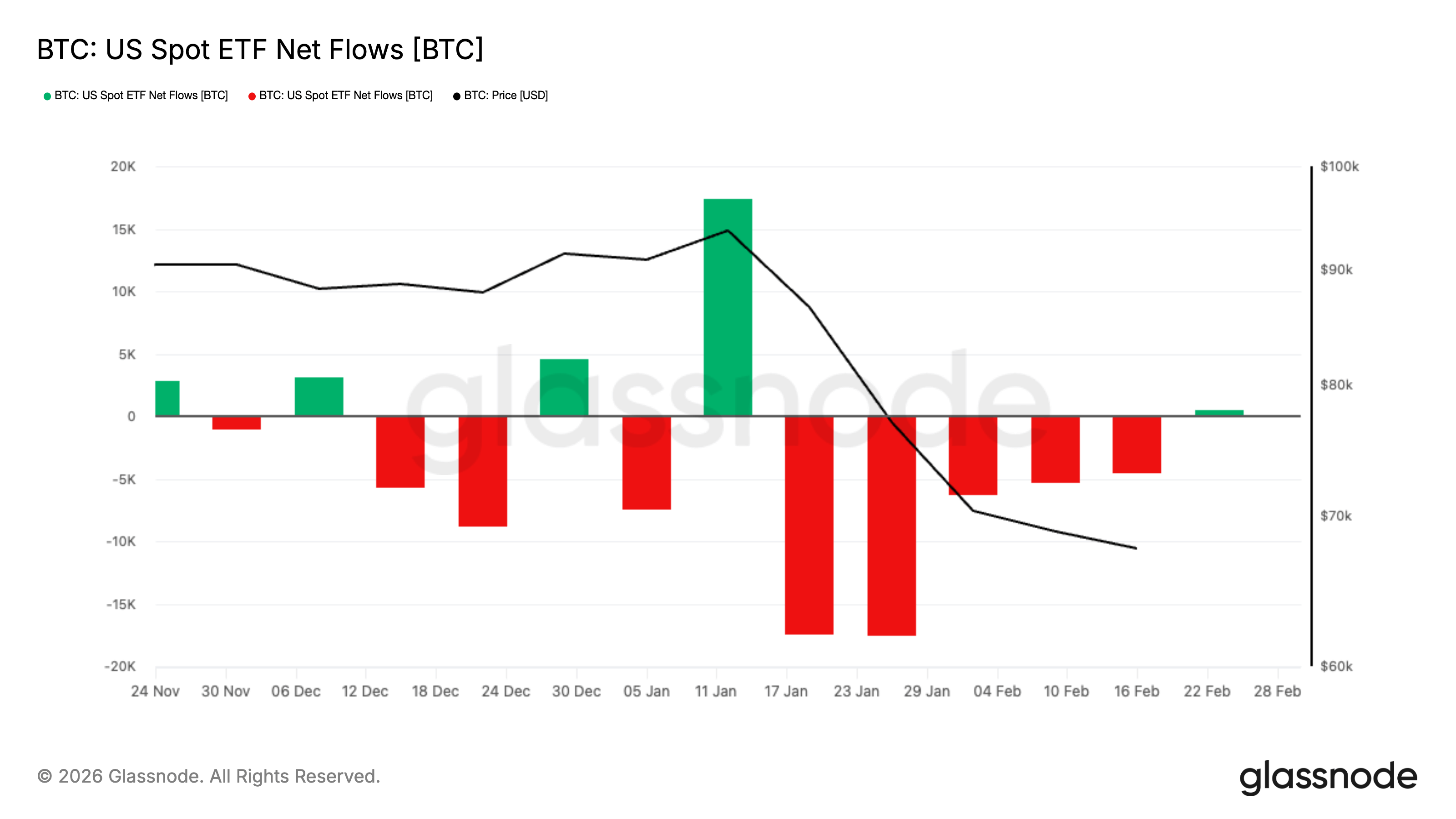

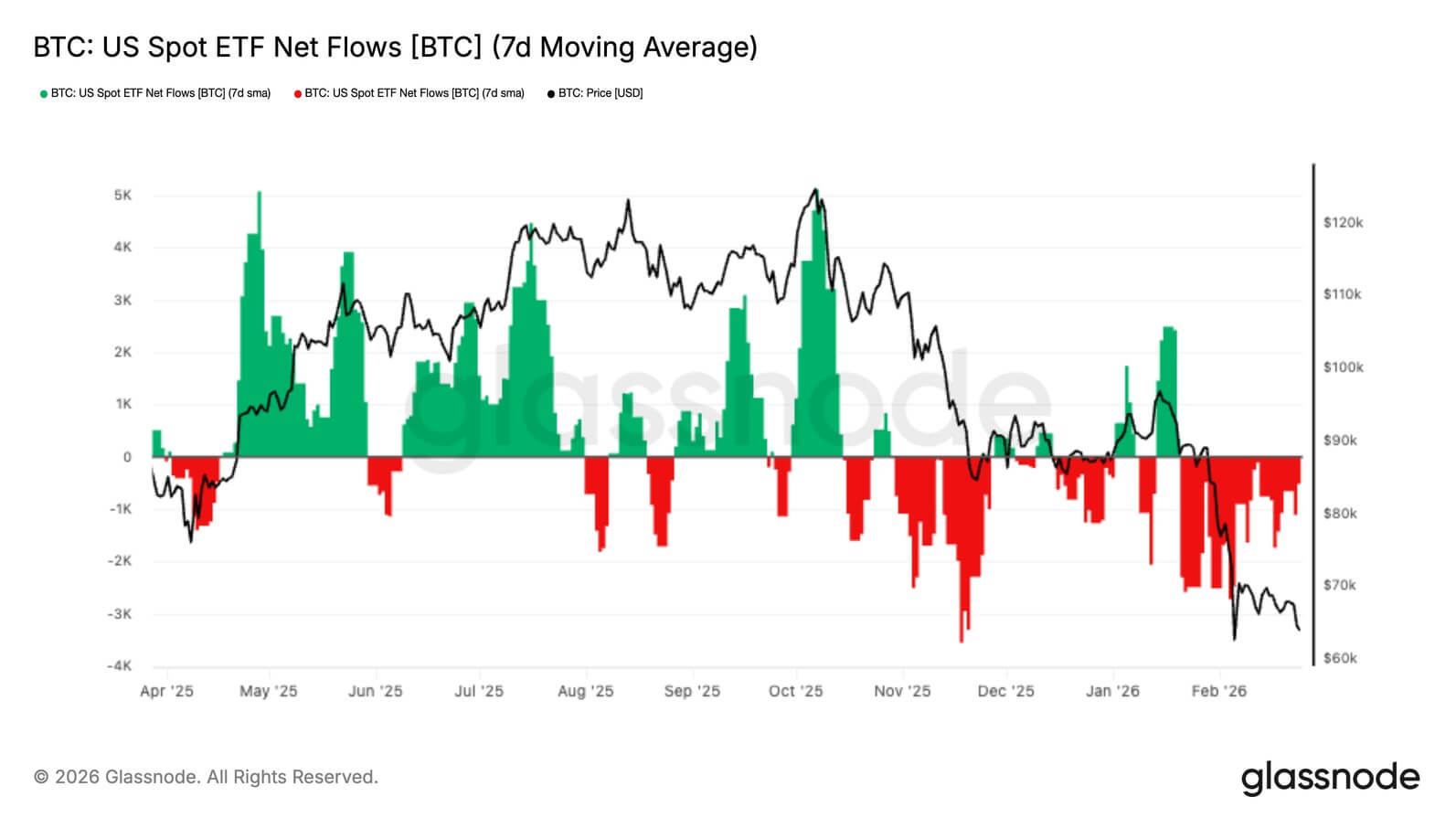

After Bitcoin ETFs drained $3.8 billion in five weeks it suddenly flipped positive, changing who controls the next move

For the better part of the last two years, spot Bitcoin ETFs were treated like a one-way door. They took Bitcoin out of keys and operational hassle and turned it into a ticker that fit inside every normal portfolio. Money

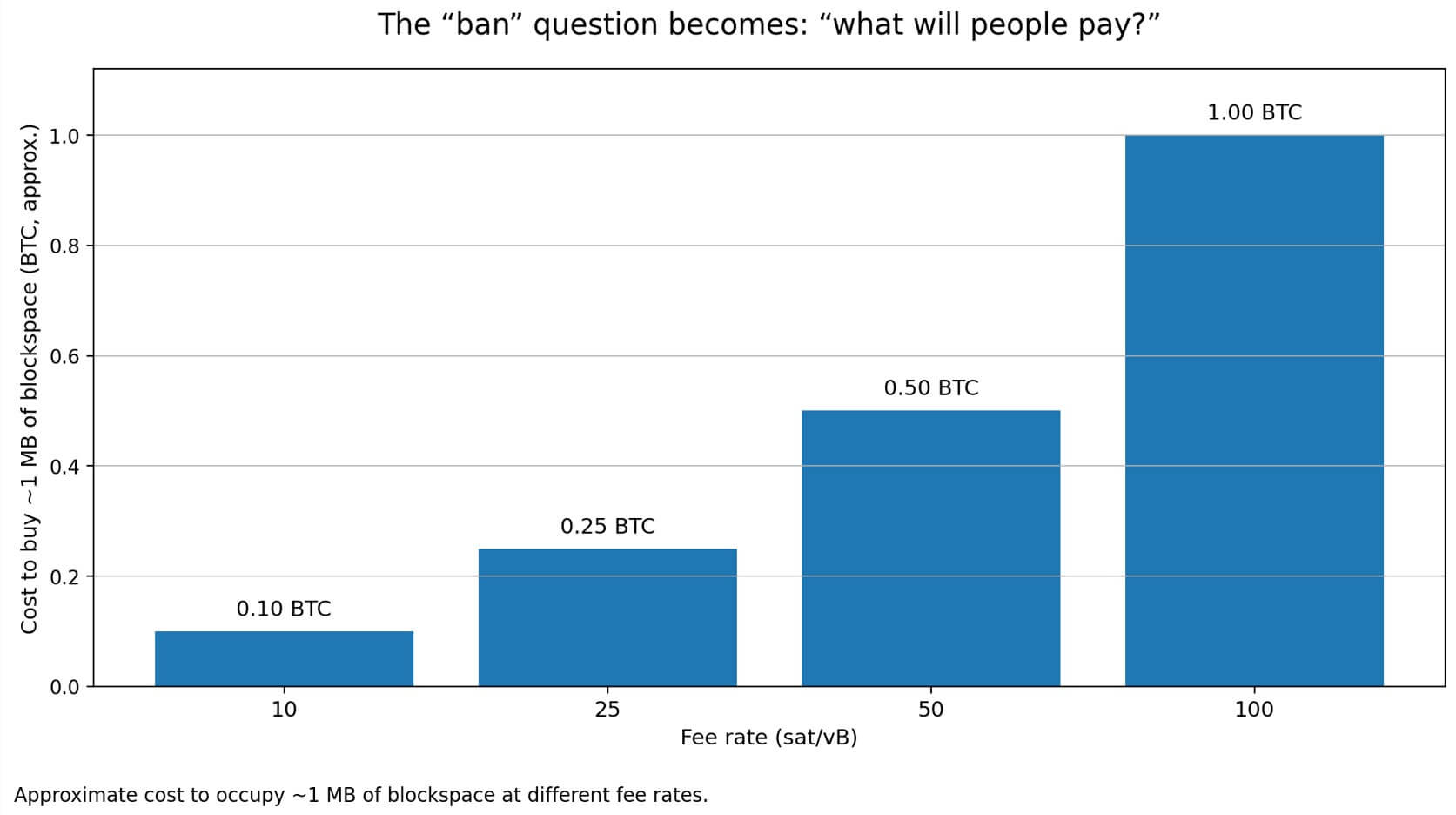

Bitcoin developer hides a 66KB image in a transaction to expose a governance blind spot vulnerable to spam

A Bitcoin developer embedded a 66-kilobyte image inside a single transaction without using OP_RETURN or Taproot. The transaction followed consensus rules. Anyone can verify the bytes using standard node software. Martin Habovštiak didn't do this to make art, but to prove

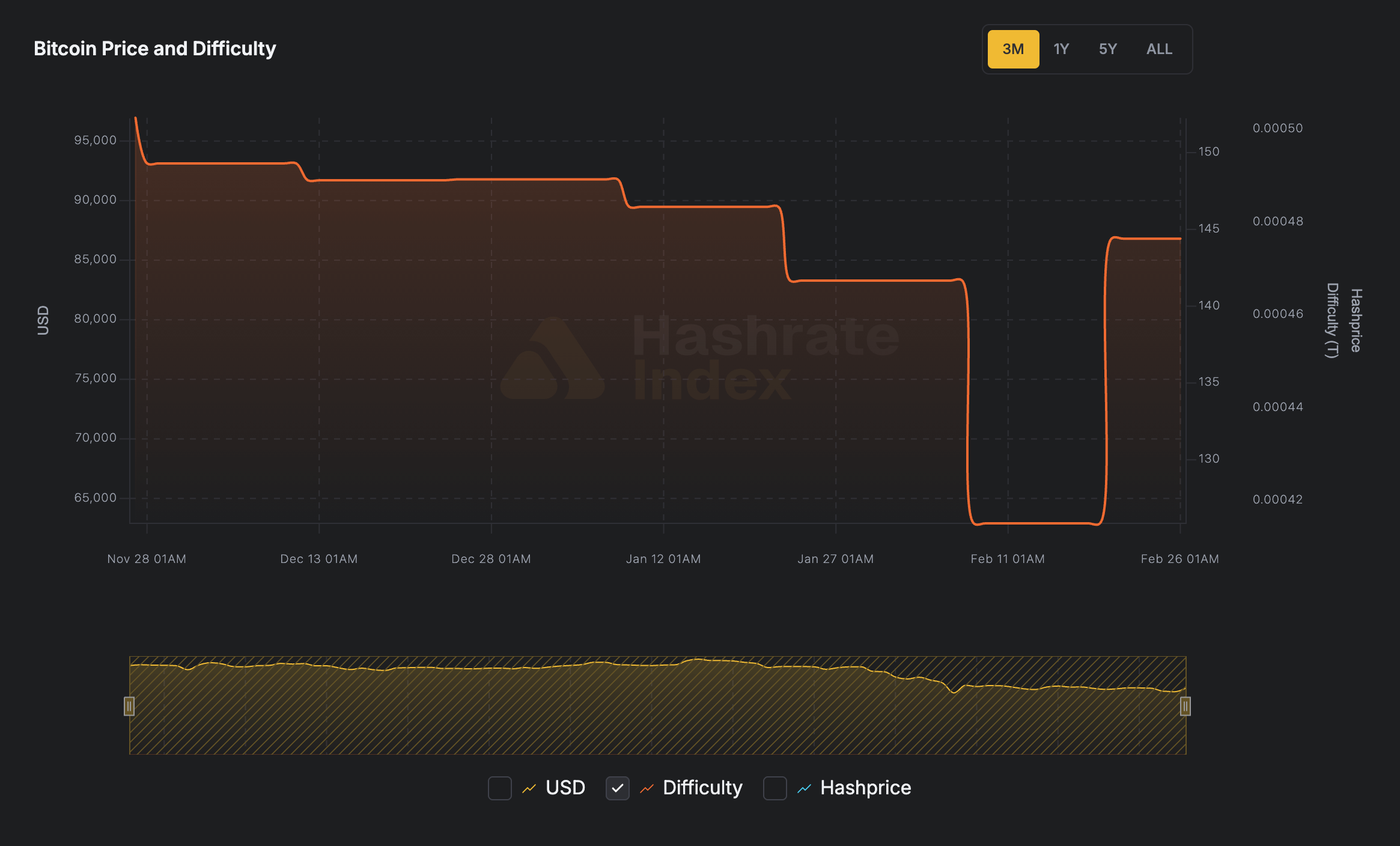

Bitcoin’s 15% difficulty spike allows one on-chain metric to flip miners from sellers to hoarders in days

Bitcoin difficulty just reset about 15% higher to roughly 144.40T. While this is neither the first nor the last, it is the largest since around 2021. The timing is important because the protocol tightened miner economics while Bitcoin has been chopping

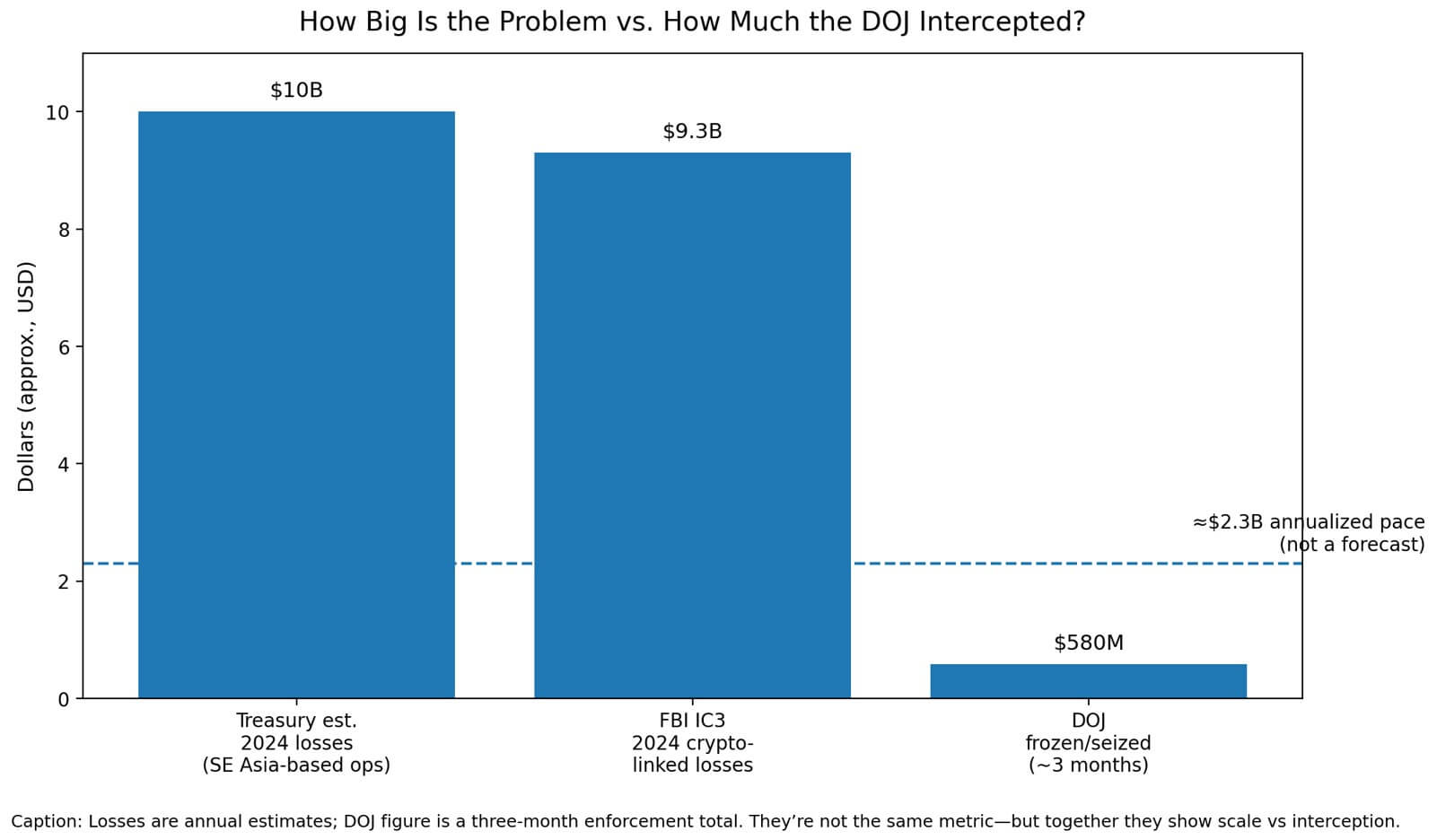

Crypto investment cons now run like call centers and the DOJ $580M haul shows where the money pools

For years, the wrong-number text arrived like clockwork. A friendly mistake, then apologies, small talk, and gradual friendship. Eventually, the investment tip was a “sure thing” on a slick platform showing returns that seemed too good to ignore. Americans watched account

Bitcoin price rebound comes under threat from UN Security Council alarm and Hormuz oil scare

Bitcoin held near $66,000 on Sunday, March 1, after a weekend geopolitical shock tied to U.S. and Israeli strikes on Iran, setting up Monday’s U.S. reopen as the first major liquidity and spot ETF flow test of the rebound. The diplomatic

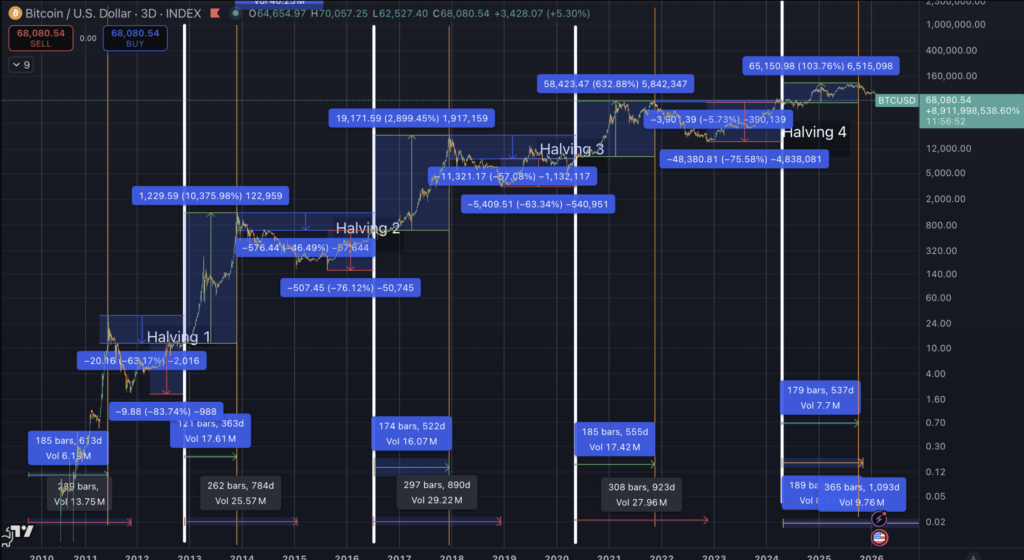

Bitcoin price projected to bottom at $35,000 in December by model that timed the last two market tops

Since it's pretty clear we've now seen this cycle's bull market high, I've created an updated halving-cycle model built on four Bitcoin cycles. The model projects a cycle low near $35,000 in December 2026 after a 72.5% drawdown from a $126,219

Why Bitcoin traders have to price tariffs like surprise rate hikes while waiting on social media posts for the next $175B trigger

The US Supreme Court struck down President Donald Trump’s emergency tariffs under IEEPA on Feb. 20, and markets immediately inherited a large cash flow question. The amount at stake was more than $175 billion in tariff collections that could be

Bitcoin just dumped 7% after Trump hit Iran, and the real reason has nothing to do with crypto

President Donald Trump has pulled the United States into military action against Iran, and the first consequence for crypto markets was another wave of selling rather than a rush into Bitcoin as a haven. According to CryptoSlate’s data, BTC price dumped

Bitcoin’s self custody culture created an inheritance time bomb, and 2026 may be when it starts detonating

Bitcoin is turning into multi-generational wealth, and a large share of holders still run it with a single point of failure. One accident, illness, or a stretch of incapacity can be the difference between inheriting generational wealth and losing everything. That's

Bitcoin recovers instantly after Iran war crashes price but one Monday number could flip the next move

Bitcoin defends $64K after U.S., Israel strikes on Iran as ETF flows return to center stage Bitcoin traded through a weekend macro shock after U.S. and Israeli strikes on Iran sparked regional retaliation. The largest price swings occurred during low-liquidity hours, leaving

Bitcoin price rally is riding record $1.2 trillion margin debt, and the unwind could be here already

Bitcoin’s rally is riding record $1.279 trillion margin debt, and the unwind could arrive without warning Bitcoin’s next phase is being shaped by a record build in U.S. market leverage, recession-leaning survey data and an expanding Treasury buyback program that is

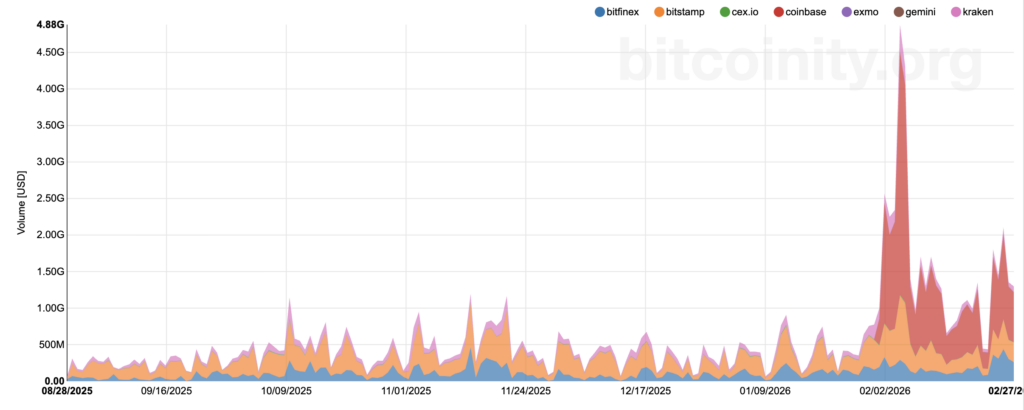

Bitcoin sees $1B ETF inflows after brutal outflow streak, setting up the clearest path to $90,000

Bitcoin has rebounded from an early-February slide that briefly pushed it to $60,000 and produced its most oversold signal on record, easing some of the pressure that has weighed on crypto markets. According to CryptoSlate's data, the flagship digital asset has

Bitcoin drops 3% as inflation hots up again, and a quiet services spike just changed the rate cut story

Bitcoin drops 3% as PPI beats forecasts, and a tiny detail could skew the next macro trade Bitcoin traded lower after January producer inflation came in above consensus. That sets up a longer stretch in which rate expectations may steer crypto

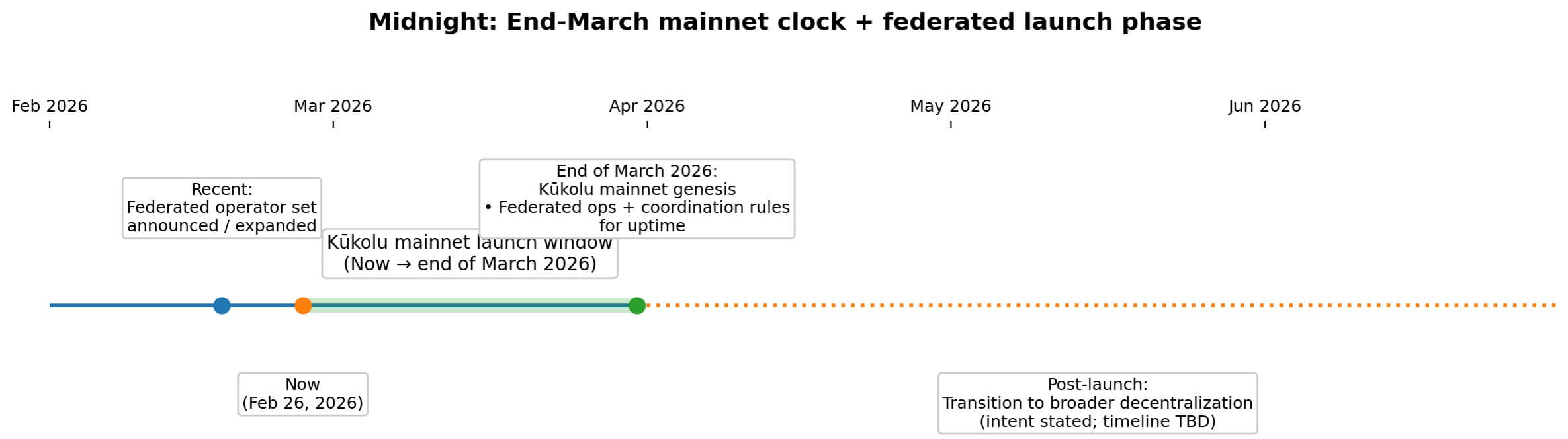

Google Cloud and MoneyGram just signed on to run launch Midnight nodes for new privacy network banks want

Google Cloud, MoneyGram, Vodafone's Pairpoint, and eToro will run launch-phase nodes on Midnight, a zero-knowledge privacy network targeting a mainnet launch at the end of March 2026. The pitch isn't anonymity, but selective disclosure. It's the ability to prove compliance or

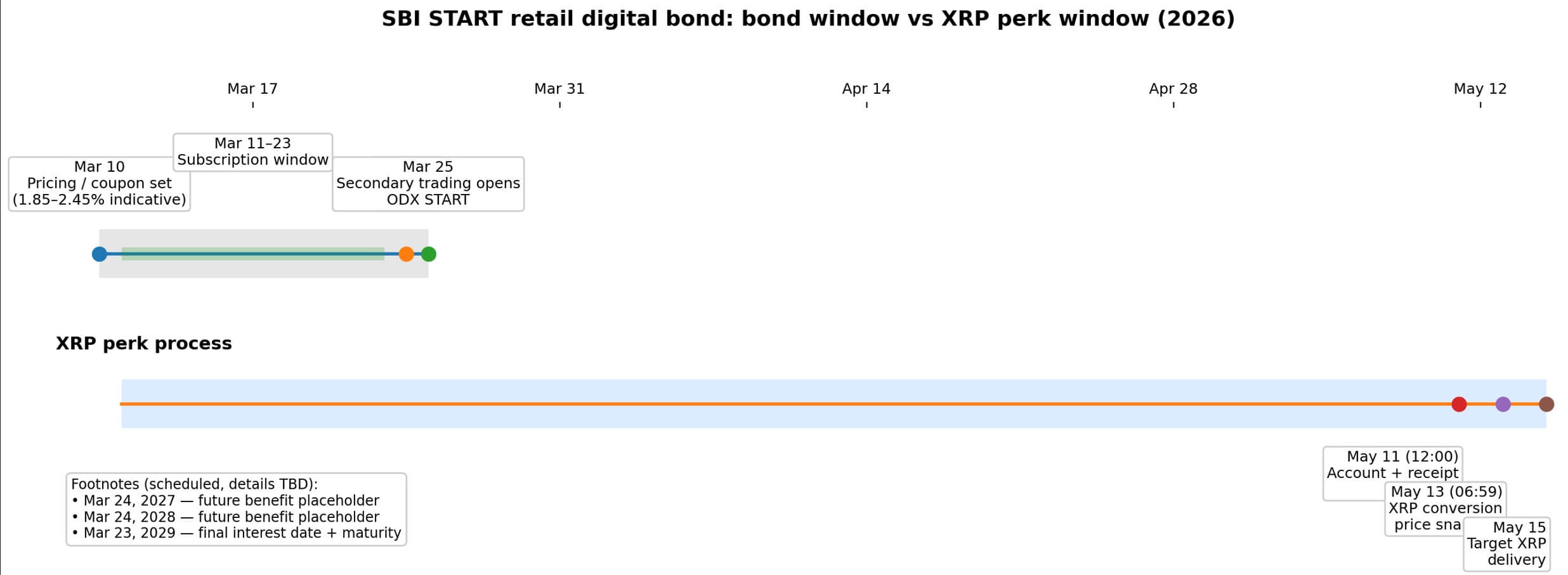

SBI Holdings is dangling XRP to sell a plain three year bond, but the numbers show how small

Japan's SBI Holdings will issue a ¥10 billion retail bond on March 24, but the story is the XRP perk dangled in front of buyers, conditional on opening an account at SBI VC Trade and completing receipt procedures by noon

Notice Bitcoin selling off at market open? Jane Street is taking the blame, but the data points elsewhere

Bitcoin’s rebound toward $70,000 over the last 24 hours has revived a familiar debate in crypto markets: whether Wall Street firms operating within the spot exchange-traded fund (ETF) ecosystem have gained too much influence over price discovery. The latest target is

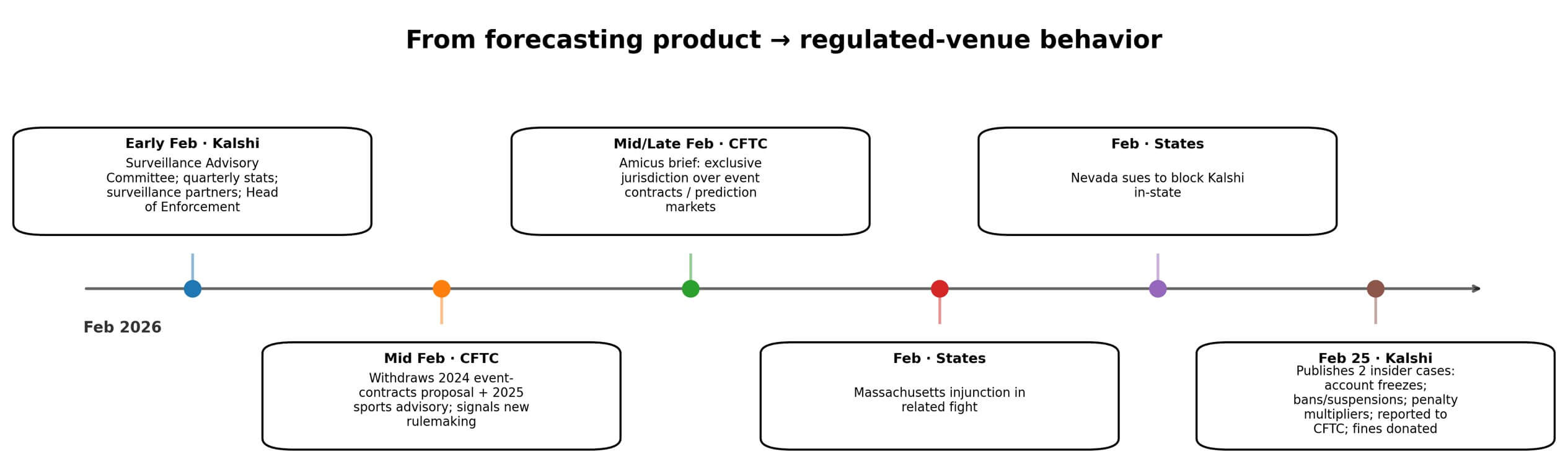

200 insider trading probes opened on Kalshi and one quiet change could remake prediction markets overnight

Prediction markets promised something elegant: put money behind beliefs, and the price converges on reality. The wisdom of crowds, sharpened by skin in the game. No pollsters, no pundits, just probabilities inching toward truth as traders stake capital on what they

Bitcoin surged toward $69,000 after a brutal flush, but Glassnode says one level decides if it fades

Bitcoin bounced back toward $69,000 on Feb. 25 after an intraday flush that printed lows in the low-$60,000s across multiple venues, liquidating nearly $500 million in short positions. The move keeps price inside the $60,000-$69,000 range that has defined February trading,