If Bitcoin stays near $67k, it breaks the Power Law floor by mid-December

Bitcoin has until the end of the year to recover, or the Power Law will be invalidated. The Power Law model isn't a prophecy. It's a time-based regression that treats Bitcoin's long-run price path as a power curve, and the “deadline”

Bitcoin may tumble toward $30,000 next year unless it shows real progress toward quantum proof upgrades

Bitcoin's current bear market could worsen over the next year if the flagship digital asset fails to address concerns about quantum computing. In a Feb. 20 report, Charles Edwards, Capriole founder, claimed that Bitcoin’s market value should already be discounted for

As Ethereum Staking Surges, SolStaking Expands the Opportunity for Scalable Crypto Returns

The post As Ethereum Staking Surges, SolStaking Expands the Opportunity for Scalable Crypto Returns appeared first on Coinpedia Fintech News Ethereum has quietly crossed a major threshold. More than half of its total supply is now locked in staking. Even as ETH

Why Is Tether USDT Supply Crashing? Biggest Monthly Drop Since FTX as USDC Surges

The post Why Is Tether USDT Supply Crashing? Biggest Monthly Drop Since FTX as USDC Surges appeared first on Coinpedia Fintech News Tether’s USDT just posted a $1.5 billion supply drop in February, marking the largest monthly decline since the aftermath

KITE Crypto On-Chain Data Signals Aggressive Expansion as Whale Activity and Volume Surge

The post KITE Crypto On-Chain Data Signals Aggressive Expansion as Whale Activity and Volume Surge appeared first on Coinpedia Fintech News KITE crypto has quietly transitioned from low-volatility consolidation into full-blown on-chain expansion and the data doesn’t look accidental. After weeks of

Expert Reveals How Low Bitcoin Could Crash If $65K Breaks

The post Expert Reveals How Low Bitcoin Could Crash If $65K Breaks appeared first on Coinpedia Fintech News Bitcoin is once again at a critical level, and traders are asking the big question: how low can Bitcoin price go if support

Ethereum Whale Profits Turn Negative: Will Whale Pressure Trigger a Sell-Off for ETH Price?

The post Ethereum Whale Profits Turn Negative: Will Whale Pressure Trigger a Sell-Off for ETH Price? appeared first on Coinpedia Fintech News The crypto market has been bleeding red over the past few weeks, with Bitcoin hovering below $70K. This has

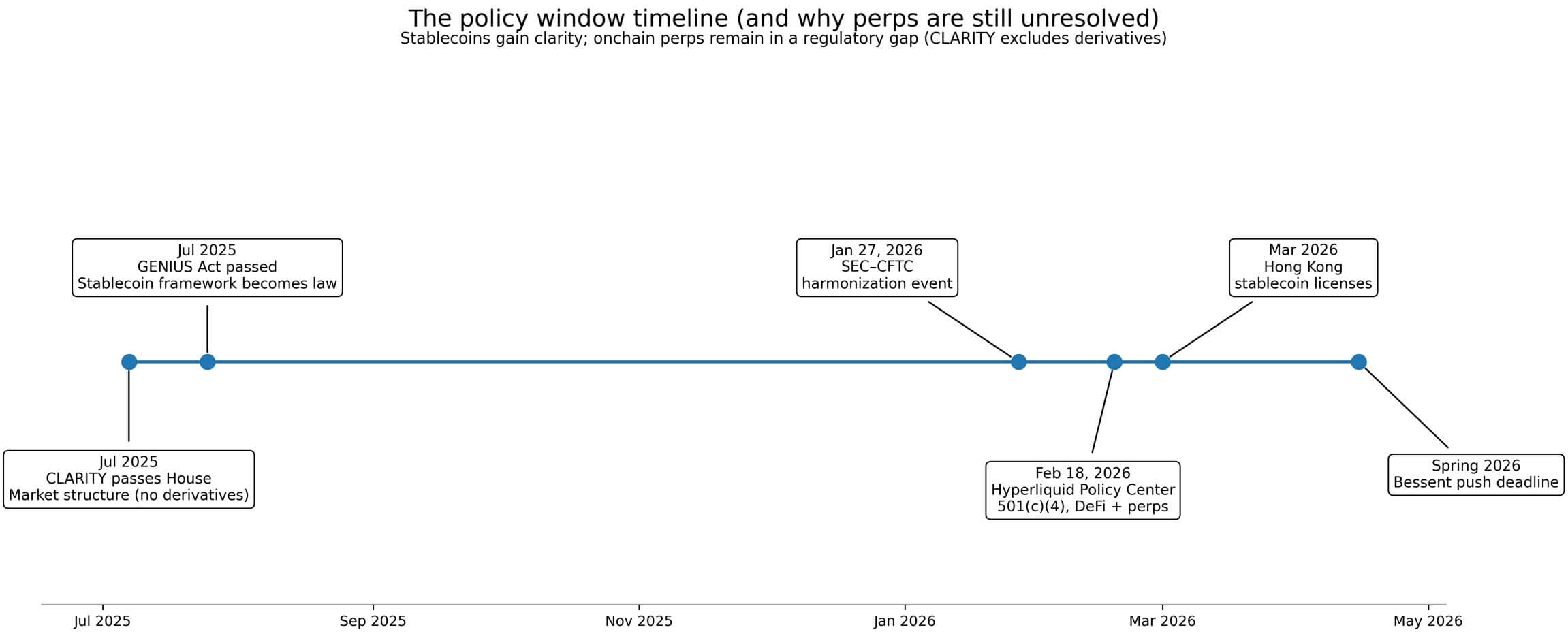

If CLARITY stalls, on-chain perps stay offshore — and US traders get pushed out

Hyperliquid launched a policy center in Washington on Feb. 18, seeded with 1 million HYPE tokens worth roughly $28 million, led by Jake Chervinsky, the crypto lawyer who spent years building the industry's Capitol Hill playbook. The Hyperliquid Policy Center operates

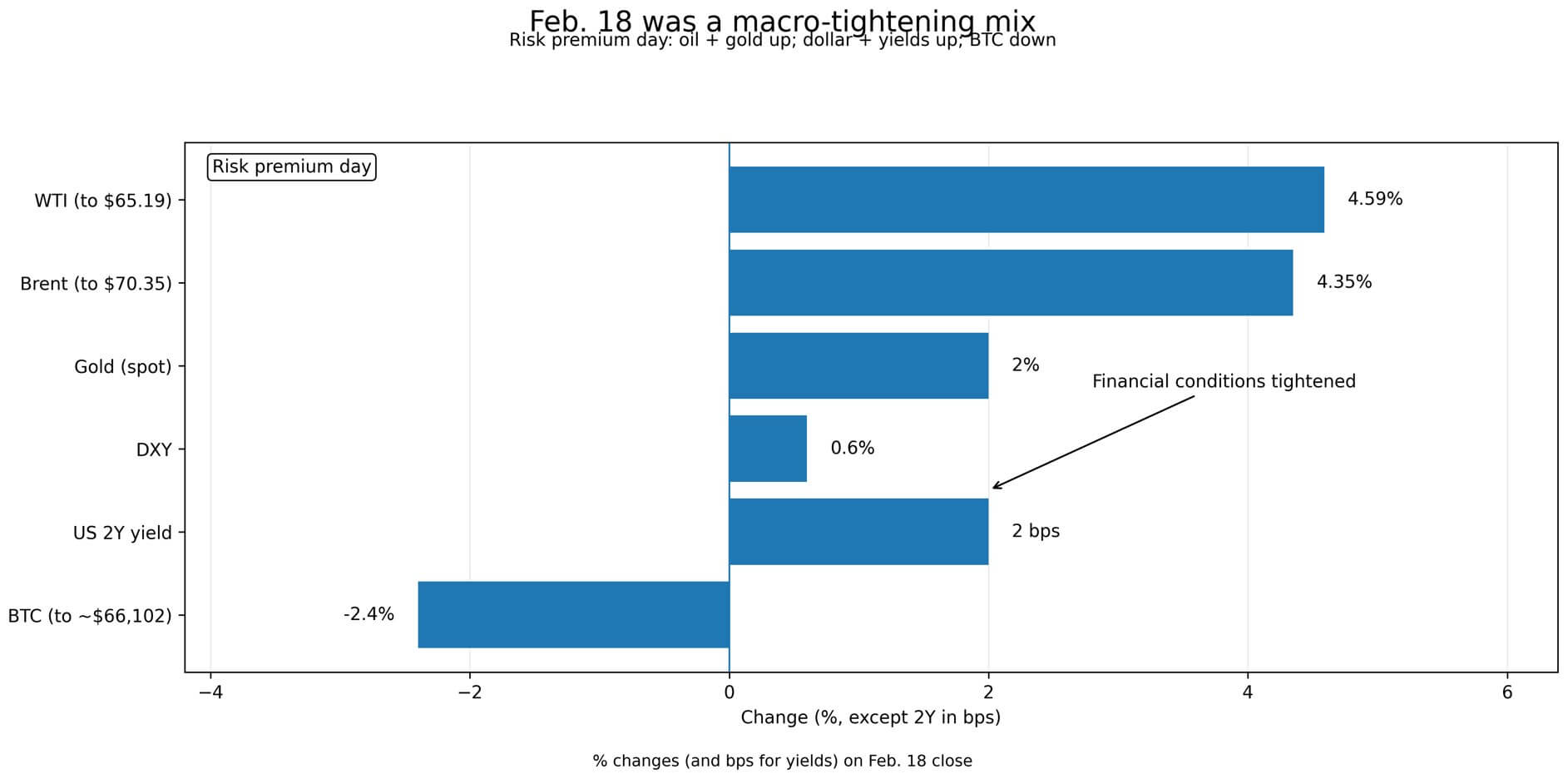

Bitcoin faces a new selloff if oil holds $70 after spike and the Fed turns less patient

Oil isn't supposed to be the story in 2026. The macro narrative powering “cuts soon, liquidity soon” trades relies on disinflation staying intact. However, Brent jumped 4.35% to $70.35 on Feb. 18, and WTI surged 4.59% to $65.19 after headlines revived

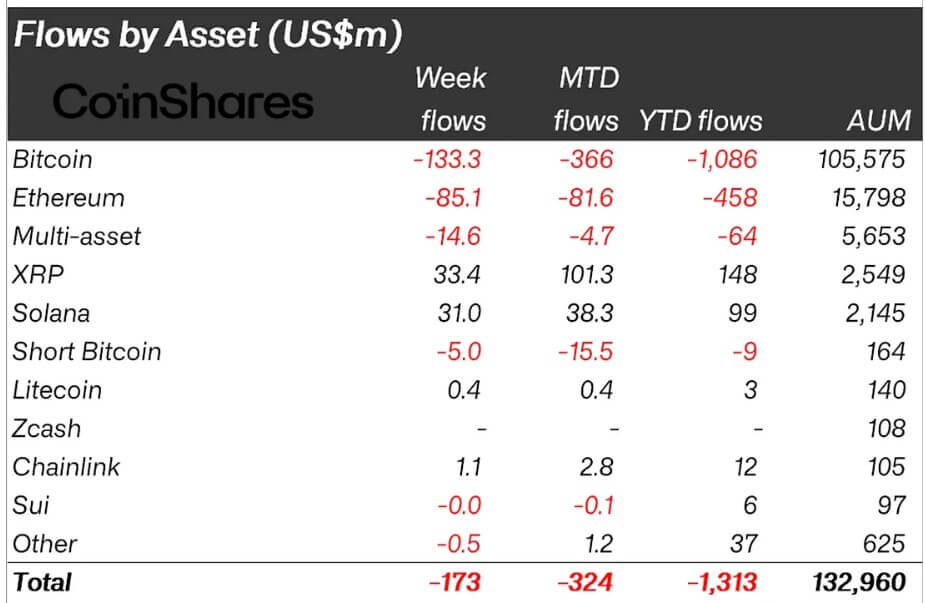

XRP sentiment hits a 5-week high as money rotates away from Bitcoin and Ethereum

XRP is attracting institutional money and a burst of bullish positioning, even as much of the crypto industry remains stuck in a risk-off tape. According to a CoinShares report, XRP is the best-performing crypto token this year, attracting around $150 million in fresh

Bitcoin eyes new liquidity as the Fed’s $18.5 billion repo spike reignites money printer chatter

Bitcoin, the largest cryptocurrency by market capitalization, continued its price struggles as traders weighed two stress-tinged signals from the US financial ecosystem. This week, there was a sudden $18.5 billion Federal Reserve overnight repo operation, and Blue Owl Capital has decided

CFTC chief sides with prediction markets over state regulators in a high-stakes court case

The Commodity Futures Trading Commission (CFTC) is stepping in to stop what it calls an “onslaught” of state-level regulation of prediction markets. CFTC Chairman Michael Selig said Tuesday in a video posted on X that the agency has filed a “friend

Why Is the Crypto Market Going Down Today?

The post Why Is the Crypto Market Going Down Today? appeared first on Coinpedia Fintech News The crypto market is under pressure again. Total market capitalization has fallen to $2.27 trillion, down just over 2% in the last 24 hours. Bitcoin has

Is This the Right Time to Buy Bitcoin?—Here’s What This Chart Suggests!

The post Is This the Right Time to Buy Bitcoin?—Here’s What This Chart Suggests! appeared first on Coinpedia Fintech News Bitcoin has been steadily pulling back after failing to hold above the $90,000 consolidation zone. Over the past few days, selling

Crypto Buy Alert For Bitcoin, Ethereum and XRP: Here’s What Comes Next

The post Crypto Buy Alert For Bitcoin, Ethereum and XRP: Here’s What Comes Next appeared first on Coinpedia Fintech News Crypto markets may be setting up for a short-term bounce, according to market strategist Gareth Soloway. After weeks of pressure and