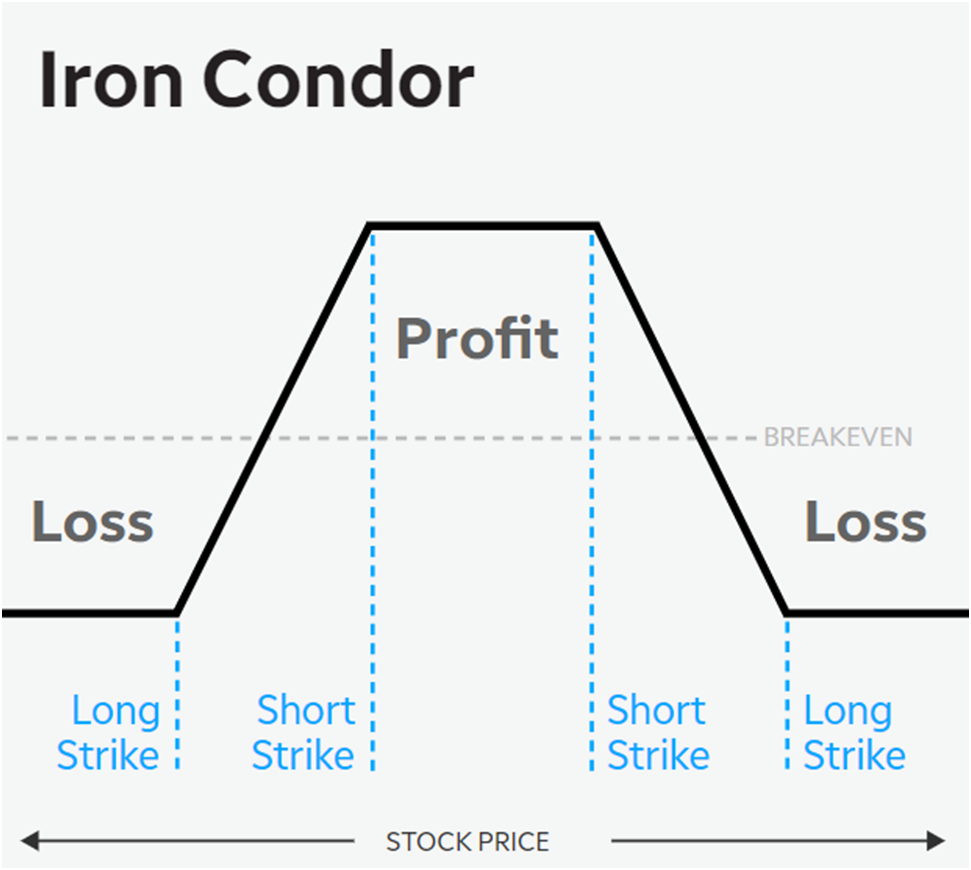

If you’re familiar with other options spreads, an iron condor combines a short vertical call spread and a short vertical put spread. Put another way, it’s a short strangle where you buy “wings” (OTM options) to cap your downside.

If you’re unfamiliar with the dictionary full of the lingo we options traders use, an Iron Condor involves shorting an out-of-the-money (OTM) put and call and buying a further OTM put and call.

These extra OTM options we buy are used to cap our downside. Because shorting options comes with an unlimited downside, the Iron Condor has the benefits of shorting options with the added benefit of limiting our downside.

Here’s a visual representation of the Iron Condor:

What is an Iron Butterfly?

The Iron Butterfly is like an Iron Condo with a higher reward/risk ratio but a lower probability of profit.

The primary difference is the short strikes. While an Iron Condor might look like this with underlying trading at $32:

● BUY (5) 28 Strike Calls

● SELL (5) 30 Strike Calls

● SELL (5) 32 Strike Puts

● BUY (5) 34 Strike Puts

The equivalent Iron Butterfly might look like:

● BUY (5) 30 Strike Calls

● SELL (10) 32 Strike Calls

● BUY (5) 34 Strike Calls

In choosing your strikes in an Iron Condor or Iron Butterfly trade, you’re defining the range you expect the underlying to remain within.

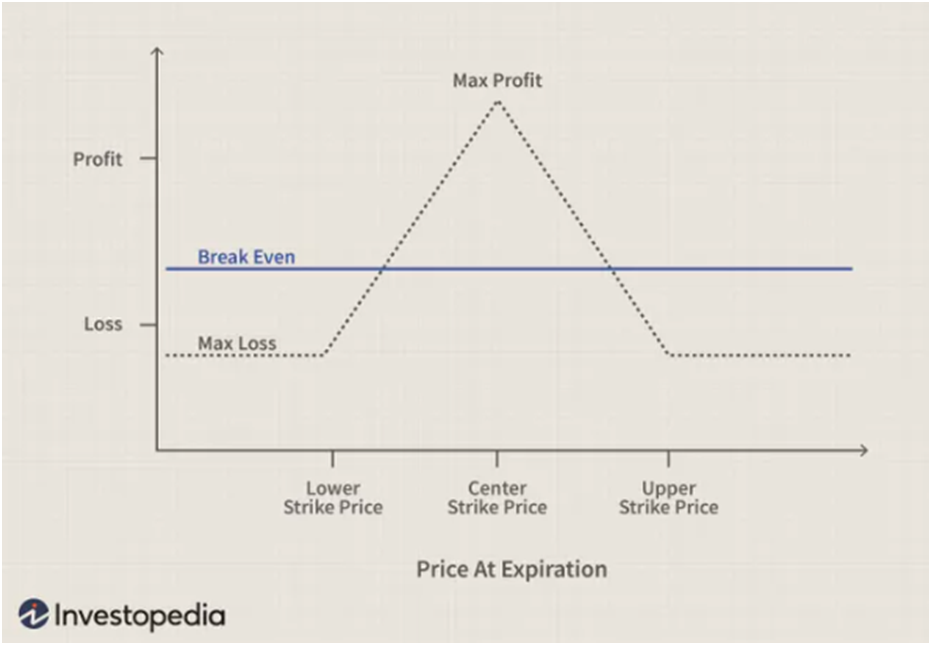

Iron Condors are more forgiving, as that range is much wider. Iron Butterflies, on the other hand, short puts and calls at the same strike, making your defined range narrower and making it less likely that you’ll profit on the trade. You will, however make more money if you’re right on the trade.

Let’s compare the payoff diagram of an Iron Butterfly to that of an Iron Condor.

First, here’s the payoff diagram of an Iron Butterfly:

The upshot is that if you’re confident that a stock will settle within a tight range by expiration, the Iron Butterfly is the preferred trade. Your potential reward is much higher for getting things right. On the other hand, if you want to give the market some more wiggle room, Iron Condors are preferred.

Bottom Line

Remember that option spreads are trade constructions, not trade strategies. There’s no inherent edge in trading Iron Condors or Iron Butterflies. They’re just tools to apply to market dynamics where its more likely for markets to stay range-bound.

To summarize:

-

Iron Condors are made up of both a short vertical spread and a short vertical put spread.

- Iron Butterflies are made up of one short option and two long “wings” that protect your downside.