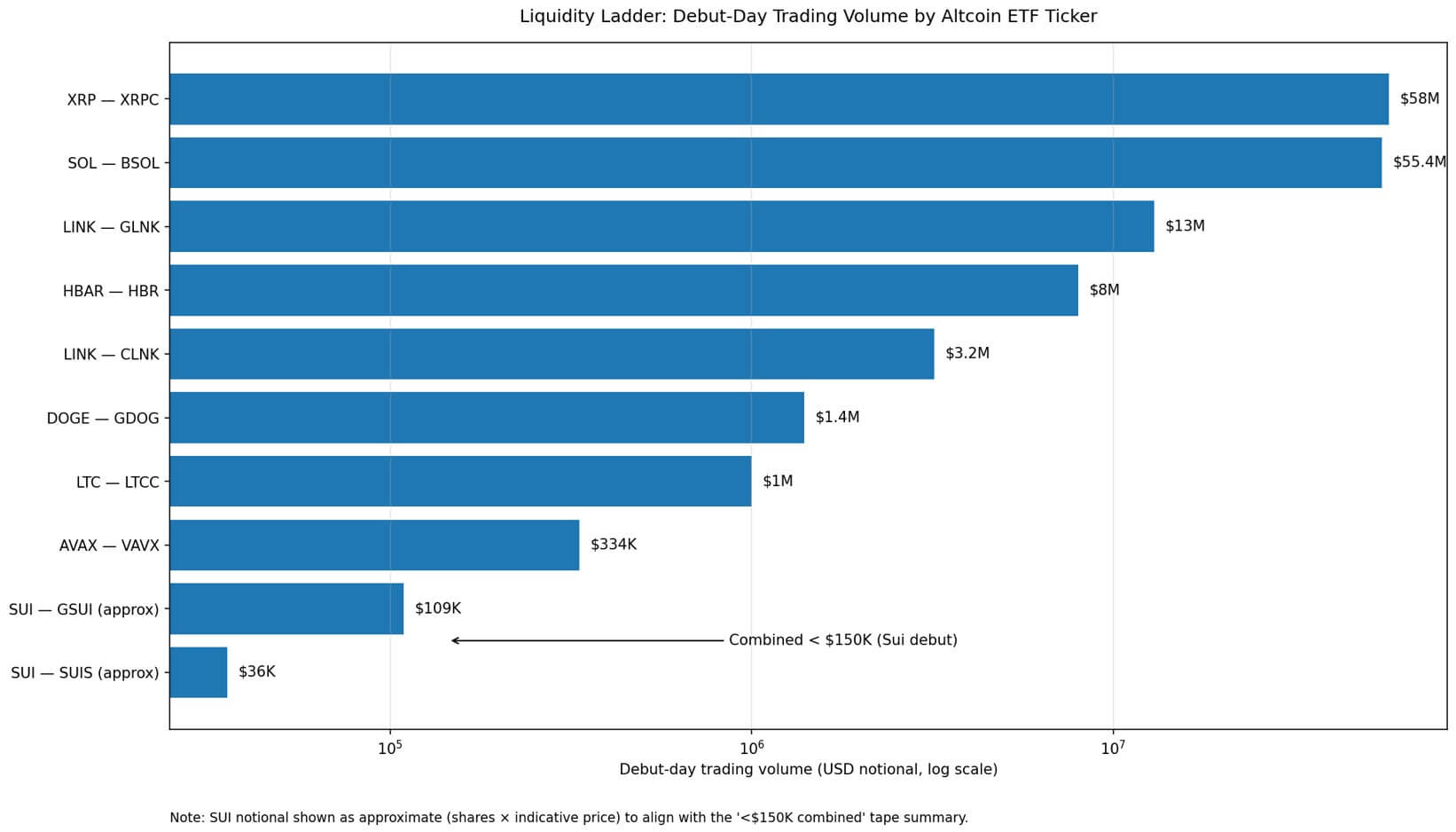

Sui ETFs just launched — and the volume is collapsing because nobody’s showing up

Two spot Sui ETFs began trading in US markets on Feb. 18. Canary's SUIS is listed on Nasdaq, while Grayscale's GSUI appeared on NYSE Arca. Both products offer staking-enabled exposure to Sui, the layer-1 blockchain positioned as a high-throughput alternative to

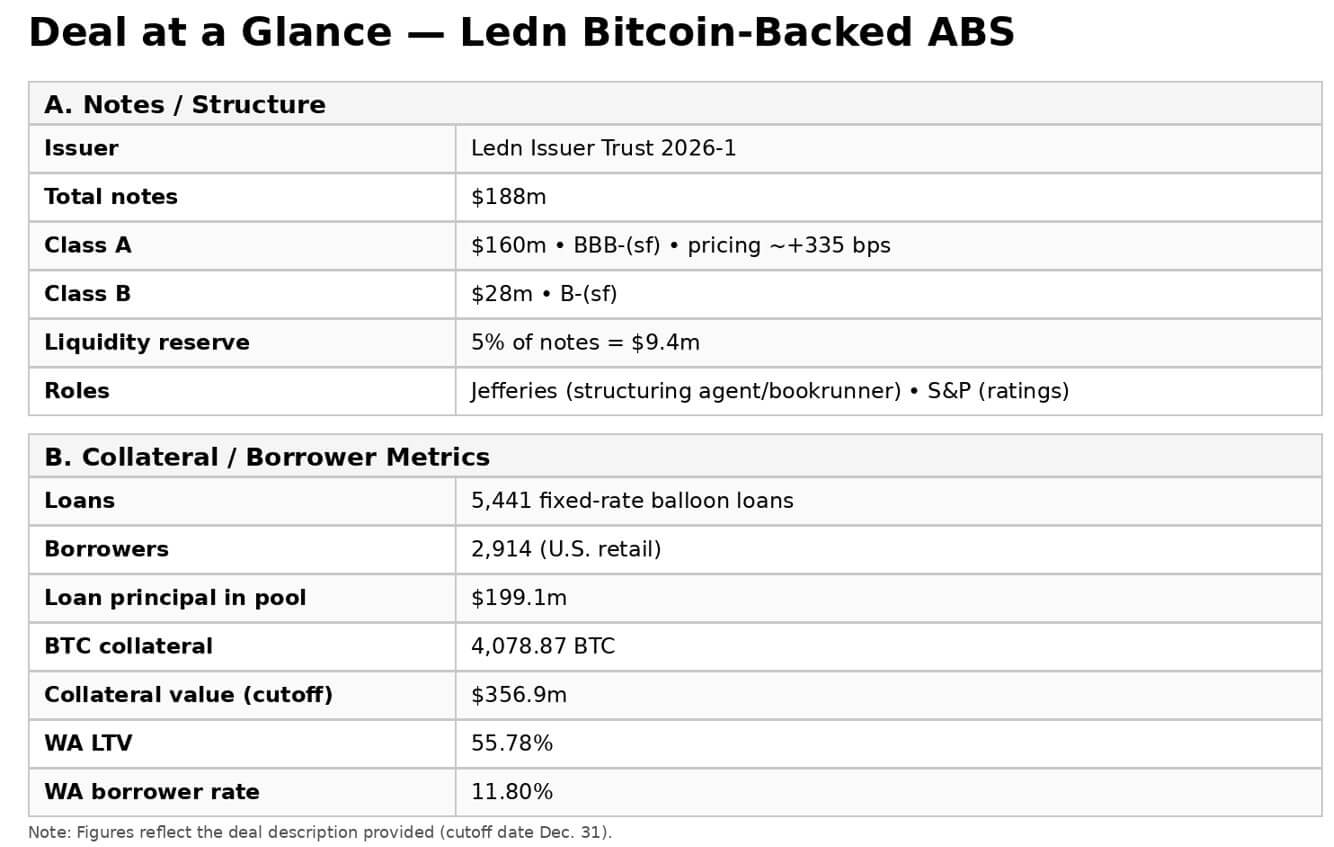

Bitcoin-backed loans with sub-prime-style incentives, but with liquidation triggers hit Wall Street

Ledn's $188 million securitization marks the moment Bitcoin-backed consumer credit started looking like mainstream asset-backed debt. Ledn Issuer Trust 2026-1 packages 5,441 fixed-rate balloon loans into rated, tradable notes with investment-grade and subordinated tranches, custody arrangements, liquidity reserves, and all the

Ethereum’s 2026 roadmap just hit — but ETH won’t recover until one metric flips

Ethereum’s new roadmap lands in a market that is less interested in vision and more interested in evidence. That is the core tension behind the Ethereum Foundation’s Protocol Priorities Update for 2026, which breaks the network’s next phase into three tracks,

If Bitcoin stays near $67k, it breaks the Power Law floor by mid-December

Bitcoin has until the end of the year to recover, or the Power Law will be invalidated. The Power Law model isn't a prophecy. It's a time-based regression that treats Bitcoin's long-run price path as a power curve, and the “deadline”

Bitcoin may tumble toward $30,000 next year unless it shows real progress toward quantum proof upgrades

Bitcoin's current bear market could worsen over the next year if the flagship digital asset fails to address concerns about quantum computing. In a Feb. 20 report, Charles Edwards, Capriole founder, claimed that Bitcoin’s market value should already be discounted for

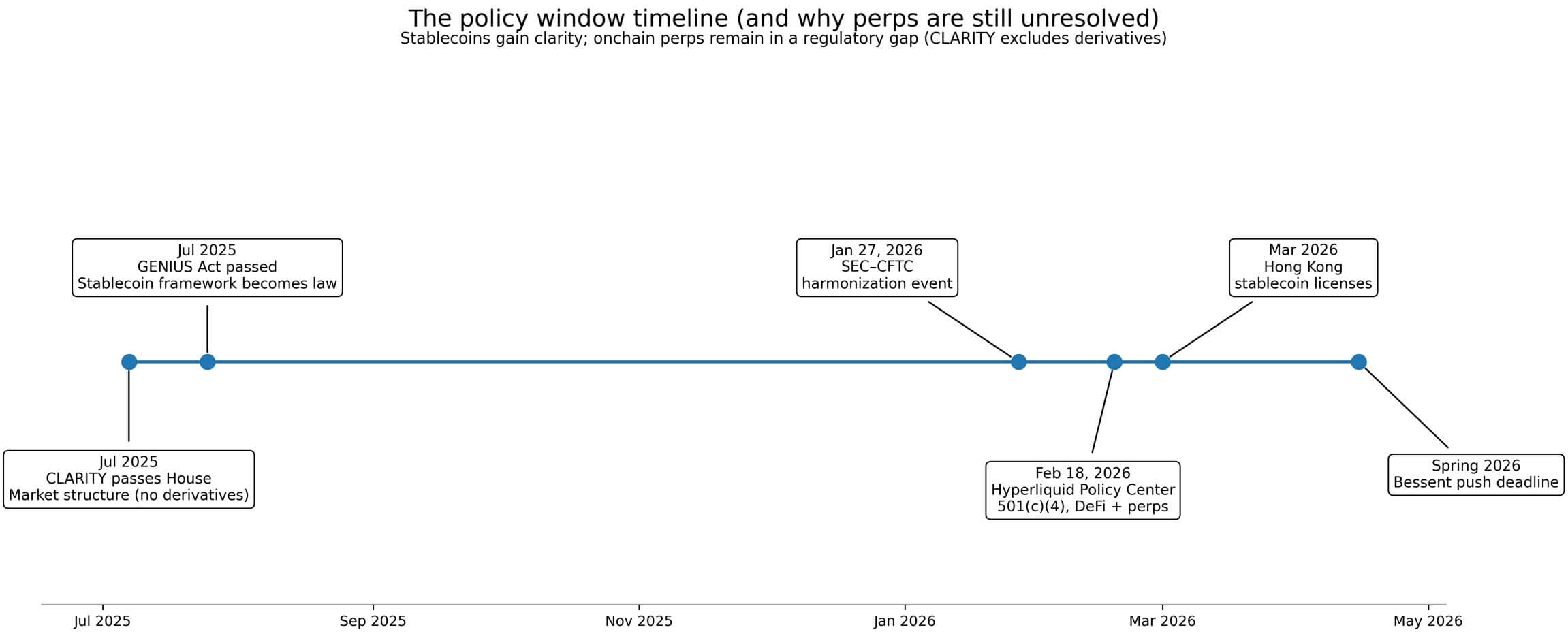

If CLARITY stalls, on-chain perps stay offshore — and US traders get pushed out

Hyperliquid launched a policy center in Washington on Feb. 18, seeded with 1 million HYPE tokens worth roughly $28 million, led by Jake Chervinsky, the crypto lawyer who spent years building the industry's Capitol Hill playbook. The Hyperliquid Policy Center operates

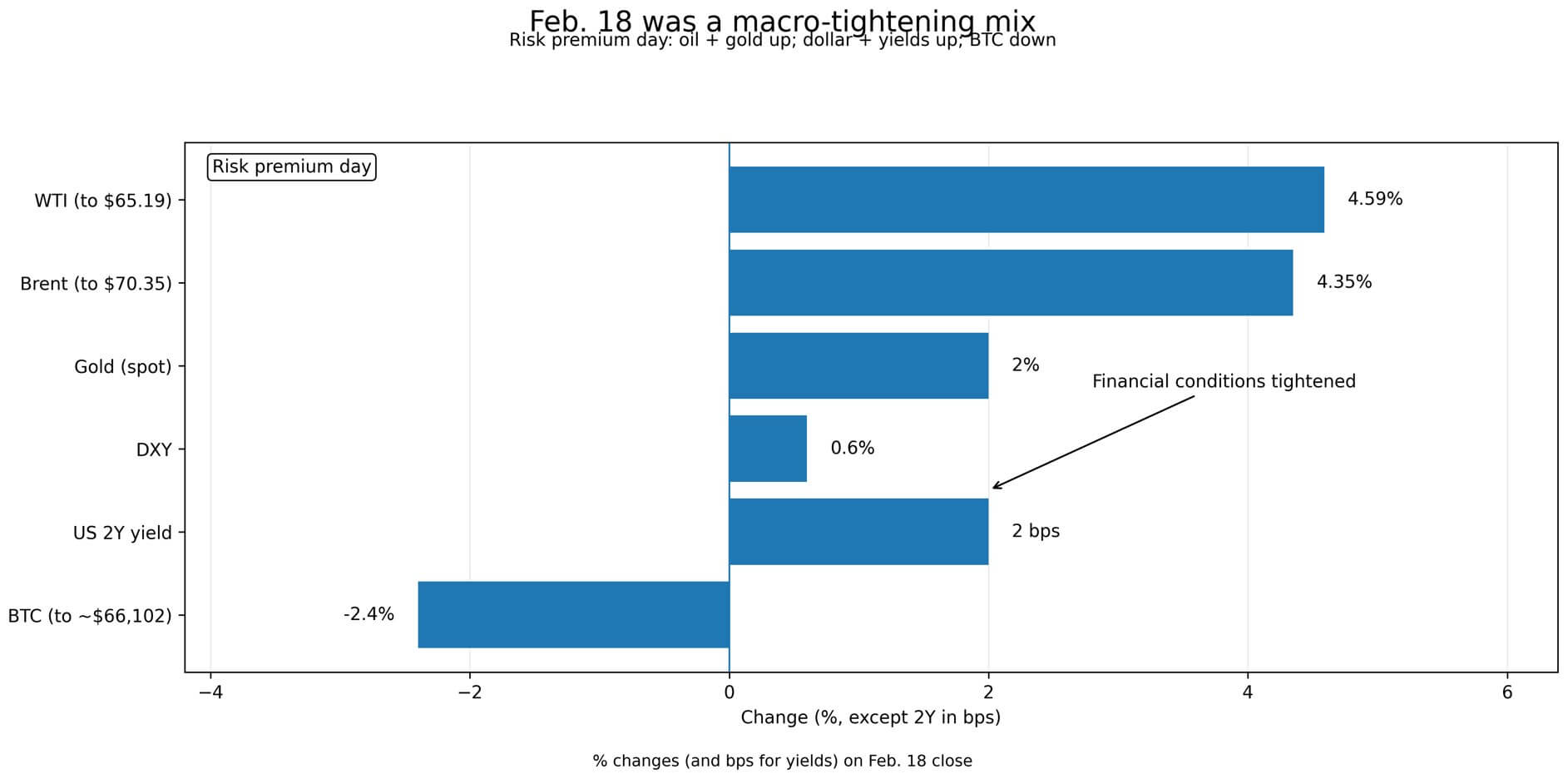

Bitcoin faces a new selloff if oil holds $70 after spike and the Fed turns less patient

Oil isn't supposed to be the story in 2026. The macro narrative powering “cuts soon, liquidity soon” trades relies on disinflation staying intact. However, Brent jumped 4.35% to $70.35 on Feb. 18, and WTI surged 4.59% to $65.19 after headlines revived

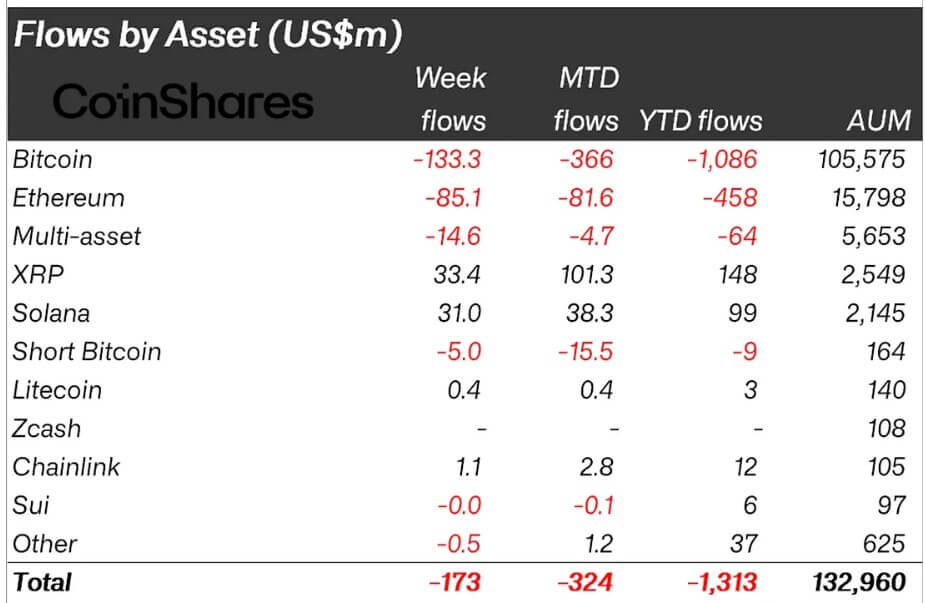

XRP sentiment hits a 5-week high as money rotates away from Bitcoin and Ethereum

XRP is attracting institutional money and a burst of bullish positioning, even as much of the crypto industry remains stuck in a risk-off tape. According to a CoinShares report, XRP is the best-performing crypto token this year, attracting around $150 million in fresh

Bitcoin eyes new liquidity as the Fed’s $18.5 billion repo spike reignites money printer chatter

Bitcoin, the largest cryptocurrency by market capitalization, continued its price struggles as traders weighed two stress-tinged signals from the US financial ecosystem. This week, there was a sudden $18.5 billion Federal Reserve overnight repo operation, and Blue Owl Capital has decided

TradFi is selling crypto income on Wall Street but a hidden switch decides who gets in

Bitwise's February announcement arrived as two moves packaged as one. The crypto asset manager announced a partnership with Morpho to launch curated yield vaults and simultaneously acquired Chorus One's institutional staking business. It looks like a deliberate assembly: curation mechanisms to

Is China using US Bitcoin ETFs as a backdoor? Mystery Hong Kong firm invested $436M in BlackRock’s IBIT

An obscure Hong Kong firm has disclosed a $436 million position in BlackRock’s Bitcoin ETF, a revelation that is fueling speculation about Chinese capital flowing into crypto through offshore side doors. Laurore Ltd, a previously unknown entity, reported the stake in

The metrics that matter for XRP network health and how to read them without counting noise

XRP network health scorecard: wallets, trustlines, DEX volume, uptime Key takeaways Ripple and Aviva Investors said Feb. 11 they intend to tokenize traditional fund structures onto the XRP Ledger “over 2026 and beyond.” Messari’s State of XRP Ledger Q4 2025 reported 425,400 total

Bitcoin whales added 200,000 BTC in a month — but short-term demand is fading at the same time

Bitcoin's ongoing price struggles is turning into a market defined less by “bad news” and more by mechanics, the kind that can keep a downtrend alive even when selling looks tired. According to CryptoSlate's data, the BTC price is down approximately

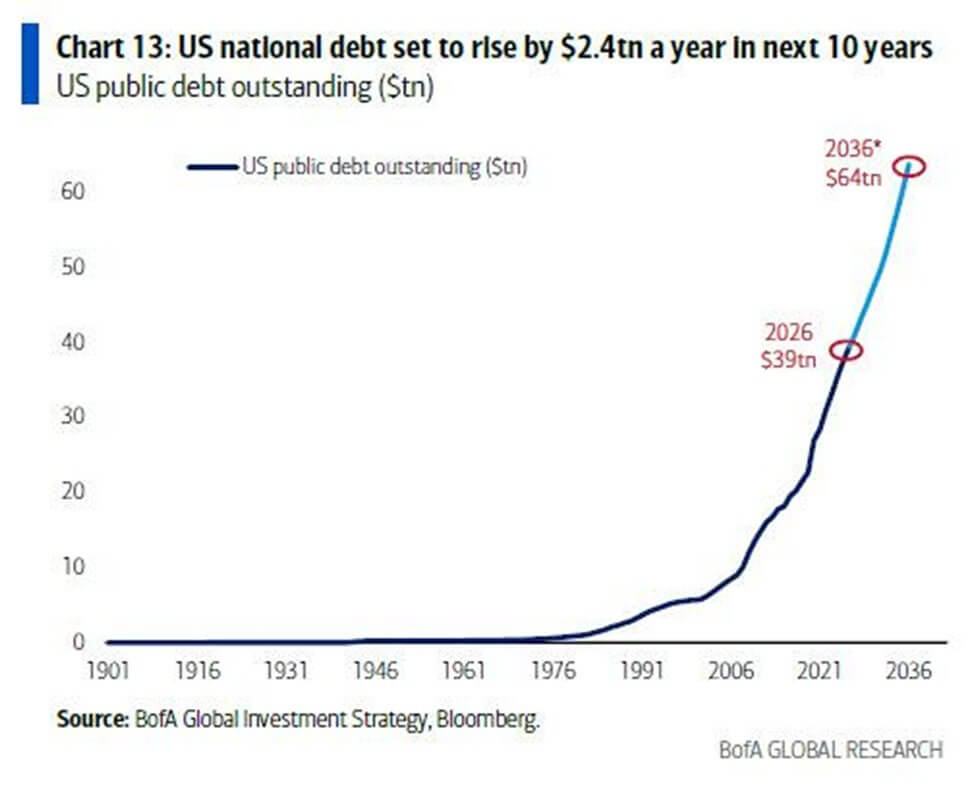

US debt will match WWII-era extreme at $64 trillion within a decade – how does Bitcoin benefit?

The fiscal mathematics of the United States are drifting toward a threshold that markets can no longer afford to ignore, and a level that, relative to GDP, hasn't transpired since the last world war. Washington’s latest budgetary outlook suggests the nation

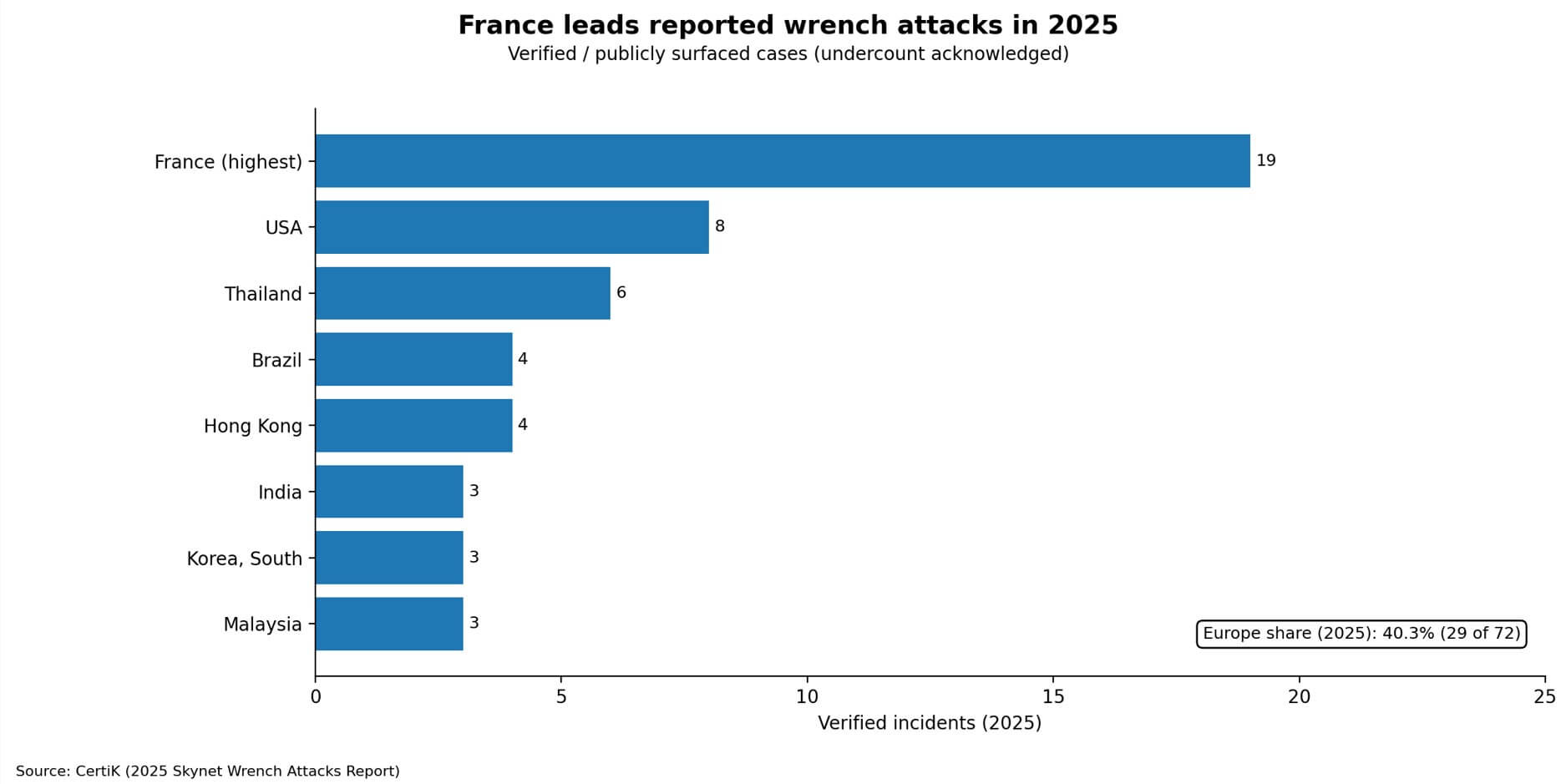

Binance employee hunted down in botched France home invasion as crypto “wrench attack” spike spreads

A botched home invasion in the Paris suburbs on Feb. 12 marked a tactical shift in crypto's physical-threat or “wrench attack” landscape. The target, according to French media reports, was the CEO of Binance France. Binance confirmed an employee was targeted

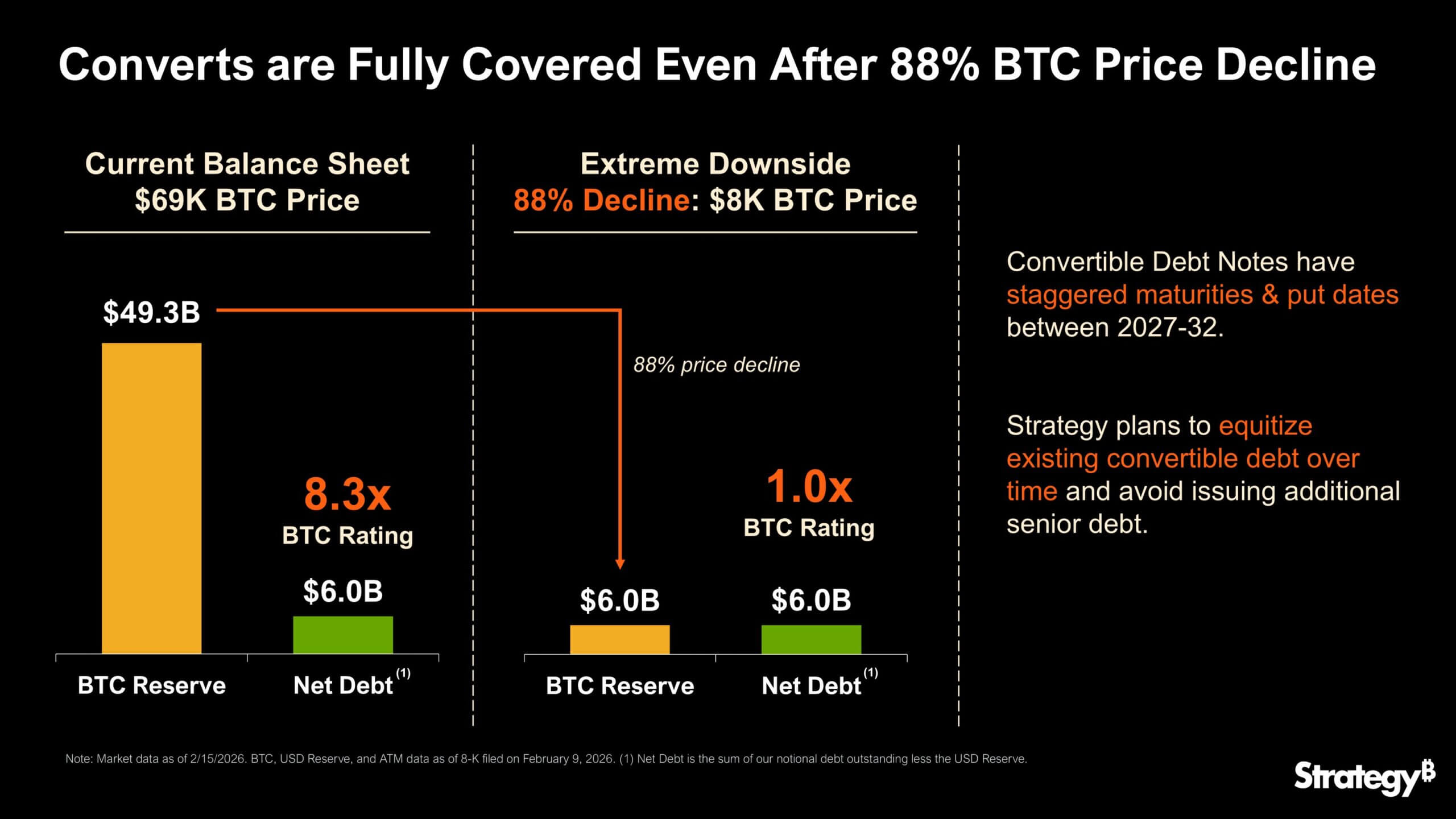

Strategy can survive Bitcoin crashing to $8,000 – but can it escape the slow bleed of dilution?

Strategy (formerly MicroStrategy) has become the public market’s most widely traded Bitcoin proxy, using equity, convertible notes, and preferred stock to build a balance sheet dominated by the top crypto. However, as Bitcoin trades near $68,000 and Strategy shares hover below

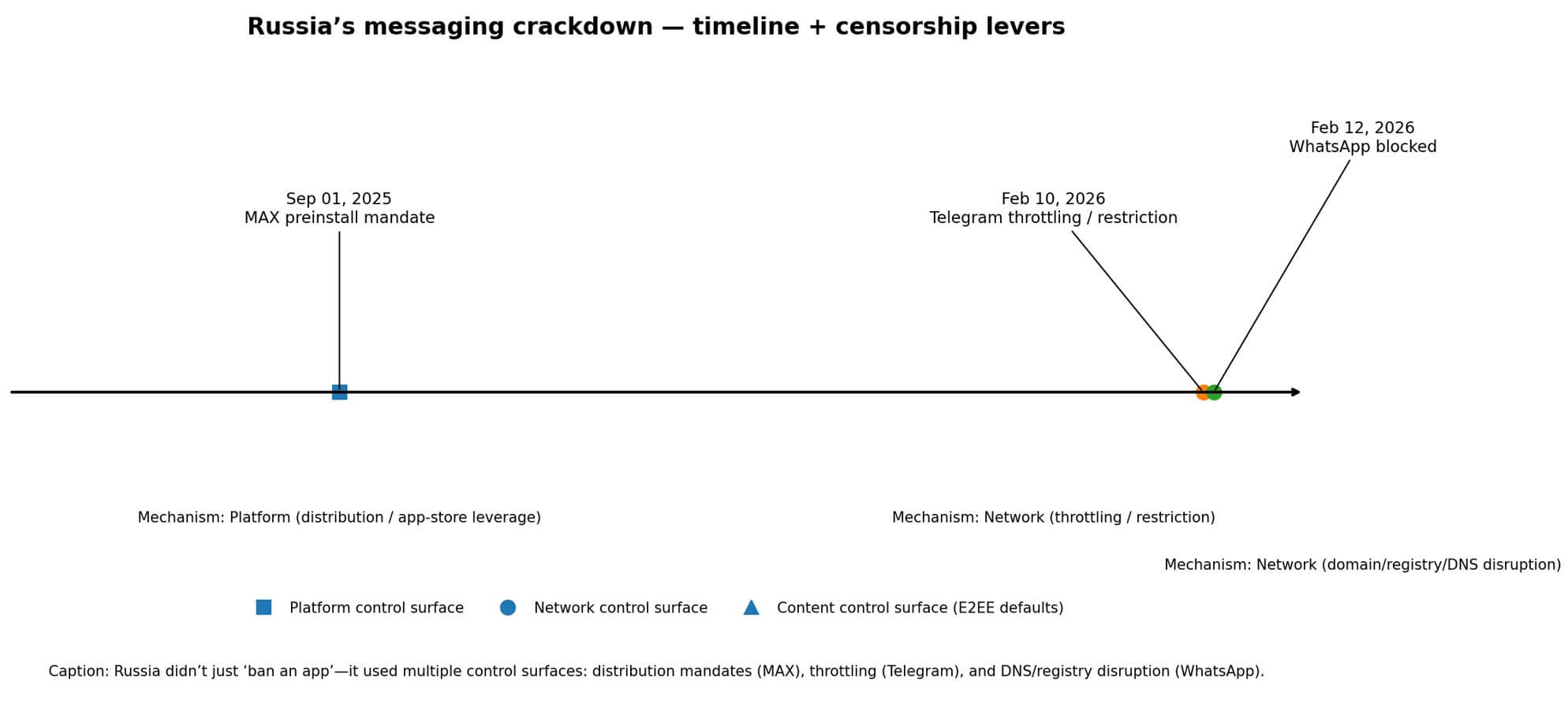

Russia’s censorship crackdown and WhatsApp ban expose the decentralization gap the crypto industry keeps missing

Russia’s recent messaging crackdown is the cleanest real-world stress test of decentralization in years, and it produced an awkward result. Roskomnadzor began throttling Telegram on Feb. 10, citing “non-compliance.” Two days later, authorities fully blocked WhatsApp, removing its domains from Russia's

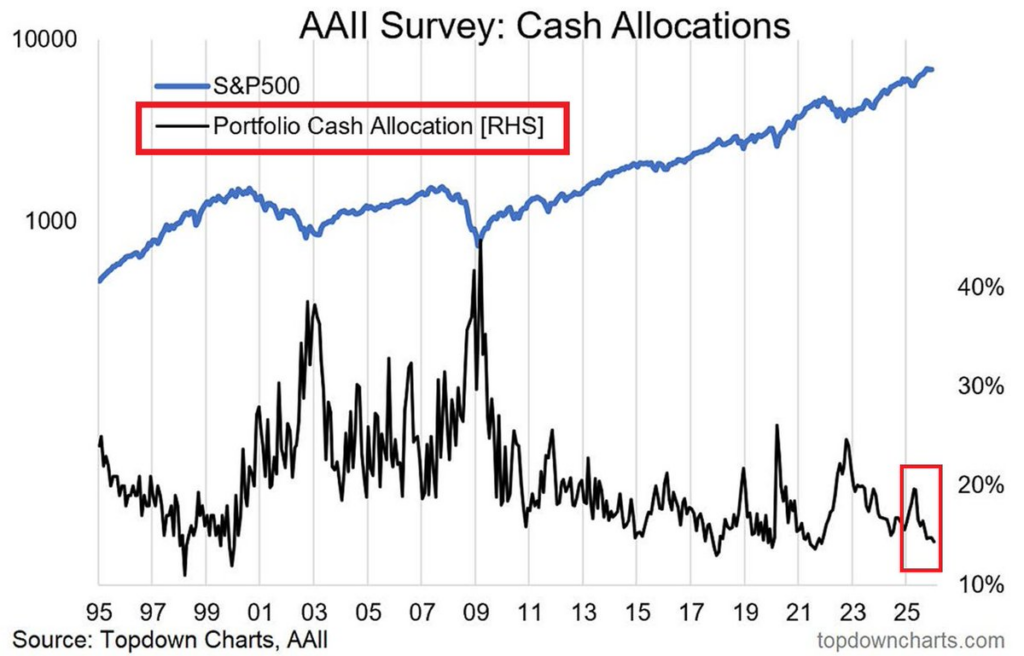

Bitcoin eyes $7.7T sidelined dollars as Wall Street runs out of cash to “buy the dip”

I came across some analysis this morning that cut through the usual stream of charts and market takes with a stark claim: there is “almost no cash on the sidelines.” If true, it challenges one of the most persistent assumptions in