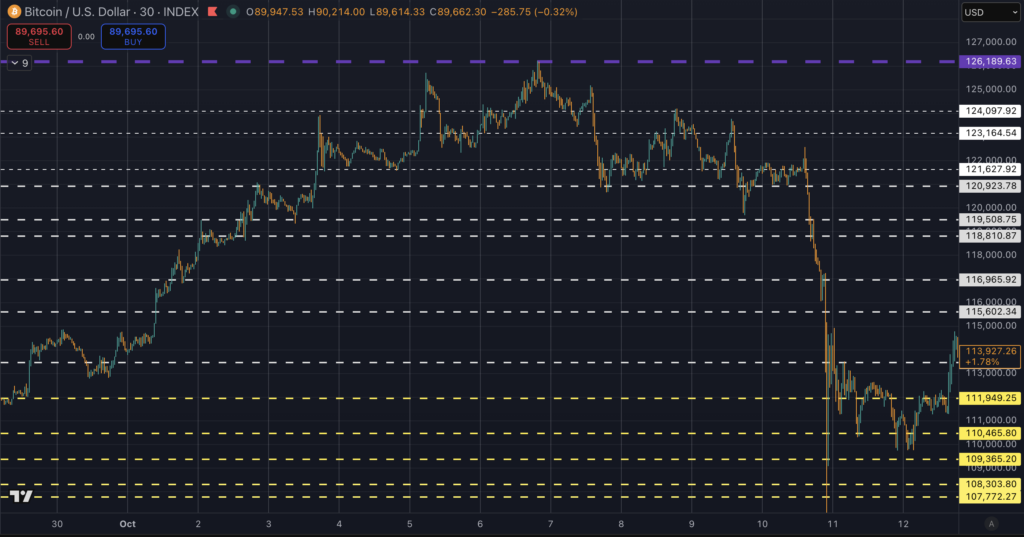

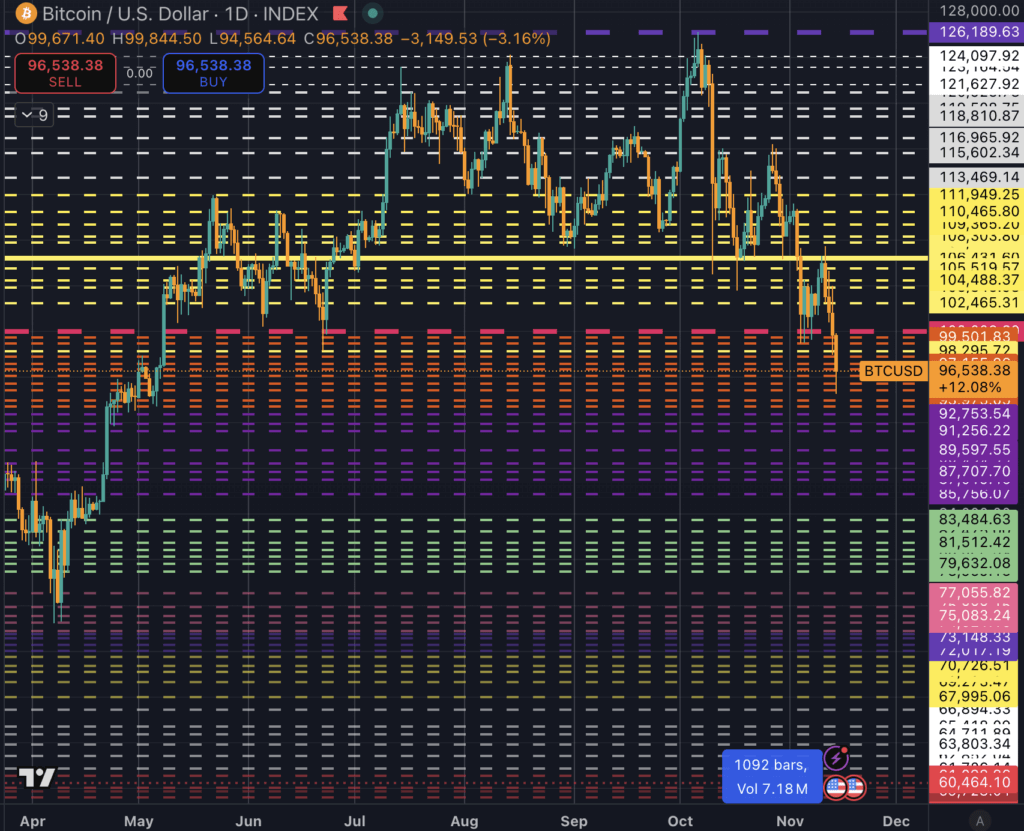

Bitcoin to $73k? Be prepared with the price levels to watch during a bear market

Bitcoin is quietly walking its way down the liquidity staircase, and the next solid step sits around $85,000. That number is not coming from a Fibonacci retracement, a moving average crossover, or any other technical analysis ‘gold standard.’ It comes from my

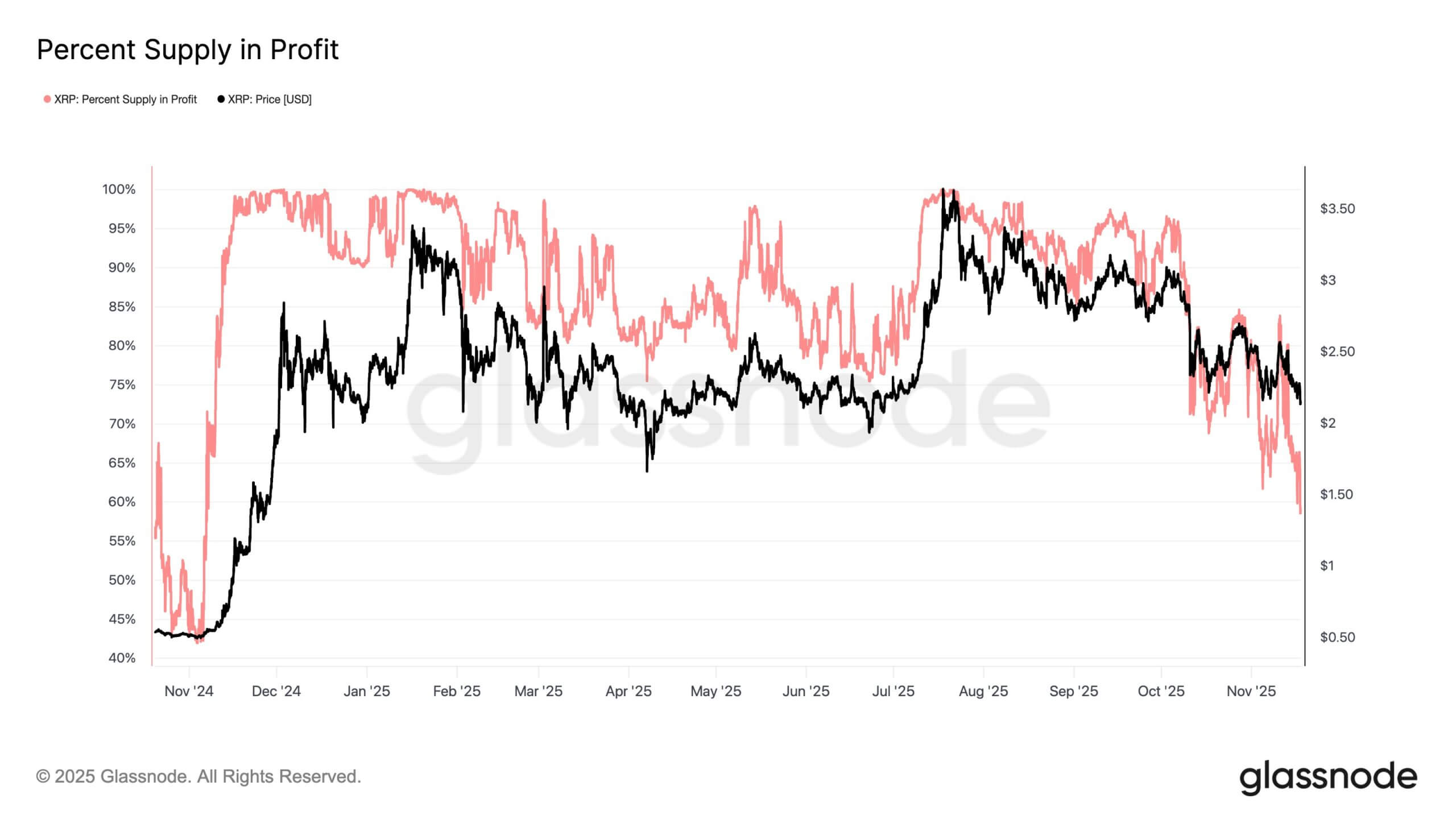

Why 26.5 billion XRP tokens are now sitting at a loss despite a $2 price tag

XRP is under renewed pressure as the broader market downturn drags its profitability metrics back to levels last seen during Donald Trump’s November 2024 re-election. Glassnode data shows that only 58.5% of XRP’s circulating supply is now in profit. That is

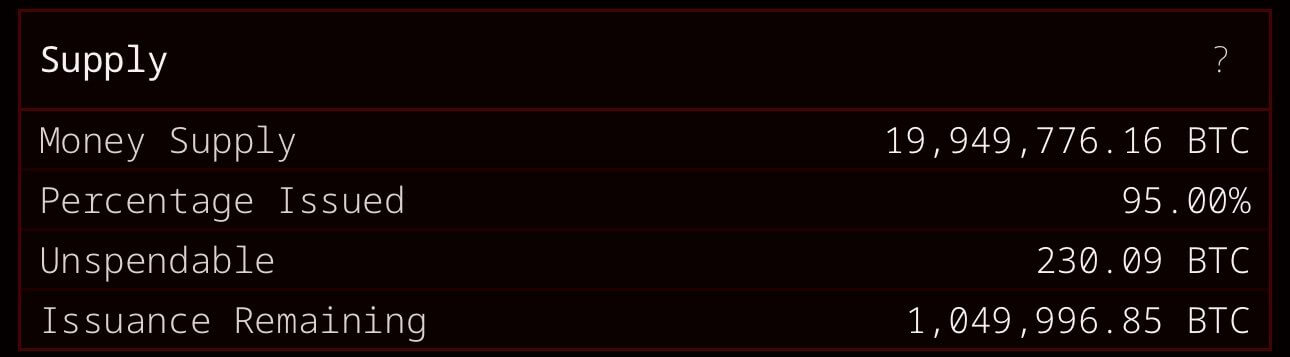

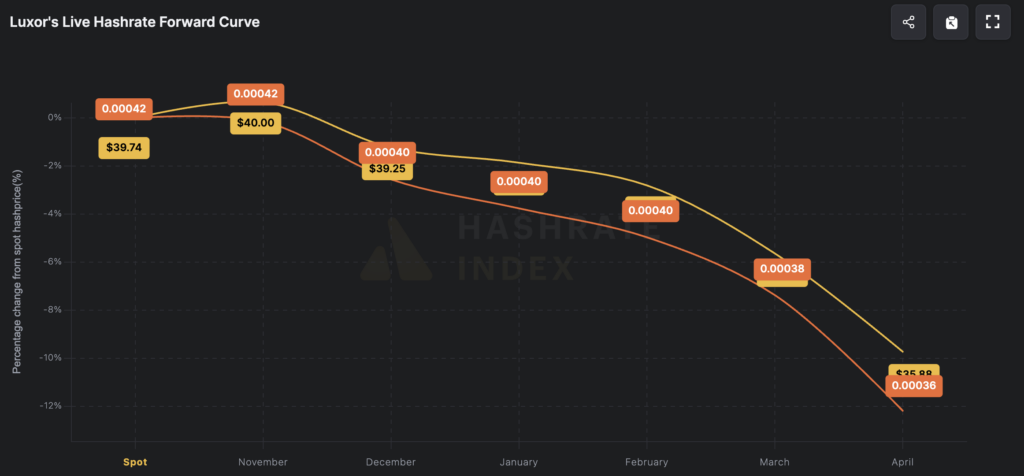

1M coins left to mine as Bitcoin enters ‘5% era’ — miners say the most dangerous part is only beginning

Bitcoin crossed a watershed moment in its monetary history on Nov. 17, surpassing 19.95 million mined coins and pushing the network past 95% of its immutable 21 million supply cap. This leaves the network with less than 1.05 million BTC

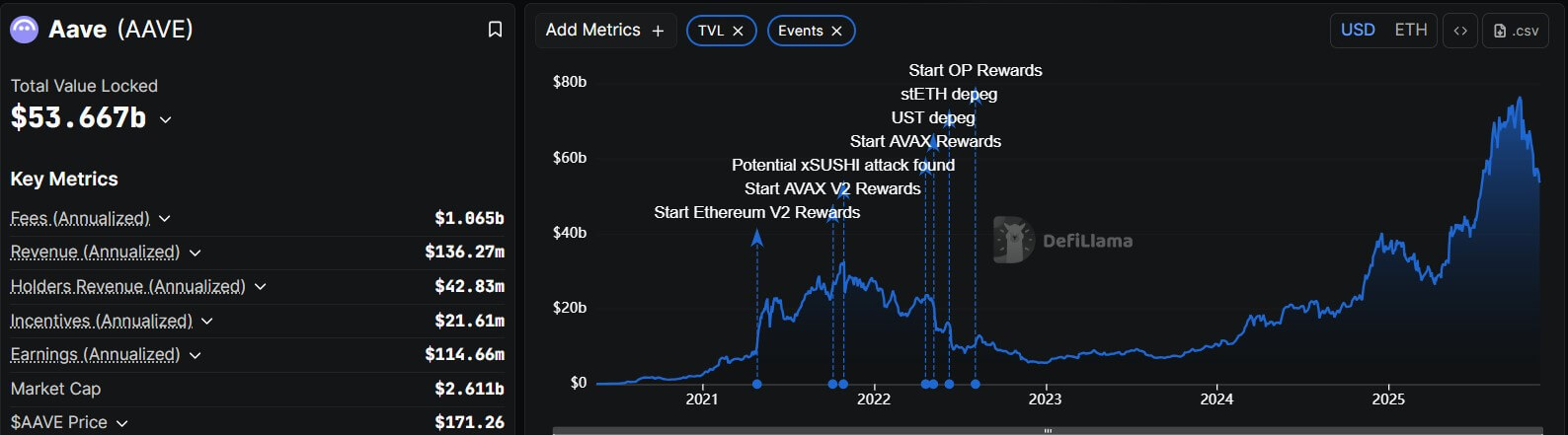

Aave launches first DeFi app that feels like a real bank — and it might finally bring crypto to everyone

For more than a decade, the DeFi sector has operated on a fractured promise. The theoretical pitch of a fairer, more accessible global financial system has consistently crashed against the rocks of practical reality. In practice, DeFi has delivered a user

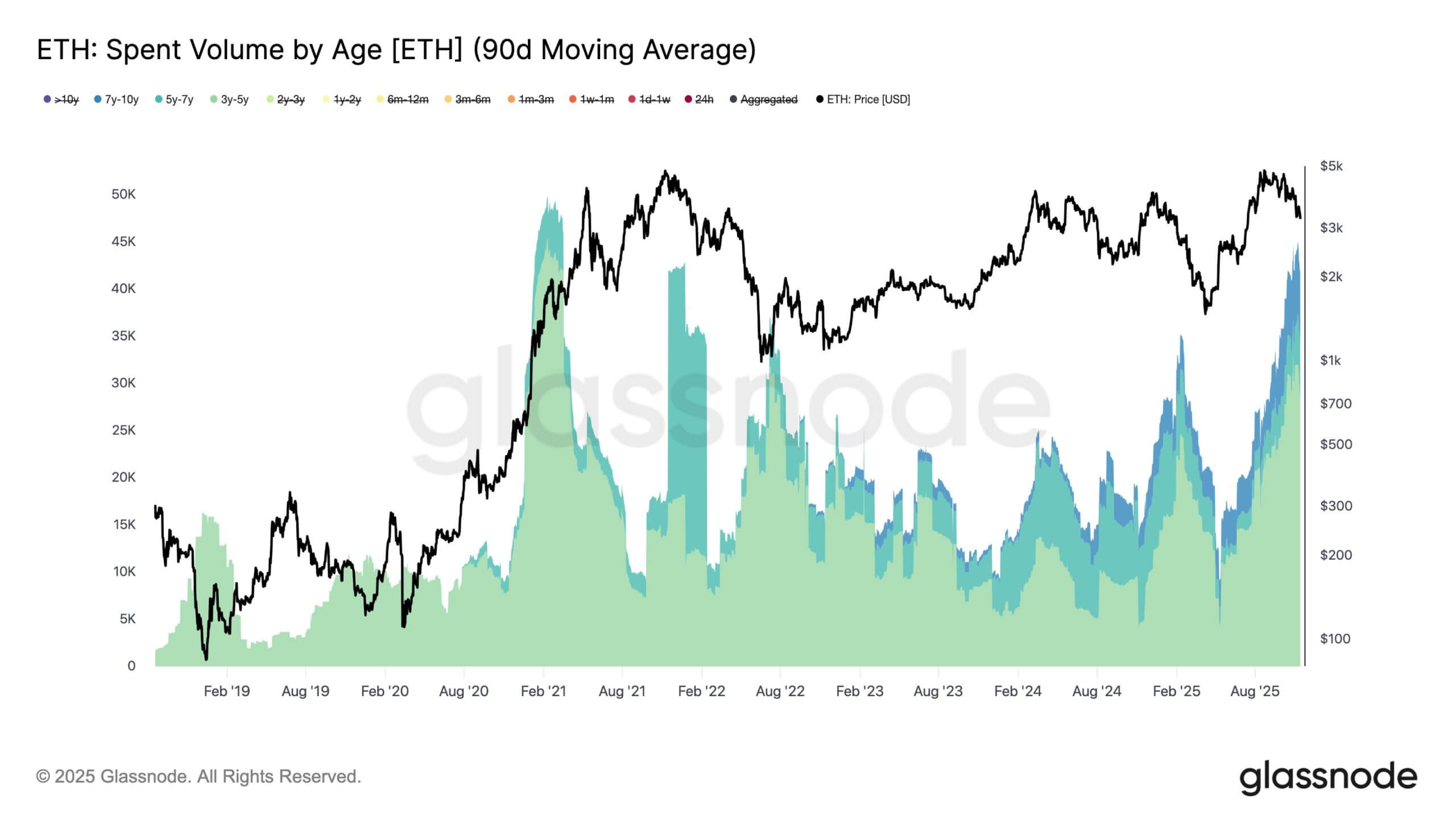

Why Ethereum’s current 35% whale sell-off may be its most bullish signal

Ethereum is undergoing its most significant transition since its August peak. A sharp, double-digit correction of more than 35% since Oct. 6 has triggered a crisis of conviction, ripping through the speculative layers of the market and forcing a wave of

Binance to invest over $4 billion in America if it gets a refund after CZ pardon

Donald Trump’s pardon of Binance founder Changpeng “CZ” Zhao removed his remaining criminal exposure while leaving intact the more than $4.3 billion that Binance has already paid to U.S. agencies. On X, CZ treated the idea of clawing that money back

Bitcoin miners can lower your power bill — if energy grids let them plug in

Power markets are starting to price Bitcoin mining that can switch on and off as a grid service. Curtailment remains elevated in regions with high renewable penetration, and short scarcity bursts continue to set value for fast demand reduction, which creates

It’s foolish to pretend Bitcoin’s story doesn’t include $79k this year

Bitcoin is slipping again, and the mood across the market is shifting. Traders who were celebrating six-figure prices only weeks ago are suddenly watching key levels evaporate. The move below $106,400 was the first real warning sign, the collapse through $99,000

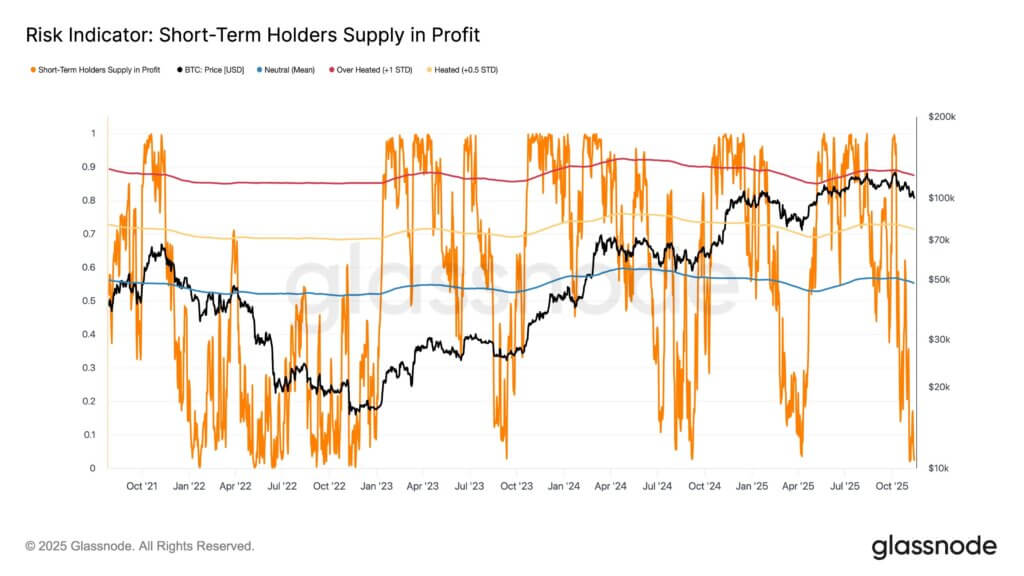

At $96k, nearly 99% of BTC investors accumulating in past 155 days are holding at a loss

As the BTC price tumbles below $100,000, Glassnode would like to share a depressing stat. If you’ve been stacking sats anytime since late spring, it’s fair to say the honeymoon is officially on pause. With Bitcoin trading at $96,000, a whopping

Ethereum Price Prediction 2025: ETH Dips to $3,200 on Holder Selling Frenzy, Whales Defy Losses—$EV2 Presale Ignites Gaming Rally

Ethereum has struggled to reclaim its recent high, and the price has gone down to below 3,200. Nevertheless, the trend is downward, and whales have been on a rise, with one of the biggest players contributing to their accounts in

Bitcoin loses its last line of defense: $98k breakdown sparks cascade not seen since May

Bitcoin (BTC) dropped 3% to $98,550.33 as of press time, falling below the psychological $100,000 threshold for the third time this month amid cascading leverage liquidations, persistent ETF outflows, and a broader risk-off posture across digital assets. The slide accelerated after

Theta Price Update: THETA Moves Near $0.45 — Why EV2 Presale Is Capturing Investor Attention Across Crypto and Gaming Communities

The THETA price has been inching upward but still feels like it is missing that extra push. Theta continues to find stability in a market currently battling to hold ground as it consolidates near $0.47. Meanwhile, investors are closely monitoring

Buy high, sell never: Saylor keeps buying Bitcoin at local tops despite mounting risk

Strategy (formerly MicroStrategy) has earned a reputation for making its weekly Bitcoin acquisitions near the local top in recent weeks. On Nov. 10, CryptoQuant analyst JA Marturn noted that the firm’s most recent acquisition disclosure from Michael Saylor followed the same

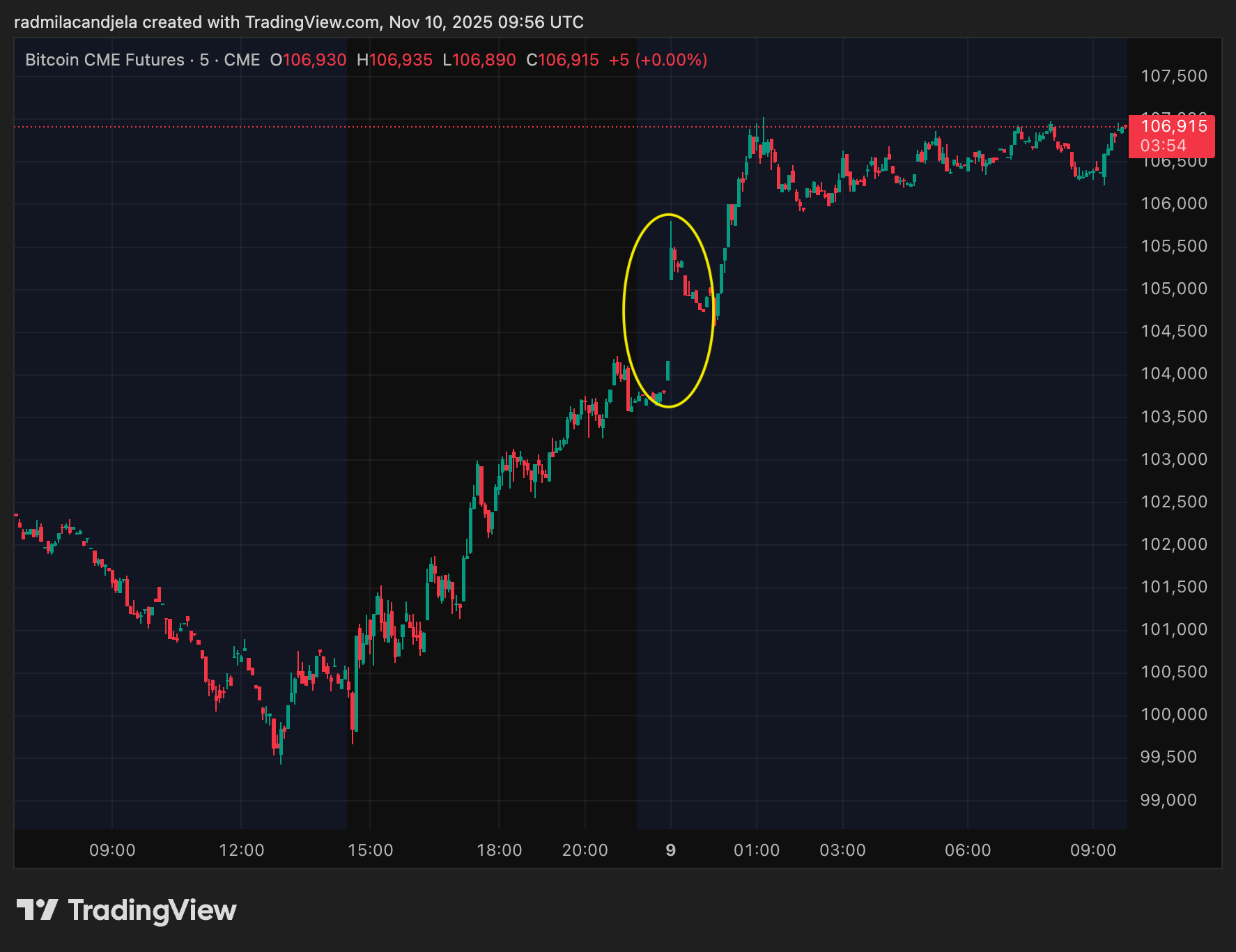

BTC targets CME gap at $104,000 as shutdown end buoys risk

Bitcoin traders are monitoring the latest CME futures gap between Friday’s close at $104,160 and Sunday’s open at $110,370. This six-thousand-dollar “missing” price action often attracts short-term moves. With Bitcoin near $105,900, focus is on whether the market will fill the

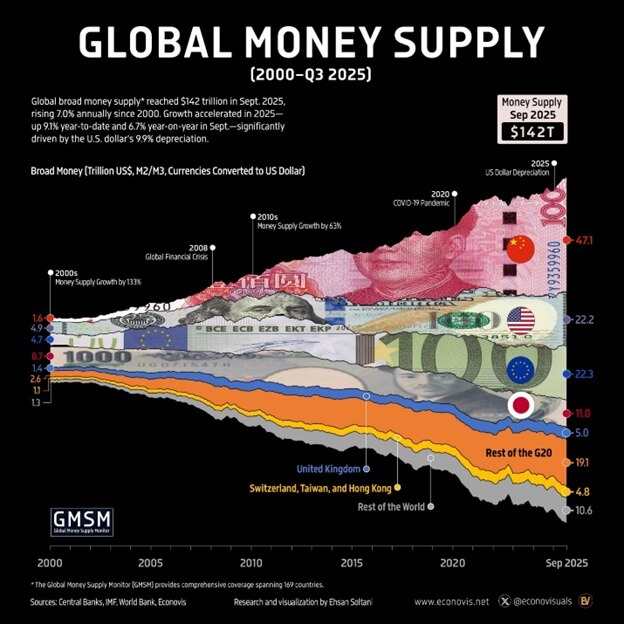

Global money supply ‘through the roof’, hitting $142 trillion in September

All eyes in global finance are glued to liquidity. As the global broad money supply reaches a record $142 trillion, this monetary firehose has macro investors sitting up in their seats. Surging 6.7% year-on-year as of September, China, the EU,

Why BlackRock remains bullish on Bitcoin despite recent price slowdown

Bitcoin’s recent struggle to hold the $100,000 level has revived familiar doubts about whether institutional demand is durable. However, in a new filing with the US Securities and Exchange Commission, BlackRock signals the opposite conclusion, saying its conviction in Bitcoin’s long-term

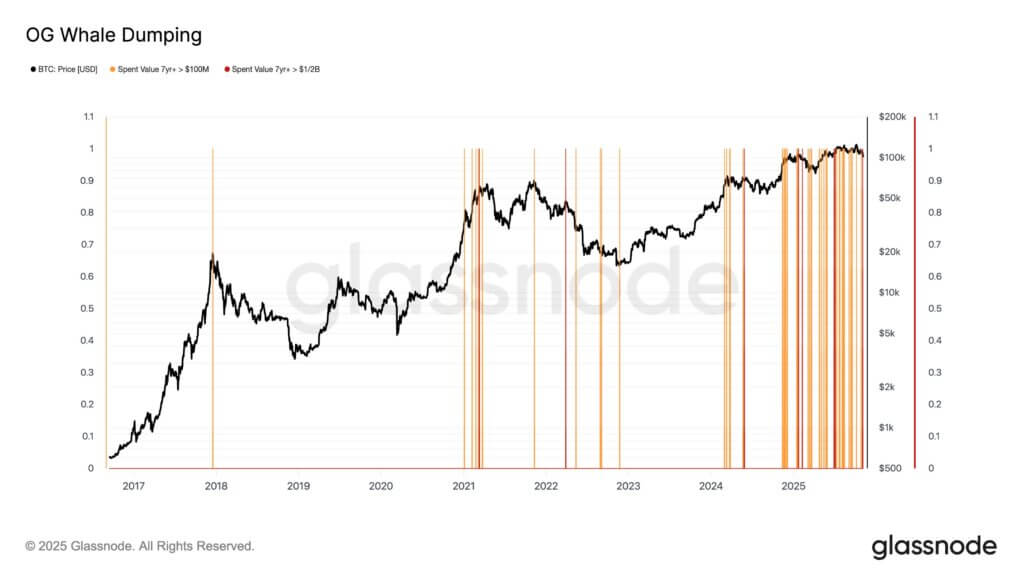

On-chain moves don’t tell the full story: Why OG Bitcoin whales may not be cashing out

“OG Bitcoin whales are dumping,” is the overarching narrative surrounding the latest Bitcoin selloff. Yet, amid nonstop chatter that Bitcoin’s earliest supporters are behind its latest price slide, on-chain analyst Willy Woo points to “nuance” in the metrics. On-chain moves

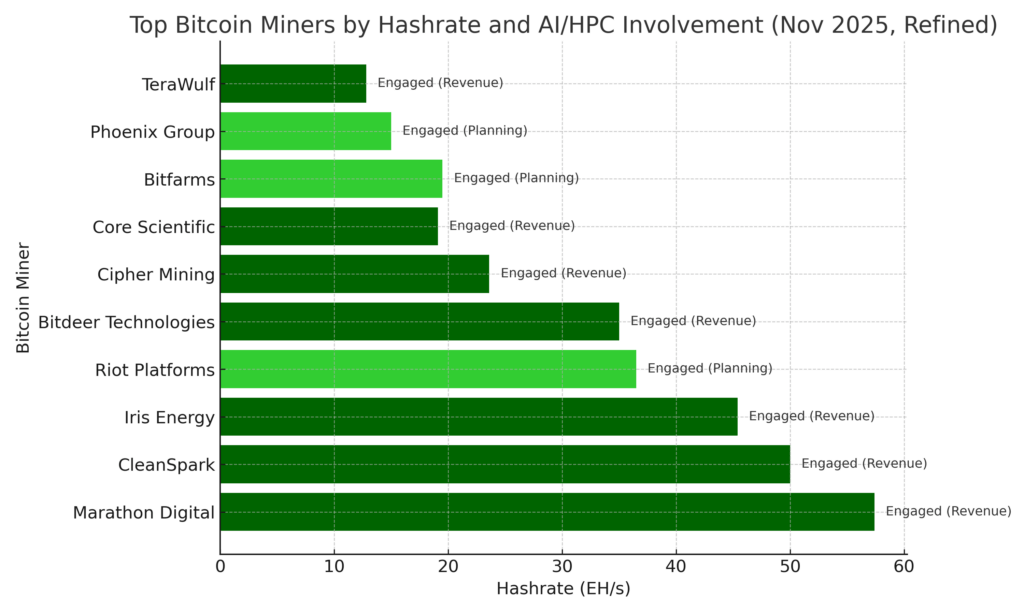

70% of top Bitcoin miners are already using AI income to survive bear market

Seven of the top ten miners by hashrate report AI or high-performance computing initiatives already generating revenue, with the other three planning to follow suit. The shift pairs miners’ energized land and interconnections with contracted revenue from GPU customers, creating a