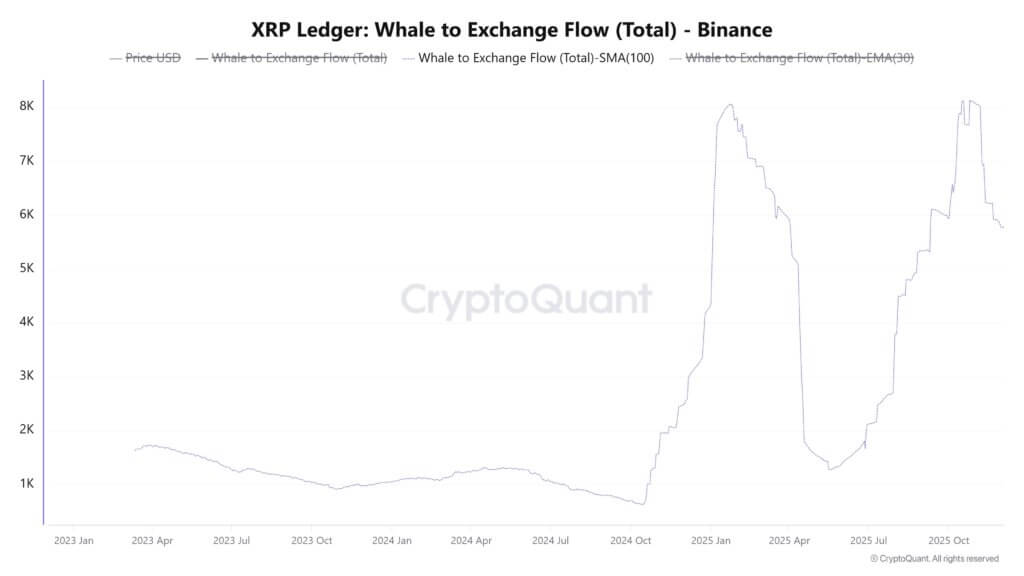

While Ethereum whales rotate, XRP data shows a fatal concentration flaw that leaves one group holding the bag.

The conventional wisdom says veteran holders don’t sell into weakness. They accumulate through drawdowns, harvest gains during euphoria, and otherwise sit still while newer cohorts churn. Late 2025 is testing that model. Across Ethereum, XRP, and pockets of the DeFi stack,

Strategy’s yield hunt inadvertently helps the very hedge funds looking to short its Bitcoin premium

Strategy, formerly known as MicroStrategy, is considering a pivot that would fundamentally alter the risk profile of the world’s largest corporate Bitcoin treasury. For a decade, the company sold Wall Street on a singular thesis: it was a digital vault, offering unencumbered exposure

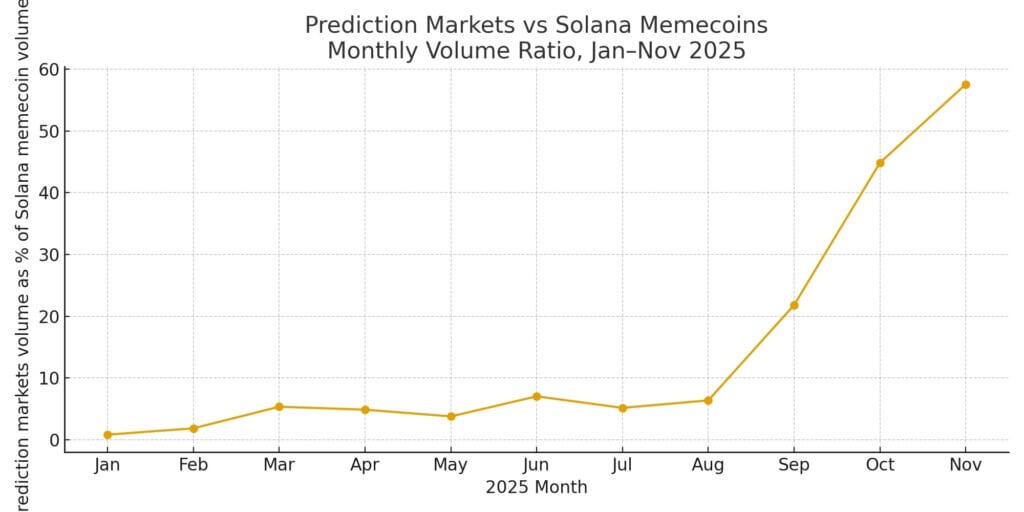

Why Solana’s crypto casino changed hands from memecoins to prediction markets

Solana’s memecoin trading registered $13.9 billion in monthly volume last month, the lowest print since February 2024, when the mania hadn’t yet caught fire. At the same time, Polymarket clocked $3.7 billion in volume, its best month since launch, while Kalshi

Everything you need to know for Bitcoin and crypto ahead of Jerome Powell’s upcoming FOMC meeting

Jerome Powell stepped in front of cameras on Dec. 1 at the Hoover Institution’s George Shultz memorial event with three audiences watching: bond traders pricing an 87% chance of a December rate cut, a divided Federal Open Market Committee bracing

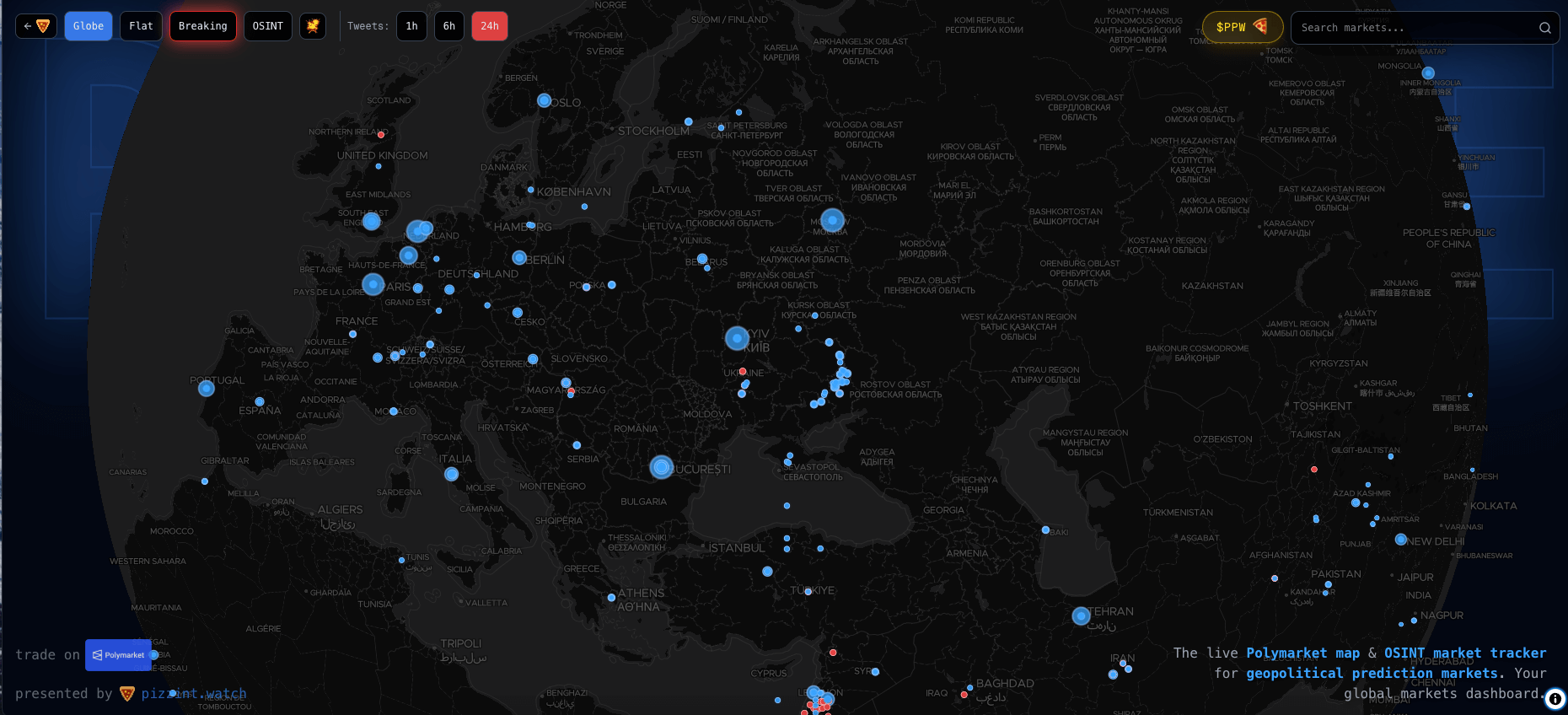

Polymarket war bets collide with the maps civilians use to survive

The first thing many Ukrainians check in the morning is not Instagram or email, it is a war map. DeepStateMap.Live, a volunteer-built OSINT project, shows which villages are under occupation, where Ukrainian advances hold, and where the front looks fragile.

RLUSD supply hit $1.26B, and 82% of it now sits on Ethereum, not XRPL

Ripple’s RLUSD stablecoin is rapidly expanding on Ethereum rather than the company’s native XRP Ledger (XRPL). According to CryptoSlate data, RLUSD’s total circulating supply has surged to $1.26 billion within 12 months of its launch. Of this, roughly $1.03 billion, or 82%

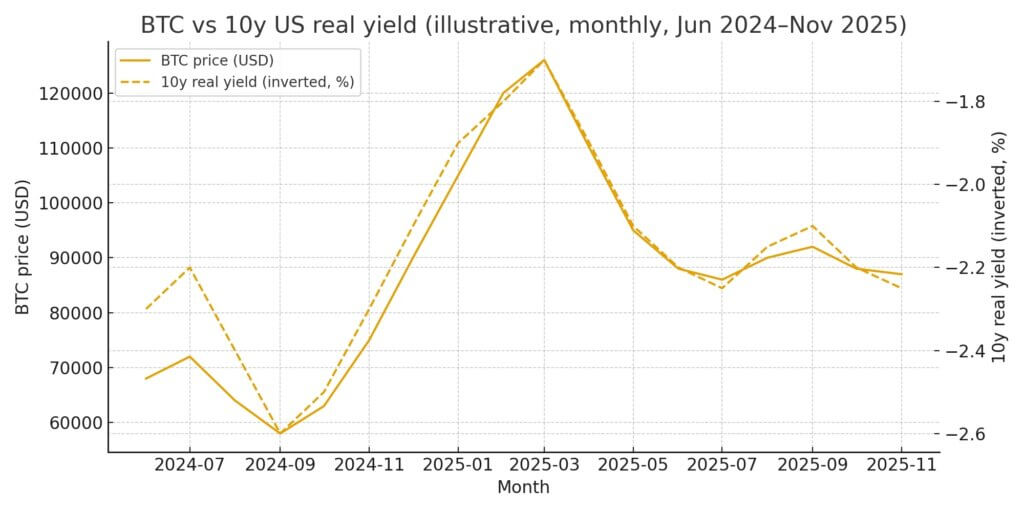

Bitcoin’s bull market: A slowdown, not a breakdown

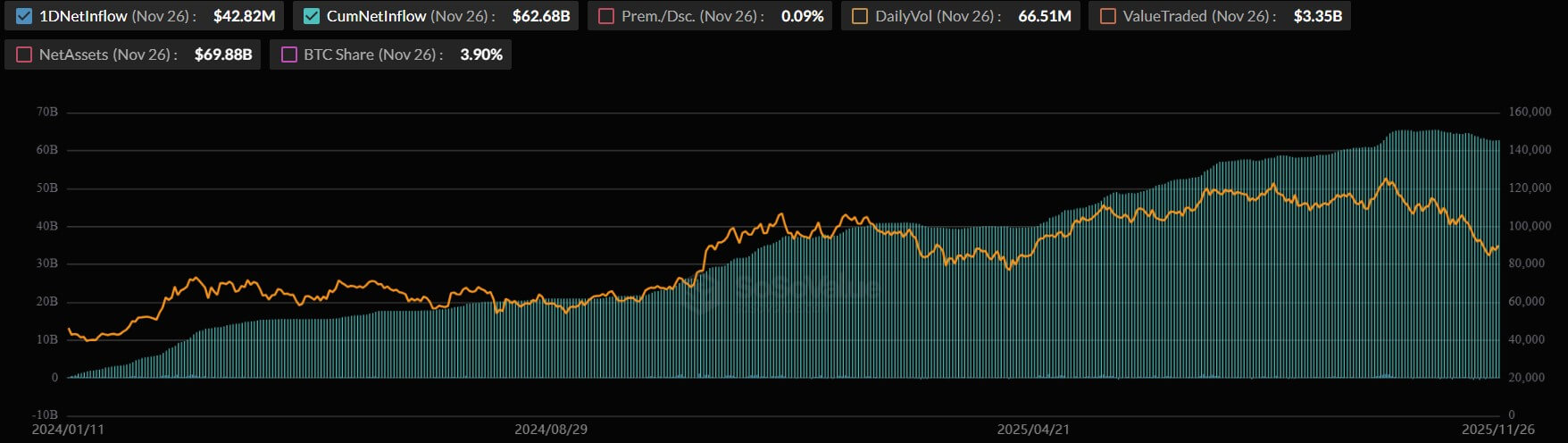

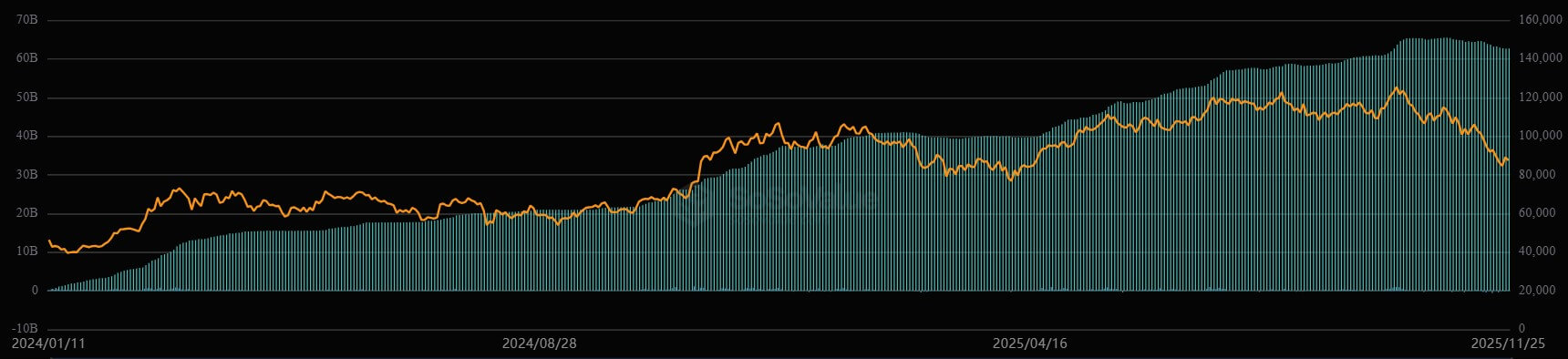

Bitcoin’s big buyers seem to have stepped off the gas. For the better part of the last year or so, it felt like there was a constant tailwind behind Bitcoin’s price. ETFs vacuumed up coins, stablecoin balances kept climbing, and traders

Why Pro Traders Choose Crypto Prop Firms

The digital asset landscape has matured significantly over the past several years. Simple spot holding is no longer the only viable strategy for generating substantial returns. Today’s market rewards precision, algorithmic discipline, and above all else, liquidity. For skilled traders, the

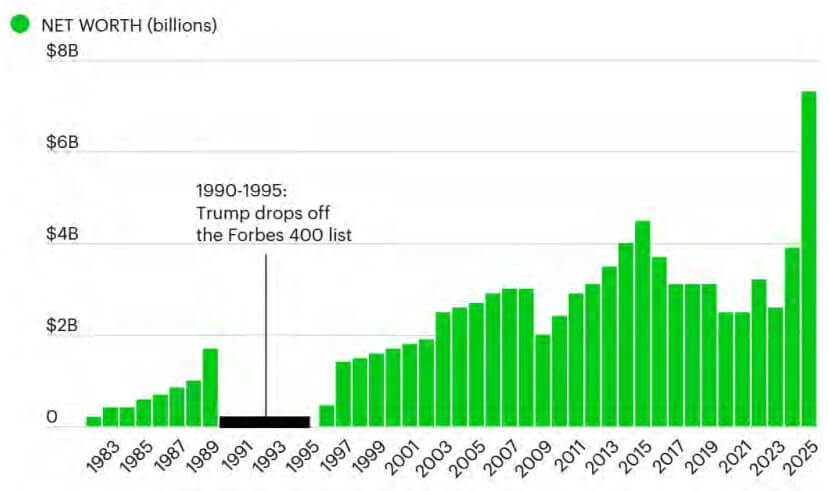

How Trump’s crypto empire became the center of a new influence economy

A new staff report released by House Judiciary Committee Ranking Member Jamie Raskin alleges that President Donald Trump has significantly utilized the presidency to expand his personal wealth through cryptocurrency ventures. The report, titled Trump, Crypto, and a New Age of

Bitcoin on Wall Street will never be the same after a quiet Nasdaq move

On Nov. 26, Nasdaq’s International Securities Exchange quietly triggered one of the most important developments in Bitcoin’s financial integration. The trading platform asked the US Securities and Exchange Commission (SEC) to raise the position limit on BlackRock’s iShares Bitcoin Trust (IBIT)

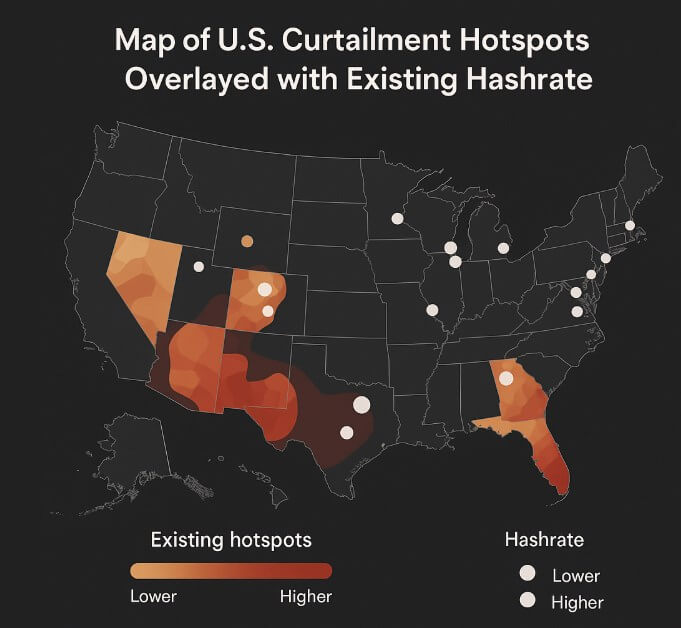

Bitcoin is redrawing where cities and data centers rise as it competes for wasted energy, not cheap labor

For two centuries, factories chased cheap hands and dense ports. Today, miners roll into windy plateaus and hydro spillways, asking a simpler question: where are the cheapest wasted watts? When computing can move to energy rather than energy to people, the

Comparing Crypto Exchanges vs. Brokers: Which Is Better for Active Traders?

The crypto landscape in 2025 looks nothing like the manic ICO days of 2017 or the “DeFi summer” of 2020. Volumes are deeper, spreads are tighter, and regulatory lines, while still blurry, are finally being drawn. Research indicates that execution

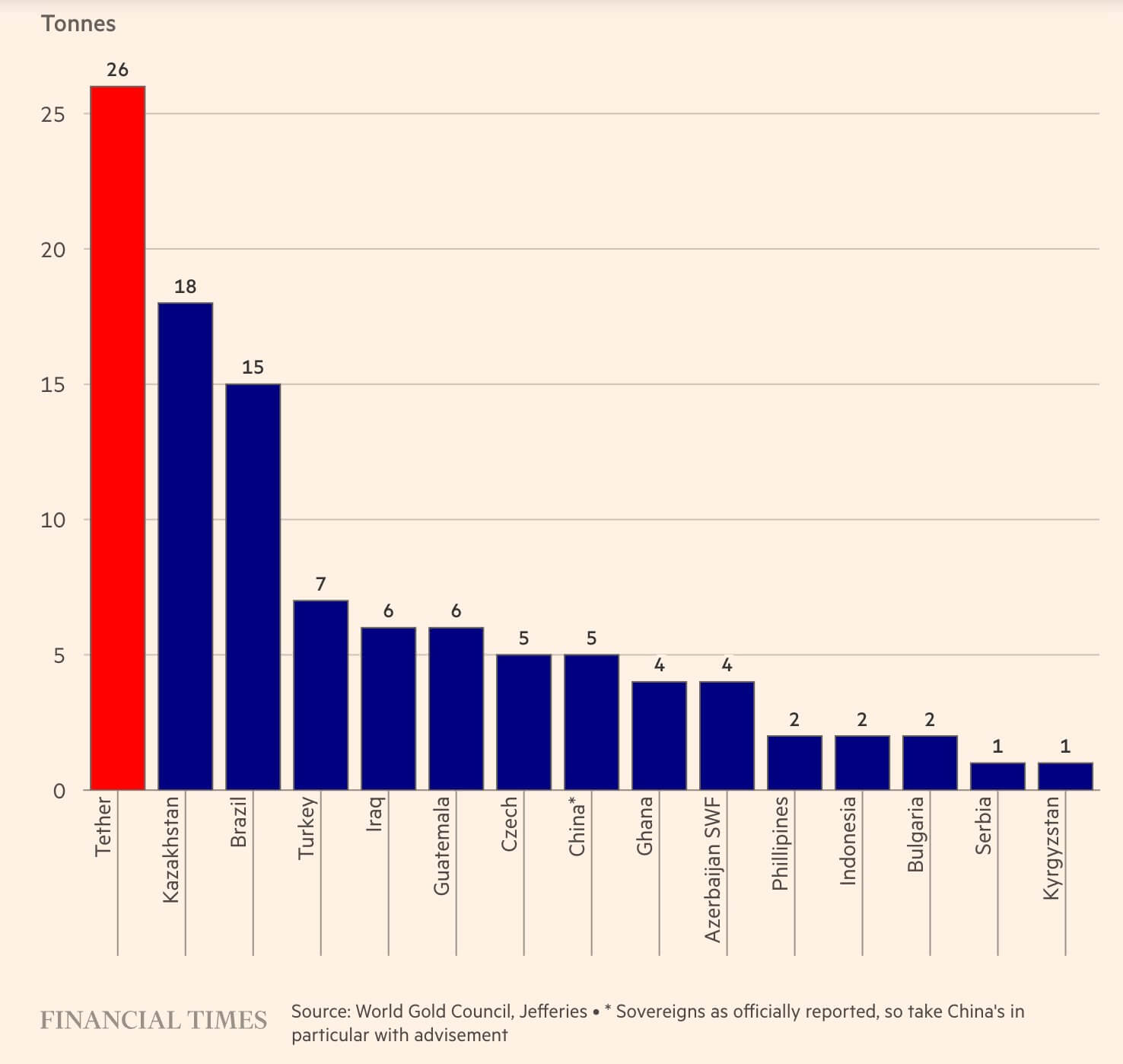

‘We wear your loathing with pride:’ Why S&P downgraded Tether after it bought more gold than any country

Tether, the issuer of the USDT stablecoin, has spent the past year accumulating Bitcoin and gold at a pace that puts it on par with several sovereign treasuries. For context, the firm purchased more gold than every central bank combined over

How long can miners hold out as revenue hits record lows while Bitcoin’s security is at record highs?

Bitcoin’s hashrate is near record levels, yet miner revenue per unit of compute has fallen to record lows, pushing the network into a ‘high-security, low-profitability’ phase. While the network’s hashrate has pinned itself above the one-zettahash watermark, which is a record

Why Bitcoin pumped today: How US liquidity lifted BTC above $90,000 and ETH over $3,000

The crypto markets staged a convincing comeback on Nov. 27, snapping a prolonged period of stagnation as a critical shift in the United States’ liquidity forced capital back into risk assets. While the headline price action saw Bitcoin surge 5% to

Why Texas is buying Bitcoin from BlackRock before building a real reserve

Texas has taken the first formal step toward becoming the first US state to hold Bitcoin as a strategic reserve asset. On Nov. 25, Lee Bratcher, president of the Texas Blockchain Council, reported that the world’s eighth-largest economy, valued at $2.7

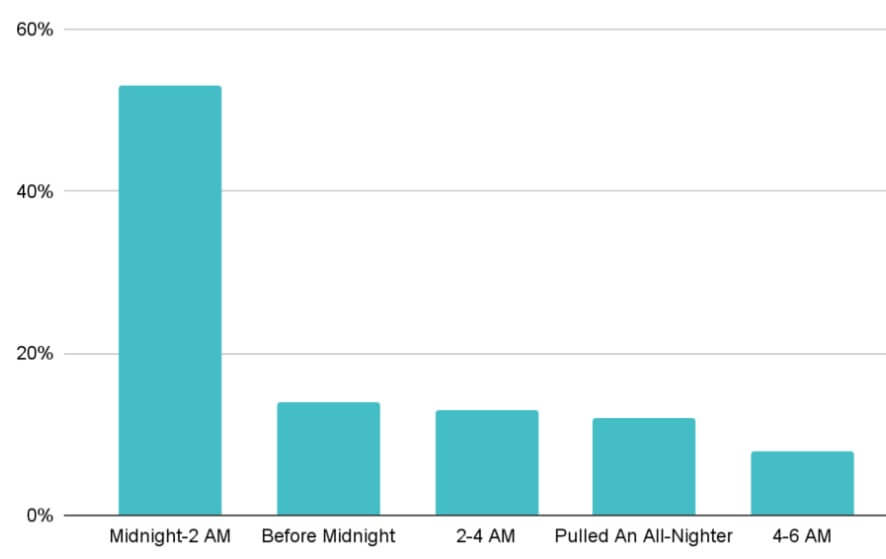

Struggling to sleep? You’re not alone – How Bitcoin’s recent price crash is affecting other traders IRL

Bitcoin’s recent slide below $80,000 has triggered a wave of sleep disruption across the retail trading community, according to a new report from CEX.io. The flagship digital asset has since rebounded to about $88,000, but the roughly 31% drawdown from its

FBI called as Cardano split in two by a single transaction: Lessons for ETH and SOL client diversity

On Nov. 21, Cardano’s mainnet bifurcated into two competing histories after a single malformed staking-delegation transaction exploited a dormant bug in newer node software. For roughly 14 and a half hours, stake pool operators and infrastructure providers watched as blocks piled