Two major crypto events canceled after city hit by 18 violent physical attacks on crypto holders amid market downturn

NFT Paris was supposed to be the kind of week people plan their year around. You book the ticket, you text the group chat, you lock in the flights before prices jump, you tell yourself the hotel bill is “work”, you

Bitcoin liquidity is about to get crunched by a new Korean law that legally excludes 99% of buyers

On paper, South Korea has been one of the world’s loudest crypto markets for years. In practice, it has been a strangely narrow one. If you were a regular person, you could trade on the big won exchanges. If you were

Vitalik Buterin warns that Ethereum’s roadmap is now a liability unless the network does this one thing immediately

Ethereum co-founder Vitalik Buterin is making a case that the most valuable upgrade for the world’s second-largest blockchain may be learning how to stop upgrading. Last November, Buterin reportedly argued that locking down parts of the base layer can reduce bugs

Bitcoin just broke its classic macro correlation because the market is suddenly pricing a terrifying new risk

On Sunday night, a lot of people in markets did the same thing at the same time: they opened a video and listened to a central banker sound like he was reading from a crisis manual. Jerome Powell said the Federal

Insiders sell government crypto database to violent home invaders as transparency laws backfire

A tax employee in Bobigny used internal software to compile dossiers on cryptocurrency specialists, billionaire Vincent Bolloré, prison guards, and a judge. She passed the information to criminals who paid €800 to attack a prison officer at home in Montreuil. Her

Ethereum just solved a critical problem Bitcoin doesn’t want to fix on its own network – but why?

A few years ago, the easiest way to explain Bitcoin to a newcomer was to keep it simple, slow, and sturdy. Ten-minute blocks. Limited space. Everyone checks everything. Nobody gets special treatment. That design is a feature. It is what makes Bitcoin

New BlackRock report exposes a historic shift in crypto that leaves only one blockchain controlling the settlement layer

Stablecoins used to be a crypto convenience, a way to park dollars between trades without touching fiat. However, the industry has matured enough that BlackRock now treats them as foundational rails for the market. In its 2026 Global Outlook, the BlackRock

Tokenized Treasuries skyrocketed 125%, creating this “programmable cash” loop that banks are scrambling to copy

Tokenized real-world assets reached $19.72 billion on Jan. 9, the closest the market has come to the $20 billion threshold. That figure measures distributed assets, which are tokens that circulate on-chain and can be transferred between user wallets. As a result,

BlackRock warns crypto’s love affair with AI is over as an energy war with Bitcoin miners begins

BlackRock is telling clients to stop looking at artificial intelligence as software and start treating it as energy. In its 2026 Global Outlook, the BlackRock Investment Institute argued that the AI buildout is pushing against physical limits and highlighted electricity as

Banks are lobbying to kill crypto rewards to protect a hidden $1,400 “tax” on every household

Banks are fighting stablecoin rewards to protect a secret $360 billion revenue machine. When Coinbase chief policy officer Faryar Shirzad posted a thread on Jan. 8 warning that stablecoin rewards “remain under debate” as Congress marks up market structure legislation, he

Shortest bear market ever? Key metrics imply Bitcoin price could surge past $125,000 before April

The crypto market is flashing early signals of a first-quarter recovery as the dust finally settles on December’s sharp sell-off. According to a new analysis from Coinbase, four structural indicators suggest the correction was a temporary setback rather than a regime

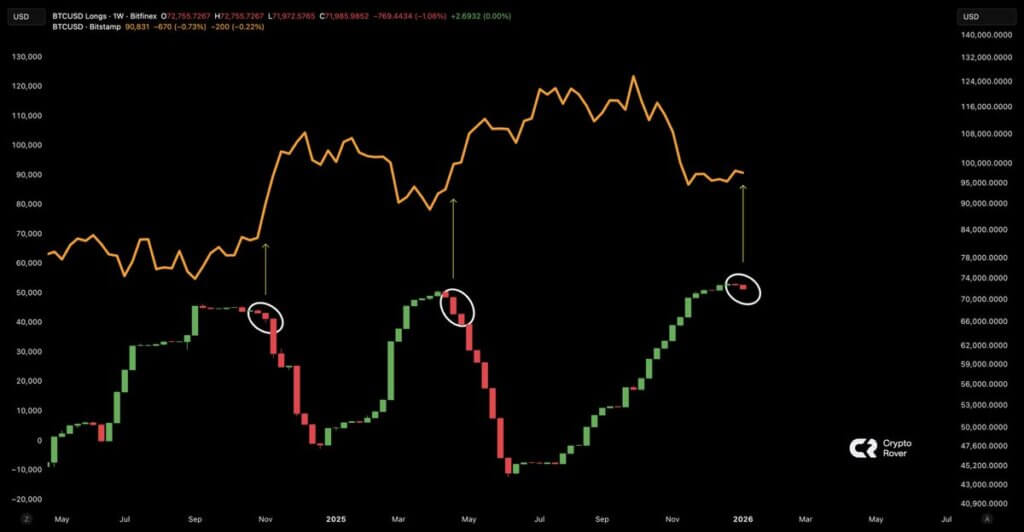

This Bitfinex whale “buy signal” is everywhere, but the real Bitcoin data suggests a much messier six weeks

The first thing you learn when you spend too long around Bitcoin is that everyone has a chart that “always works”, and everyone has a scar from the last time it didn’t. This week’s chart is making the rounds again, it’s

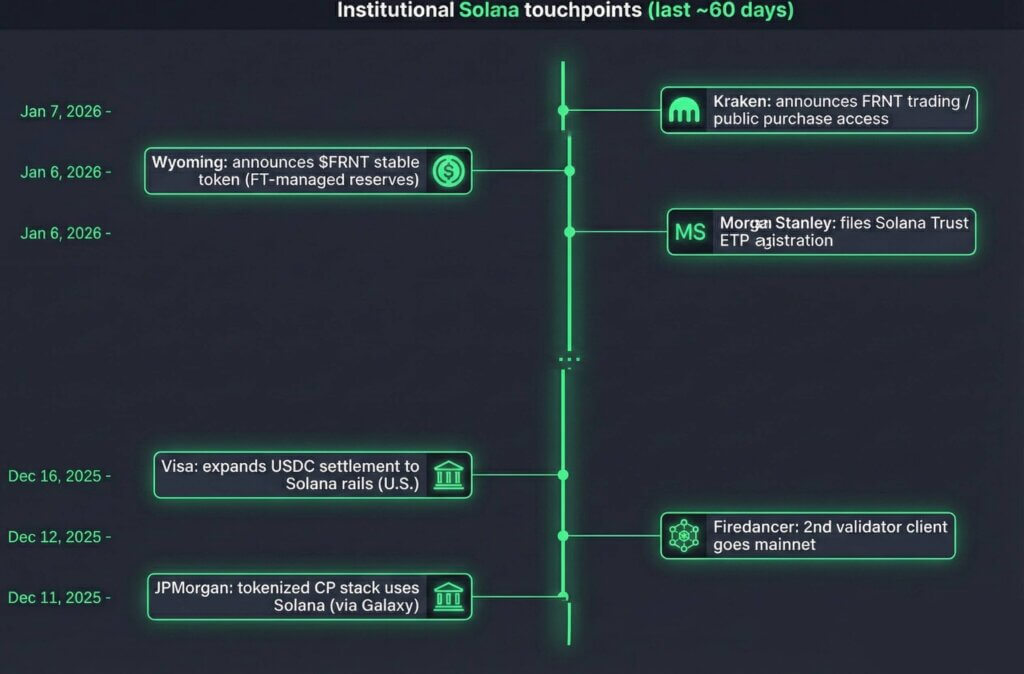

Solana is becoming settlement rail for Visa and JPMorgan but one metric still scares insiders

Wyoming launched a state-backed stablecoin on Solana, and Morgan Stanley filed for a Solana trust product this week. Last month, Visa expanded USDC settlement to run on Solana rails, and JPMorgan tokenized commercial paper using Solana for part of the

Prediction markets let insiders profit on leaks, yet a massive Dow Jones partnership just validated the rig

Dow Jones announced an exclusive partnership to distribute Polymarket prediction data across The Wall Street Journal, Barron's, and MarketWatch on the same day Kalshi claimed it had hit $100 billion in annualized trading volume. The juxtaposition captures where prediction markets sit

Zcash just plummeted 20% after its entire team walked out, exposing a boardroom battle over the project’s assets

Zcash (ZEC) suffered the steepest decline among top-tier digital assets on Jan. 8, plunging approximately 20% amid a collision of governance turmoil and a leverage-driven market flush. According to CryptoSlate data, Zcash fell to a month-low of $382, making it the

Trump could use Greenland for 10,000 EH/s Bitcoin mining hub from stranded energy if it becomes a part of the US

Talk of the United States buying Greenland has returned to Washington, and miners are tracking the power projects on the island. The White House said a U.S. purchase of Greenland is an “active discussion,” according to Reuters. For Bitcoin miners, the more

Bitcoin ripped to $94,000 as critical metric quietly turns positive for first time since October

Bitcoin ETFs grabbed $1.2 billion in the first two trading sessions of 2026, coinciding with BTC's climb to $94,000, a 7% gain in just days. The narrative wrote itself: institutional money flooded in, prices followed. Yet, that correlation masks a more

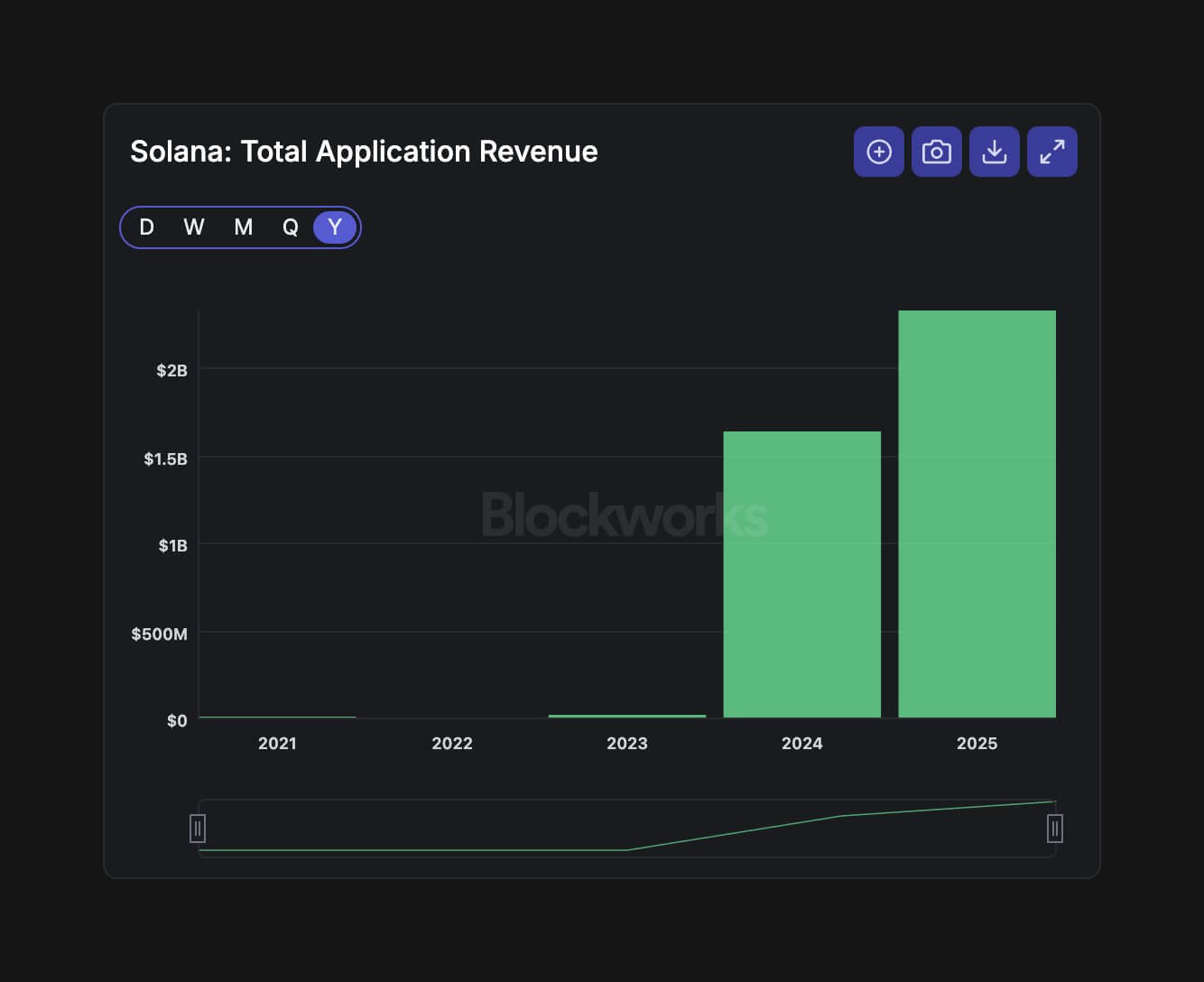

Solana applications generate $2.4 billion, proving the network is finally decoupling from this volatile metric

Solana’s ecosystem recorded its strongest financial year to date in 2025, posting all-time highs in revenue, active users, and trading volume even as the network’s native token finished the year nearly 50% below its early peak. According to CryptoSlate data, SOL