XRP volume is exploding in Korea because it exploits a specific gap in the country’s spot-only exchange laws

XRP has become the default trading chip of South Korea, bypassing Bitcoin and Ethereum to dominate the country’s high-velocity retail market. While institutional capital worldwide typically gravitates toward Bitcoin as a store of value, South Korean trading patterns tell a different

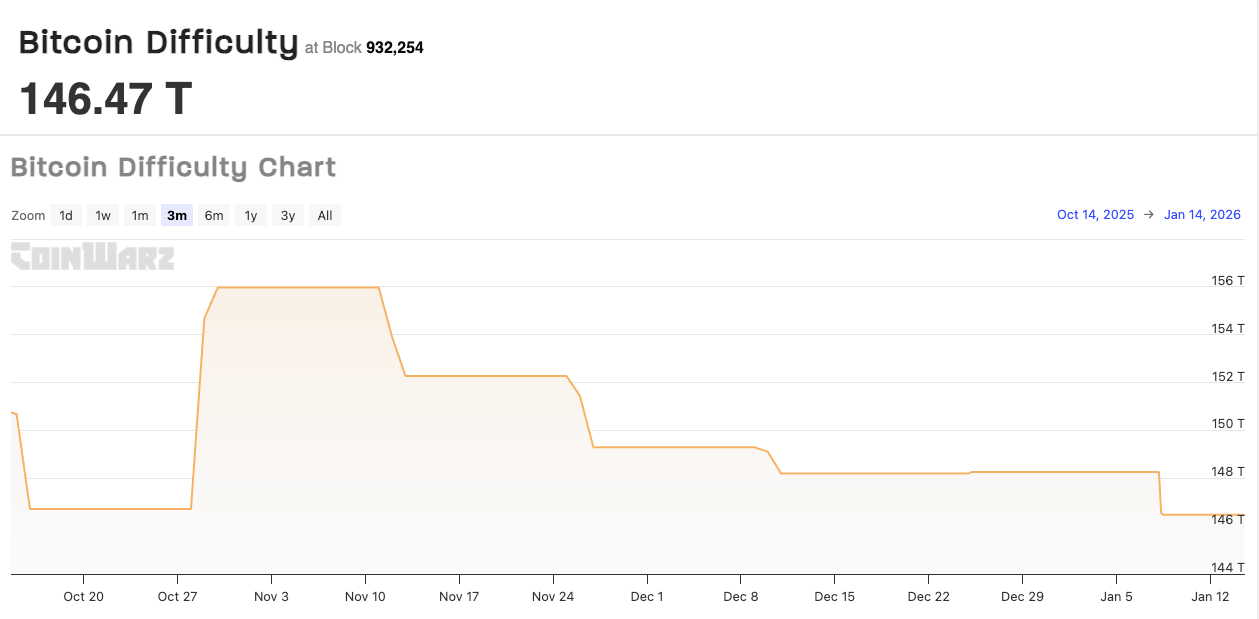

Bitcoin difficulty just retreated, but a more critical “survival metric” signals the mining sector is bleeding out

Bitcoin’s first difficulty adjustment of 2026 was anything but dramatic. The network nudged the dial down to about 146.4 trillion, a pretty small retreat after the late-2025 grind higher. Graph showing Bitcoin's mining difficulty from Oct. 14, 2025, to Jan. 14,

Why writing open-source code is suddenly an existential risk, and the five-page bill designed to fix it

Two senators have introduced a short bill with an unusually big ambition: to stop US law from treating people who write and publish blockchain software as if they were running a shadow payments company. The proposal, titled the Blockchain Regulatory Certainty

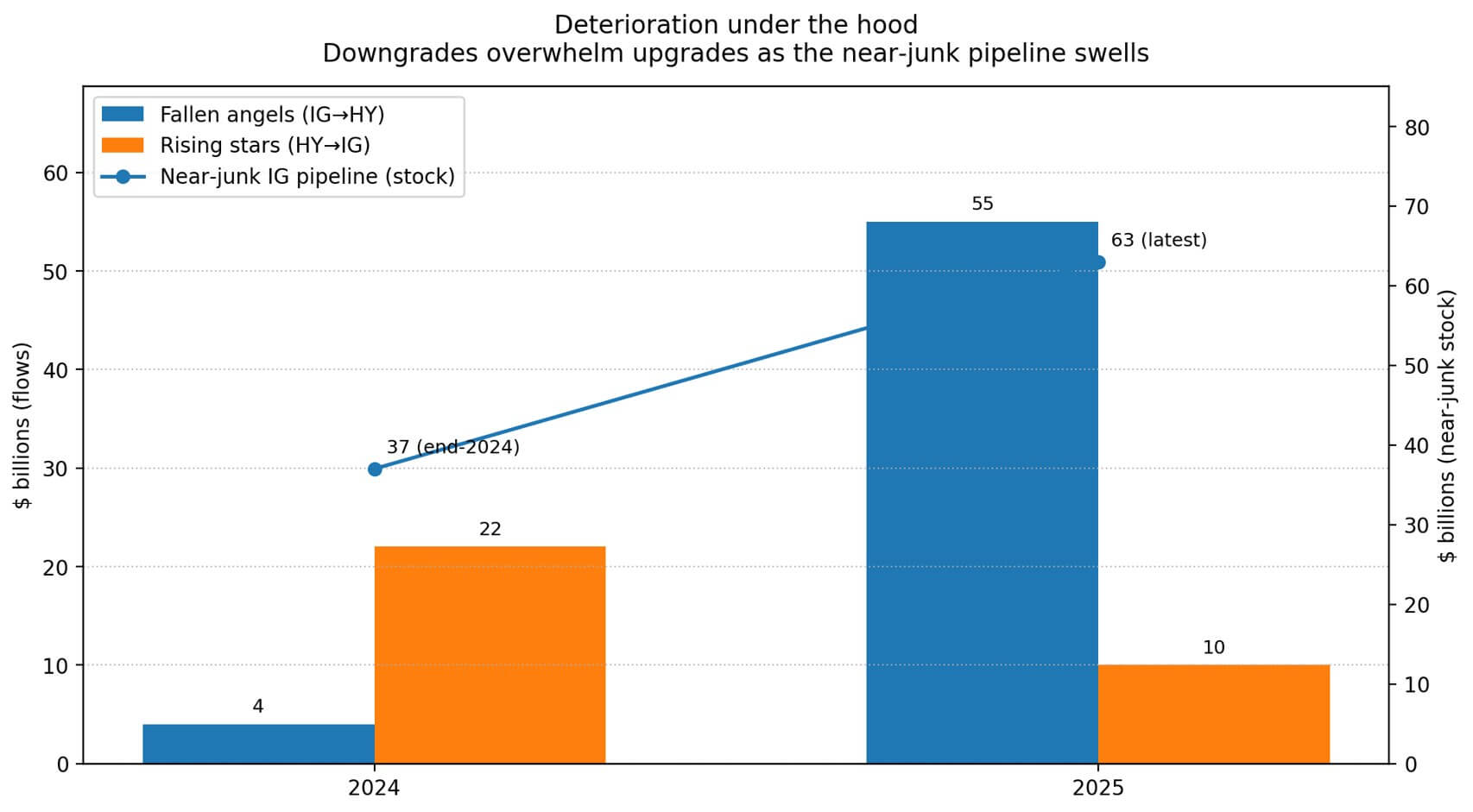

Bitcoin’s next major move hinges on a $63 billion “fallen angel” signal that most investors are completely ignoring

Corporate credit quality is deteriorating beneath a surface that looks deceptively calm. JPMorgan tallied roughly $55 billion in US corporate bonds that slid from investment-grade to junk status in 2025, the so-called “fallen angels.” At the same time, only $10 billion

Why a record 13M crypto projects are now dead as Bitcoin critics still claim “anyone can launch a token”

Bitcoin developer, Jameson Lopp, posted a simple observation days after CoinGecko published its 2025 dead coins report. Ignorant folks claim that Bitcoin isn't scarce because anyone can launch their

Bitcoin’s “quantum” death sentence is causing a Wall Street rift, but the fix is already hidden in the code

The consensus that Bitcoin has matured into “digital gold” faces a new fracture line on Wall Street, one that has little to do with daily price volatility and everything to do with the distant future of computing. Two prominent strategists named

The US government just caved to a crypto exchange pulling support for legislation that changes everything for investors

The US crypto industry believed it stood on the precipice of securing the regulatory legitimacy it has pursued for a decade, but the political ground has suddenly shifted beneath it. On Jan. 14, Sen. Tim Scott, the chair of the Senate

Crypto futures legitimized by CME with Cardano, Chainlink, and Stellar addition, but retail traders face a massive catch

The era of the crypto industry being seen as a two-asset town is officially over at the world’s largest derivatives marketplace. On Jan. 15, CME Group announced plans to launch futures contracts for Cardano (ADA), Chainlink (LINK), and Stellar (XLM) on

Bitcoin is following a discreet lag pattern behind gold that puts a $130k target immediately in play

Gold and silver pushed to fresh all-time highs this week, creating a financial gap that sets the stage for a potential Bitcoin catch-up rally. According to Gold Price data, gold reached an all-time high of over $4,600, with industry experts predicting

Bitcoin ignored Trump’s latest 25% tariff threat, but the $19B liquidation ghost from October is quietly resetting in the shadows

President Donald Trump declared on Jan. 12 that the US would impose a 25% tariff on any country conducting business with Iran, “effective immediately,” via Truth Social. Bitcoin (BTC) dipped briefly below $91,000, then recovered above $92,000 within hours. No liquidation

Data reveals the new “sweet spot” for crypto in your portfolio as financial advisors flip aggressive on Bitcoin

Financial advisors held crypto allocations below 1% for years, treating Bitcoin as a speculative footnote rather than a portfolio component. That era is ending. According to Bitwise and VettaFi's 2026 benchmark survey, 47% of advisor portfolios with crypto exposure now allocate

Crypto yields expose the exact amount banks are underpaying you, and why they want Congress to ban it

While Congress pushes ahead with the CLARITY Act, the unfinished fight over how the U.S. draws the line between “crypto” and “securities” is spilling into public view, and into a familiar blame game. Online, critics argue the bill’s structure could hardwire

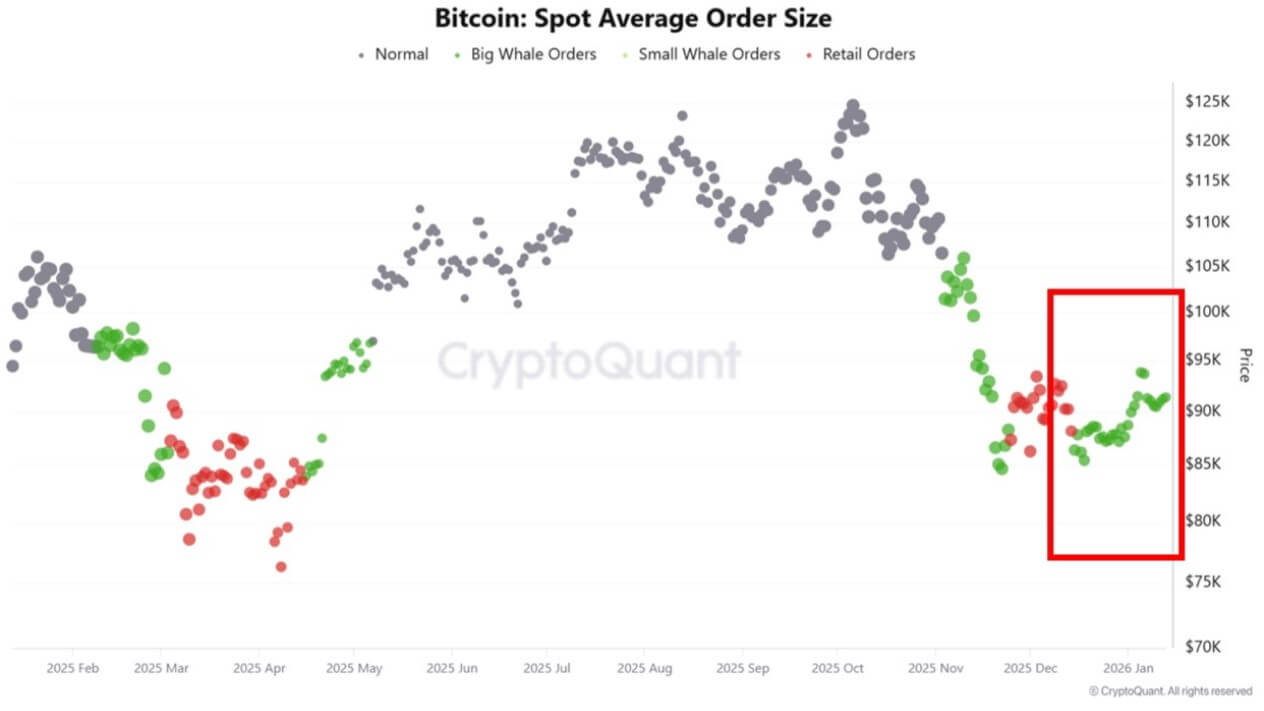

Bitcoin just wiped out $600 million in bets, triggering a “mechanical” loop that forces prices toward $100k

Bitcoin’s price rallied above $95,000 during the last 24 hours, signalling a definitive shift in market structure rather than a simple volatility spike. According to CryptoSlate's data, the top crypto rose by more than 3% to reach a high of over

Bitcoin is walking into a perfect setup for a long-term bull run but first faces a brutal 72-hour gauntlet

Bitcoin investors are bracing for a rare convergence of market forces this week, walking into a gauntlet of three distinct macro and policy catalysts packed into a single 72-hour window. The catalysts include the release of December’s Consumer Price Index (CPI)

The US Senate could wipe out $6 billion in crypto rewards this week by closing one specific loophole

The GENIUS Act banned issuer-paid yield, but the Senate markup fight is whether exchanges can keep routing rewards around that restriction, and the answer could decide who controls $6 billion in annual incentives. Senate Banking is scheduled to consider the CLARITY

Energy grid operators are ignoring Bitcoin’s stabilization benefits to chase a wealthier, less flexible buyer

Former Binance CEO, Changpeng Zhao (CZ), recently stated that the UAE generates surplus power in order to cover “three days” of high demand each year, making Bitcoin a buyer of last resort for energy that would otherwise go unused. Stripping away

Here’s how the US government now offers a path to a new all-time high for Bitcoin and crypto CLARITY

On Jan. 13, the US Senate Banking Committee released the full text of the highly anticipated Digital Asset Market Clarity Act (CLARITY) ahead of its expected markup this week. The 278-page draft abandons the strategy of picking winners on a token-by-token

Bitcoin traders are bracing for a Fed “credibility shock” that hinges on one critical date this month

Bitcoin opened the year trading like it usually does when macro uncertainty rises: it moved with the tide of rates, the dollar, and risk appetite, even as investors tried to pin a more specific narrative on top. However, this week the