XRPL could capture billions in machine payments but only if AI agents choose RLUSD

On Feb. 25, t54 Labs announced that Ripple was a strategic investor in its $5 million seed round investment. t54 describes itself as the trust layer for the fast-rising agentic economy. The latest artificial intelligence move is small in dollar terms,

Ethereum price path to $10,000 now hinges on seven upgrades and a fragile ecosystem vote

Ethereum’s latest long-term planning document has given investors a new way to assess whether the digital asset can eventually reach $10,000 by the end of this decade. The newly published “Strawmap,” introduced by Ethereum Foundation researcher Justin Drake, reads less like

Crypto traders are chasing 10x leverage in the US while Europe tightens the screws behind the scenes

Two regulators converged on the same market from opposite directions in February 2026. The European Securities and Markets Authority warned that derivatives marketed as “perpetual futures” or “perpetual contracts” tied to Bitcoin and Ethereum likely fall within the scope of contracts-for-difference

If Bitcoin can hold $65,000 after its strong bounce it could avoid a deeper crypto winter

Bitcoin spent the last two days sliding down familiar shelves, and the order book kept printing lower bids as liquidity thinned. However, by Wednesday afternoon, the price traded back toward $65,000 after sweeping the low $63,000s, with the last 24 hours

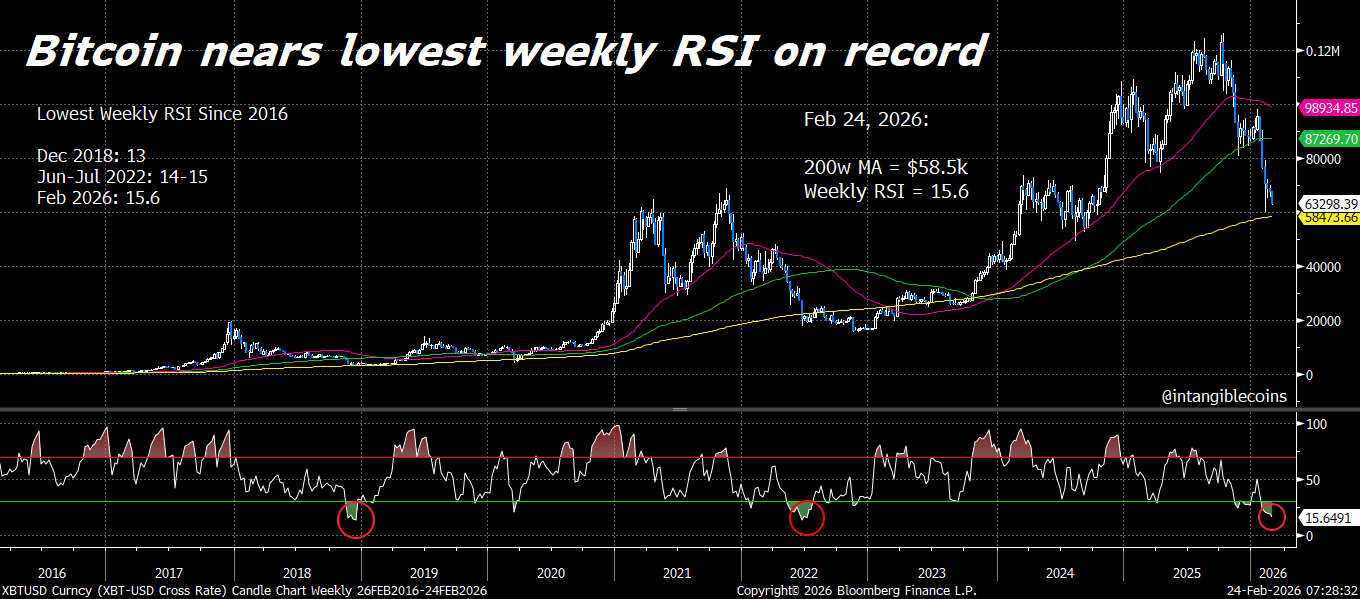

Bitcoin reveals a rare bullish cycle bottom signal before bouncing as futures bears tighten their grip

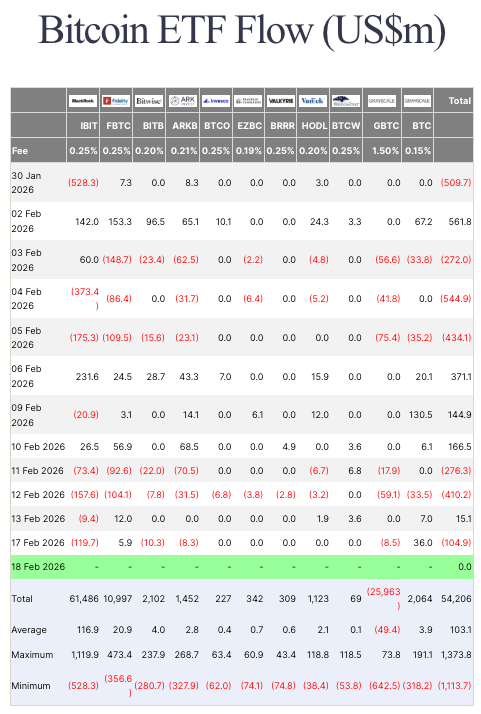

Bitcoin is flashing its most oversold signal on record amid its continued price struggles in this current macroeconomic environment and persistent exchange-traded fund (ETF) outflows. According to CryptoSlate data, BTC's price dipped to around $62,700 over the last 24 hours, while

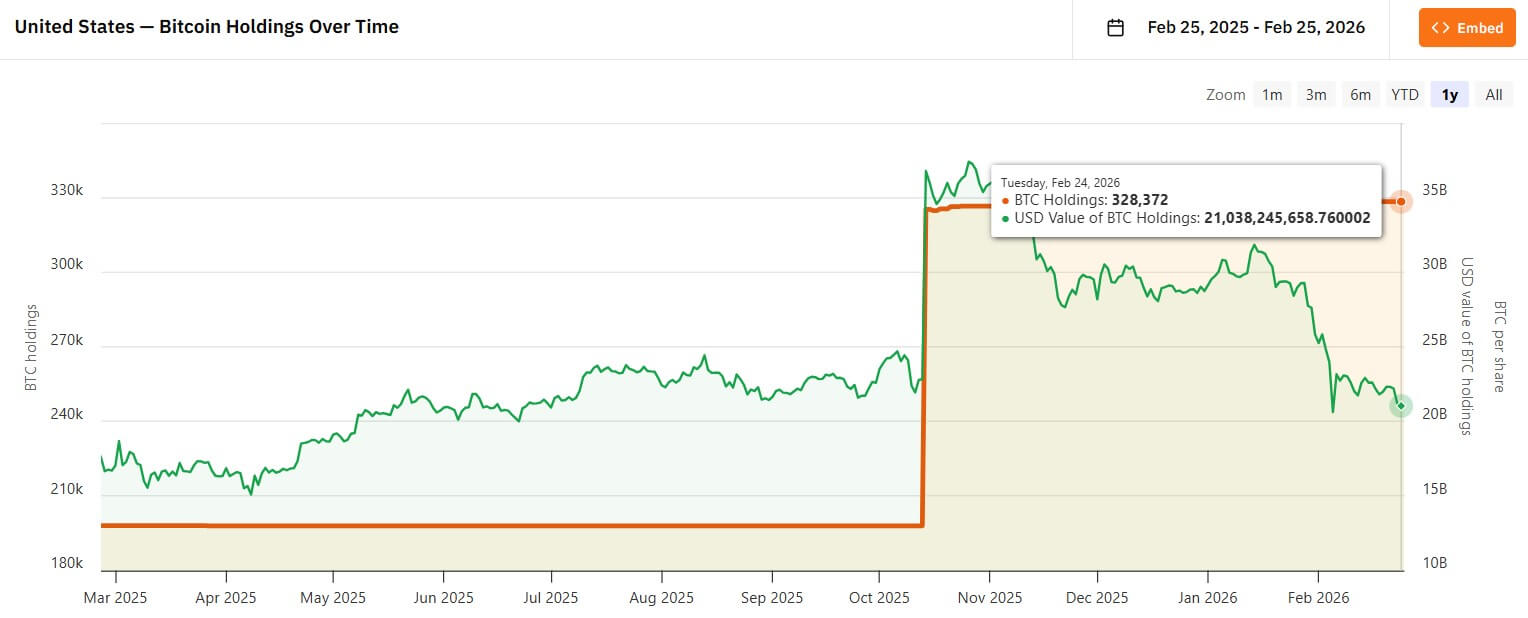

US Strategic Bitcoin Reserve could lose 30% in one ruling as Bitfinex battle intensifies

The US Strategic Bitcoin Reserve could lose nearly 30% of its holdings in a single legal move, even if the government does not sell a single coin. Last year, President Donald Trump signed an executive order creating a Strategic Bitcoin Reserve.

XRP ETF inflows collapse 93% as price capitulates, will this cause a reset or repair phase?

XRP is entering a stretch where on-chain cost basis, leverage, and flow data may matter more than broad market narratives. The token is approaching a critical point after a sharp rise in realized losses, with on-chain activity showing investors moving coins

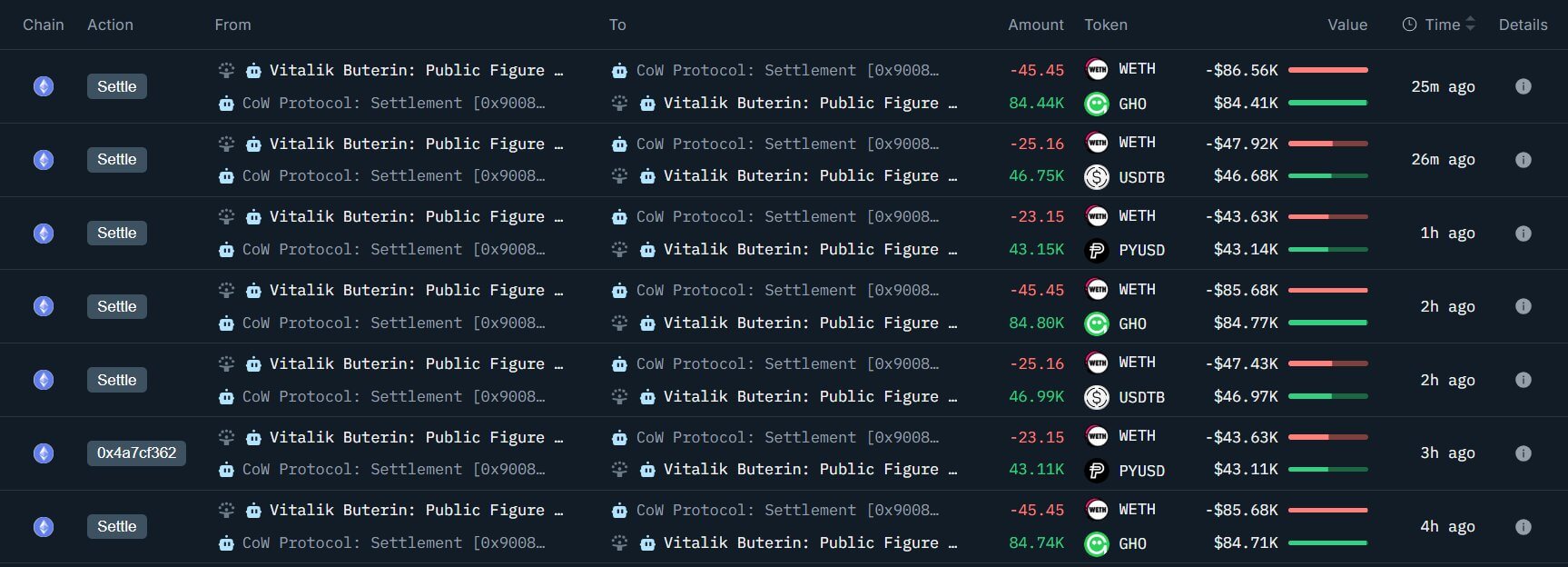

Vitalik selling Ethereum grabs attention — but this liquidity shift matters more

Ethereum is getting two headline signals at once, and they point in different directions. On-chain trackers have flagged a burst of ETH sales linked to Vitalik Buterin, the network’s most recognizable figure. At nearly the same time, the Ethereum Foundation began staking

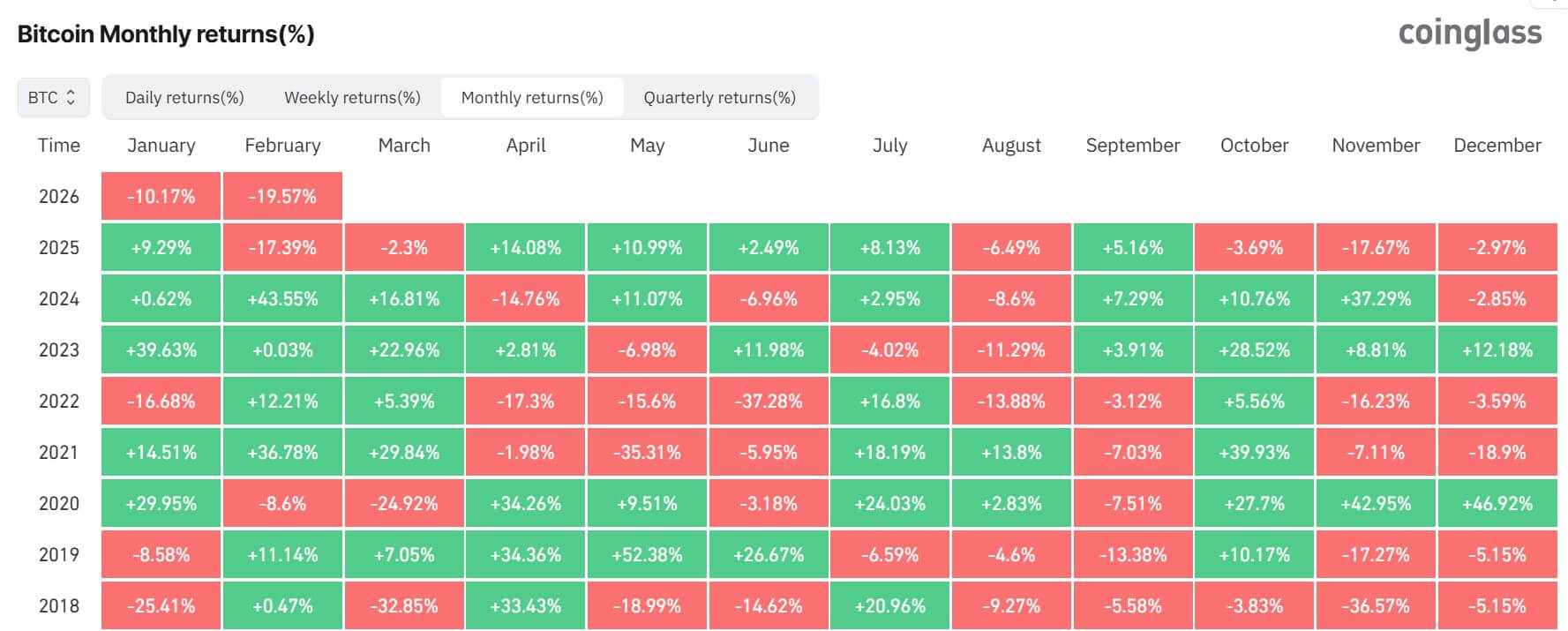

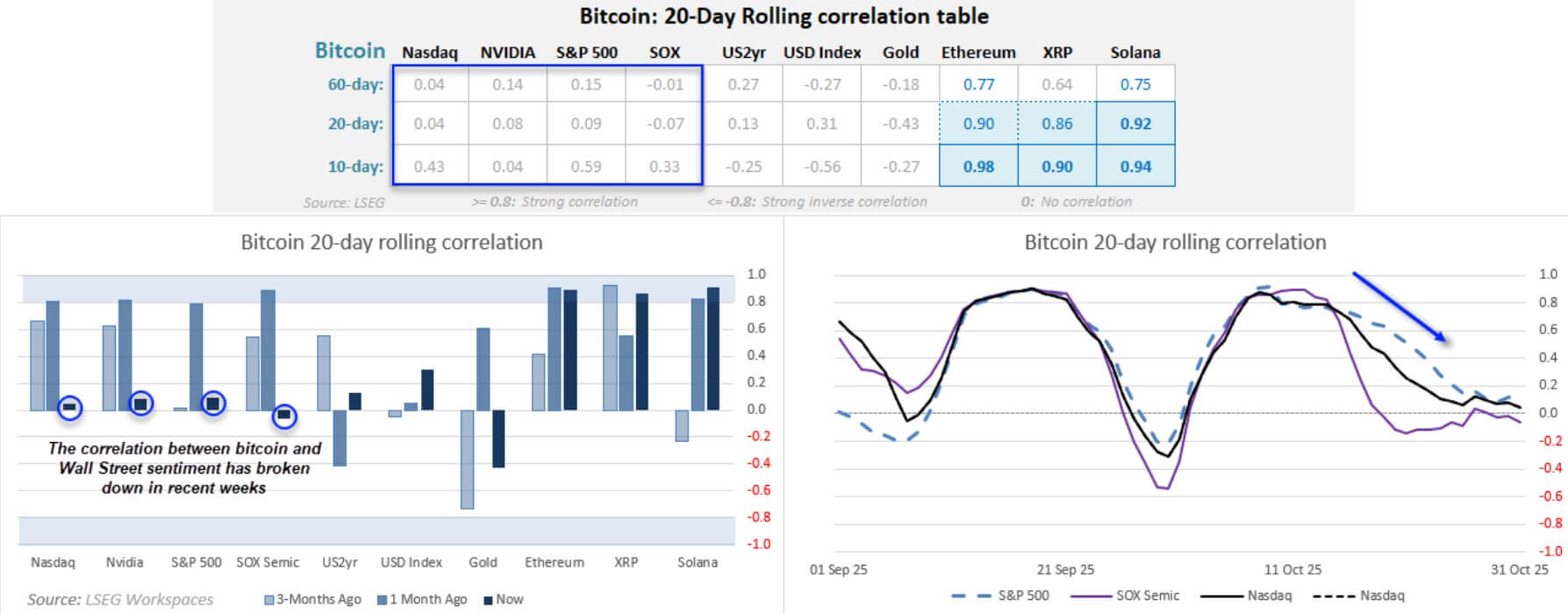

Bitcoin slides toward fifth straight monthly loss as $4.5B ETF outflows put $58,000 on the line

Bitcoin is heading toward an uncomfortable milestone, a potential fifth consecutive monthly decline if February closes in the red, and the setup is starting to look less like a crypto-specific drawdown and more like a macro-driven repricing. This five-month losing streak

Bitcoin losing $63k means crypto winter will not thaw any time soon as tariff shock rattles ETF flows

Bitcoin spent the last two days sliding down a familiar set of shelves, and the order book kept printing lower bids as liquidity thinned. By this morning, it sat at $63,214, a level that places the price inside the lower band

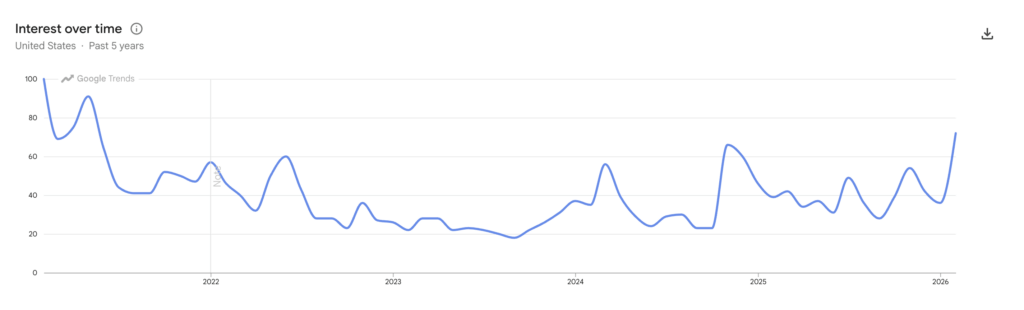

Bitcoin interest hits 5-year high in the United States defying bear market price decline

Bitcoin search interest in the United States is finally climbing back toward its 2021 highs. The move comes even as Bitcoin trades in the mid-$60,000s after topping $126,000 in October 2025. That pairing, attention rising as price slides, is an unfamiliar noise

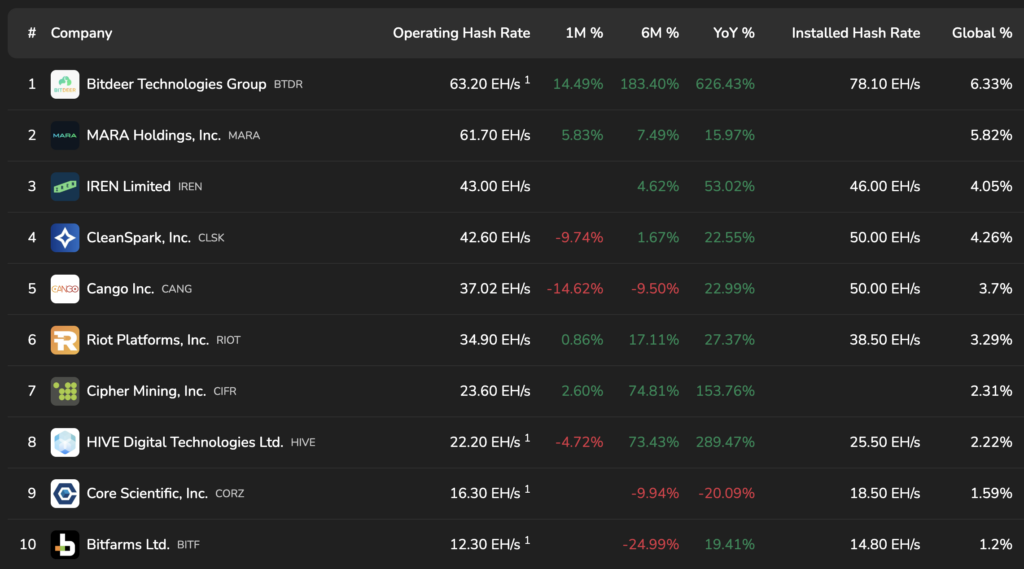

Largest US Bitcoin miner dumps entire BTC stash as margin pressure intensifies

Bitdeer, the largest Bitcoin mining company by hashrate, wiped its BTC ledger clean this week. Its corporate Bitcoin treasury now shows 0 BTC as the company sold 189.8 newly mined BTC and pulled 943.1 BTC from reserves. A mining business usually carries

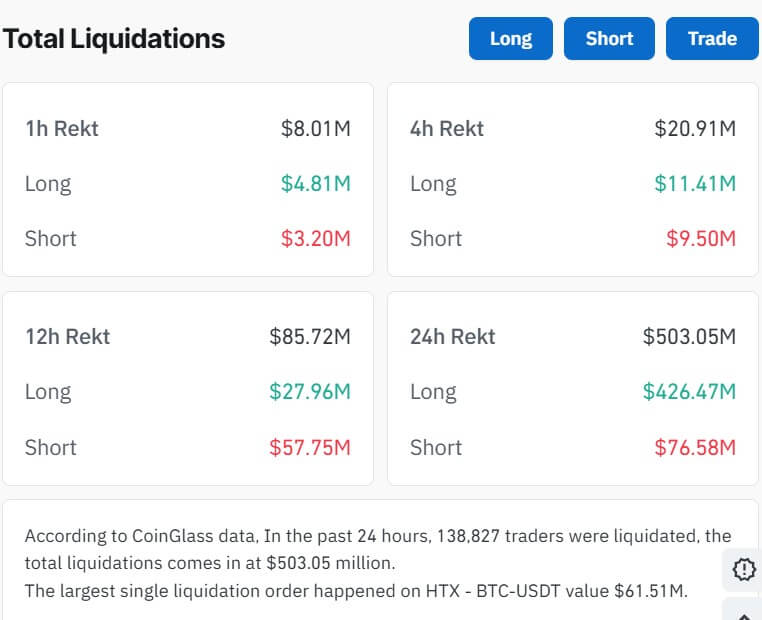

Bitcoin rebounds after $100B tariff whiplash — but $60k options price target hints at bigger risk

Bitcoin's weekend selloff led to about $100 billion in crypto market value losses during the reporting period and was triggered by a sudden burst of tariff policy uncertainty. Over the last 24 hours, BTC price had slipped below $65,000, pulling the

Bitcoin enters a 150-day danger zone as Trump pivots to a 1974 trade law the Supreme Court hasn’t touched yet

Bitcoin trades sideways as Trump cites Trade Act for 15% tariffs after Supreme Court limits IEEPA authority, and the market starts watching the 150-day clock It is one of those rare weekend sessions where the chart barely moves… yet it still

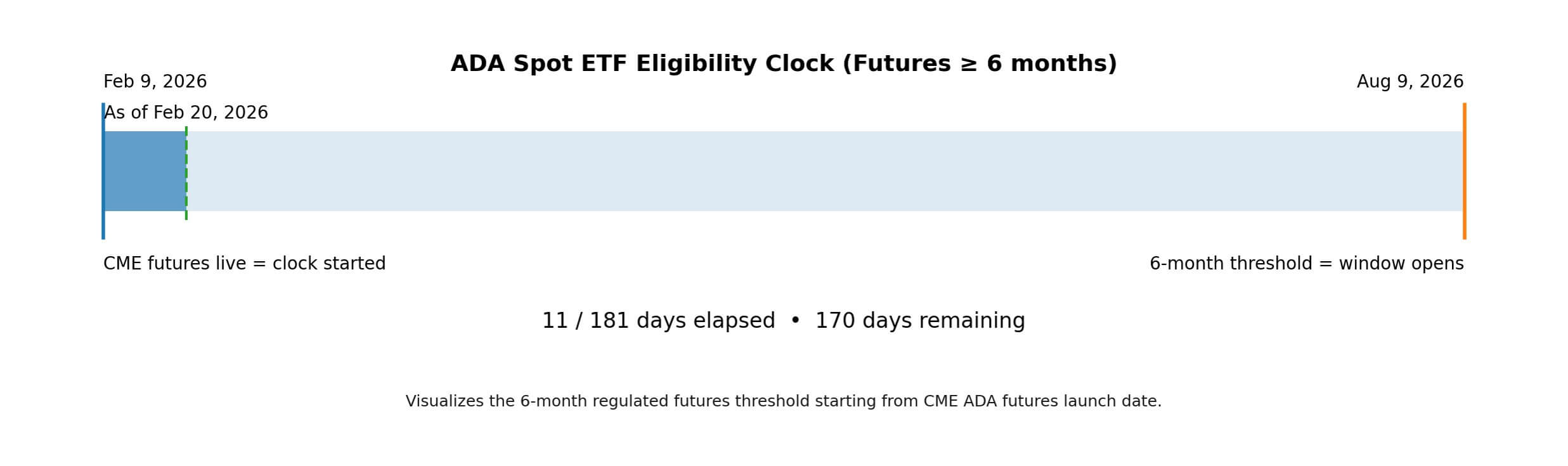

The SEC just gave Cardano a 75-day shortcut to a spot ETF that took Bitcoin 240 days

CME's Cardano futures went live on Feb. 9, and that date may matter more for ETFs than for trading. Under the SEC's new generic listing standards for commodity-based trust shares, one of the clearest fast lanes for a spot crypto ETP

Bitcoin bulls could walk into a $1 billion liquidation trap as Bank of America warns multiples are about to compress

Bank of America's latest market call reads less like a typical bear forecast and more like a structural warning about what happens when markets stop paying premium multiples, even if profits keep growing. The firm argues that the S&P 500 remains

Bitcoin’s calm price action is a trap: The steady ETF bid that supported it has already disappeared

Spot Bitcoin ETFs gave the market a clean, daily scoreboard: a green print meant fresh cash crossing the boundary from traditional brokerage accounts into Bitcoin exposure, and a red print meant the opposite. For much of the first year of spot

Crypto has a native version of the M2 money supply that’s falling and killing Bitcoin liquidity

Stablecoin supply is crypto’s deployable cash. With a total stablecoin market cap of around $307.92 billion and down -1.13% in the past 30 days, the pool has stopped growing month over month. When supply stalls, price moves get sharper, and Bitcoin