EU crypto reporting goes live and Netherlands immediately votes on 36% Bitcoin tax – even if you don’t sell

The scoop: The Netherlands has just moved to tax Bitcoin like a stock, marked to market. Lawmakers in the Dutch House backed a Box 3 overhaul that would tax “actual returns,” including annual price changes in liquid assets like BTC, at

Bitcoin on track to equal its most bearish period in history – only one price matters now

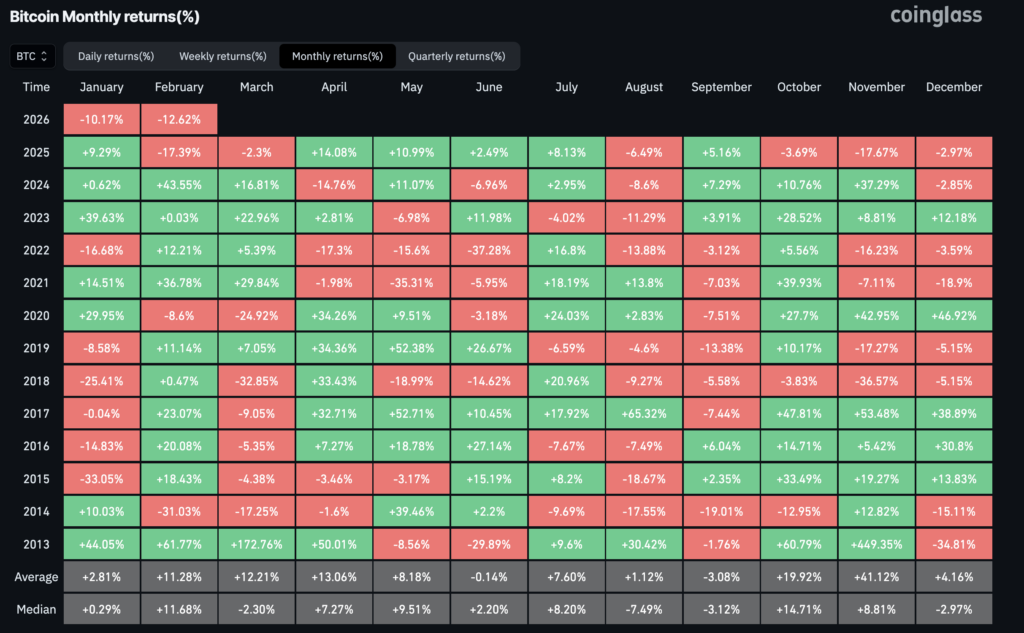

The scoop: Bitcoin is on pace for a fifth straight monthly drop if February closes red, its longest losing streak since 2018, while spot ETF flows flip persistently negative, reinforcing a new reality: post-ETF BTC is trading like a rates-and-risk

Bitcoin no longer acting like “digital gold” because its correlation with physical gold, USD collapsed

In 2025 and early 2026, Bitcoin's behavior has been less “digital gold” and more regime-dependent. Sometimes it trades like a tech beta, then like a rates-and-liquidity-duration trade, and only intermittently like a hedge. The real story is which macro regime makes

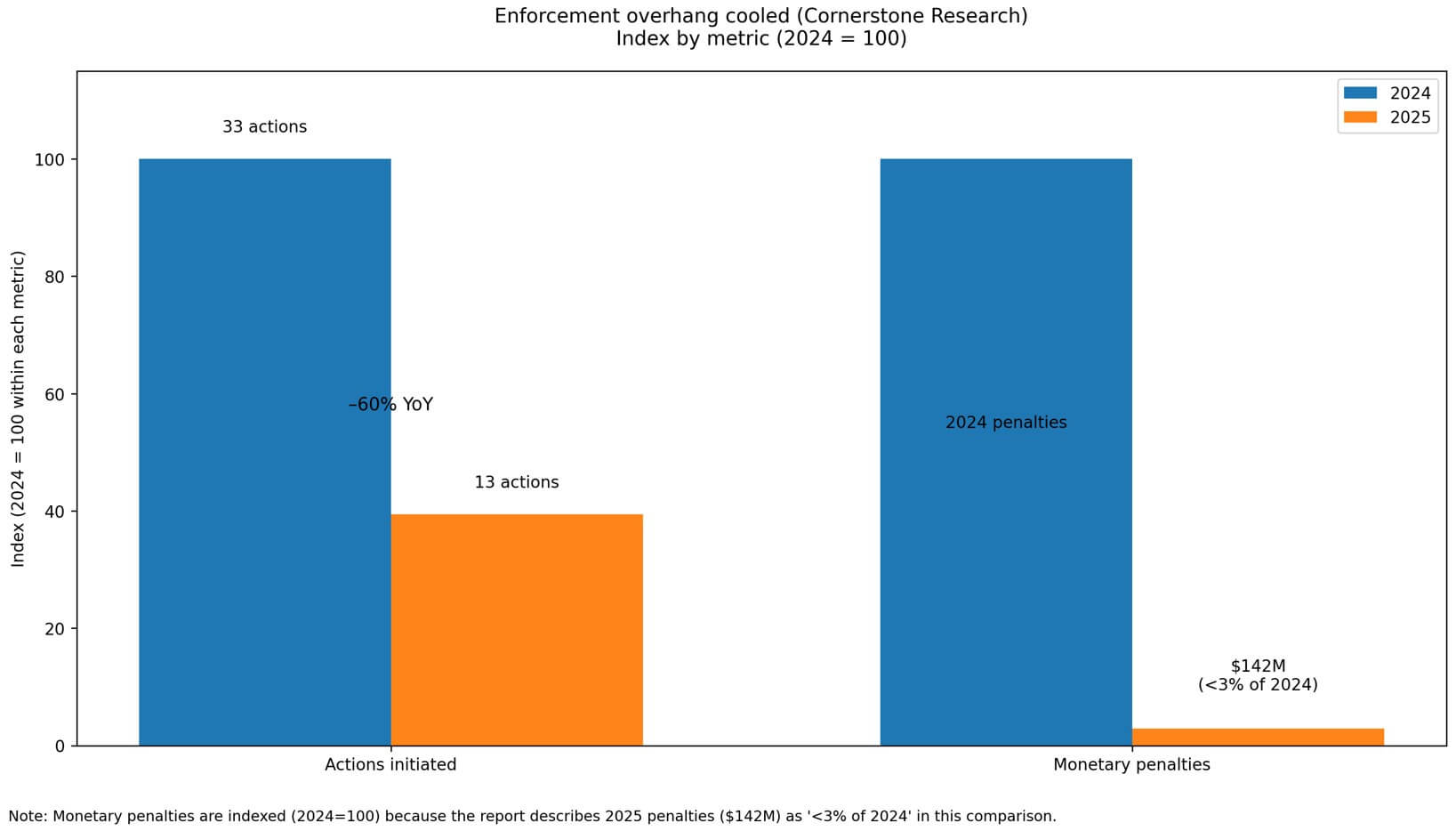

If the SEC stays softer, Aave’s DAO could start capturing $100M+ annualized revenue

Aave Labs posted a governance proposal on Feb. 12 asking tokenholders to endorse a strategic package that would direct 100% of Aave-branded product revenue to the DAO treasury, formalize brand protection, and center the roadmap on Aave V4. The initiative was

Bitcoin shorts just hit their most extreme level in years as BTC defiantly holds above $70k

Bitcoin derivative traders are increasingly positioning for further downside rather than a clean bounce as the leading cryptocurrency continues to trade in a tight range below $70,000. According to CryptoSlate's data, BTC price bottomed at $65,092 during the last 24 hours

Robinhood’s $221 million crypto revenue drop shows crypto winter isn’t on chain and retail already moved

Crypto winter has a branding problem. The phrase makes it sound like the chain goes quiet, wallets stop moving, and the whole machine turns cold. However, the cleanest proof of retail pulling back rarely lives on-chain. The people who vanish first aren’t

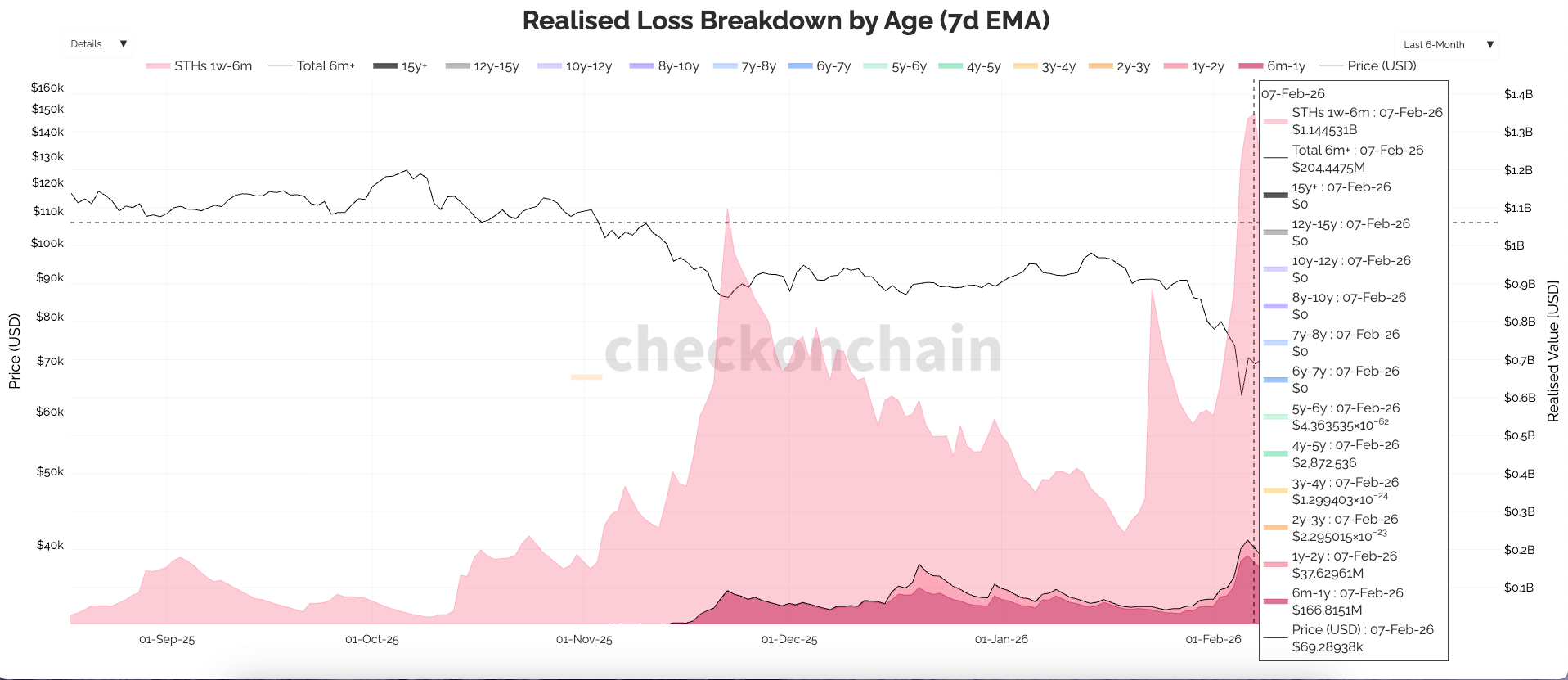

Bitcoin hit $60,000 because two different groups finally surrendered — on-chain data shows who blinked

Bitcoin’s February drop to about $60,000 was the kind of single-day panic people will remember as a bottom. But the more accurate reading of this washout is harder and more useful: this cycle quit in stages, and the sellers rotated. A Feb.

Early Bitcoin bottom signals are starting to flash as BTC is still down $20k as stocks rip

Bitcoin bottom signals: ETF outflows, miner stress, and why a 2026 recession looks like the outlier Bitcoin could be approaching a cycle low as spot Bitcoin ETF flows keep leaking and miner economics stay tight, even while recession talk dominates the

Bitcoin refuses to lose $70,000 this weekend. Was my $49k bottom call wrong?

Bitcoin is holding its ground this weekend. After Friday’s soft CPI rally, price keeps leaning into the same overhead zone around $70,300, and bids keep showing up above $65,000. That detail matters more than the stall. Last Sunday I framed $71,500 as

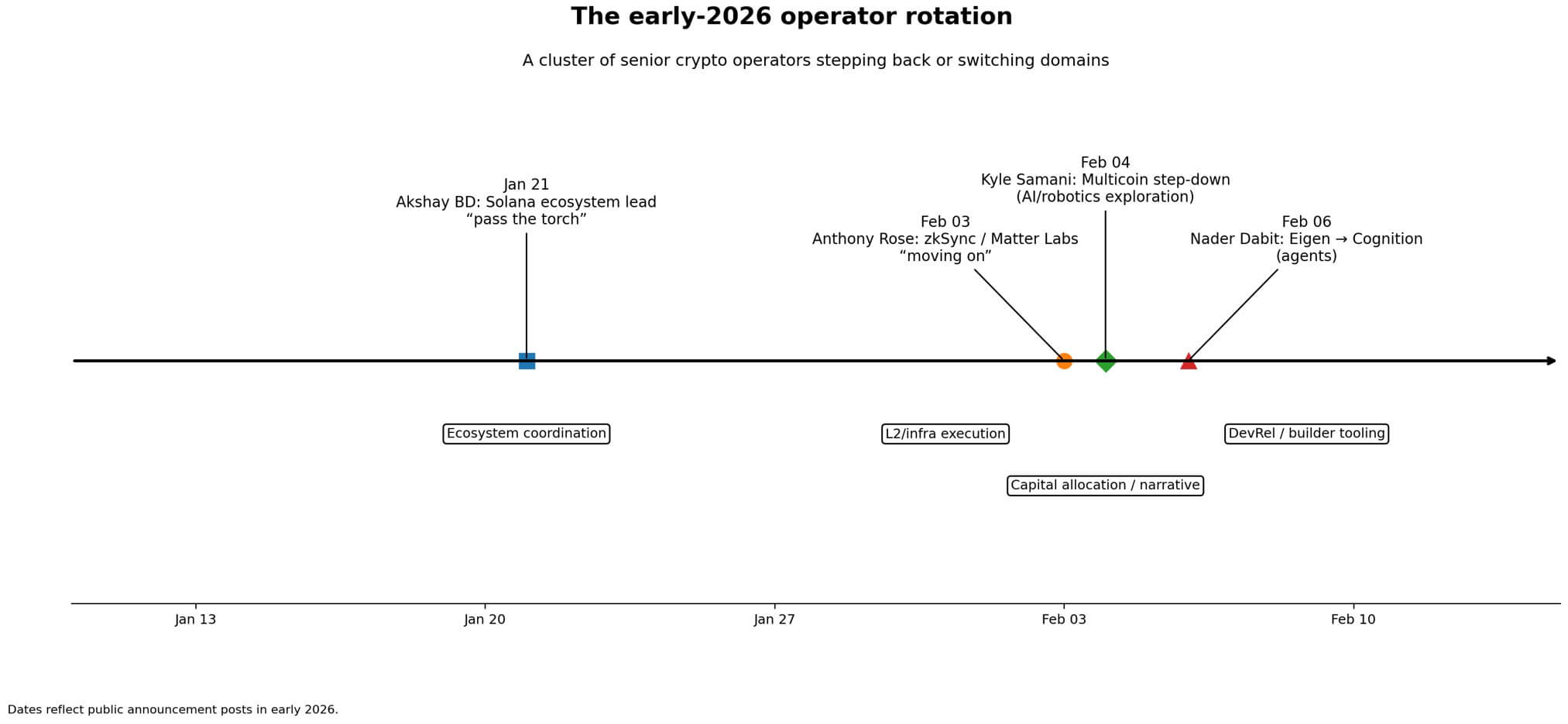

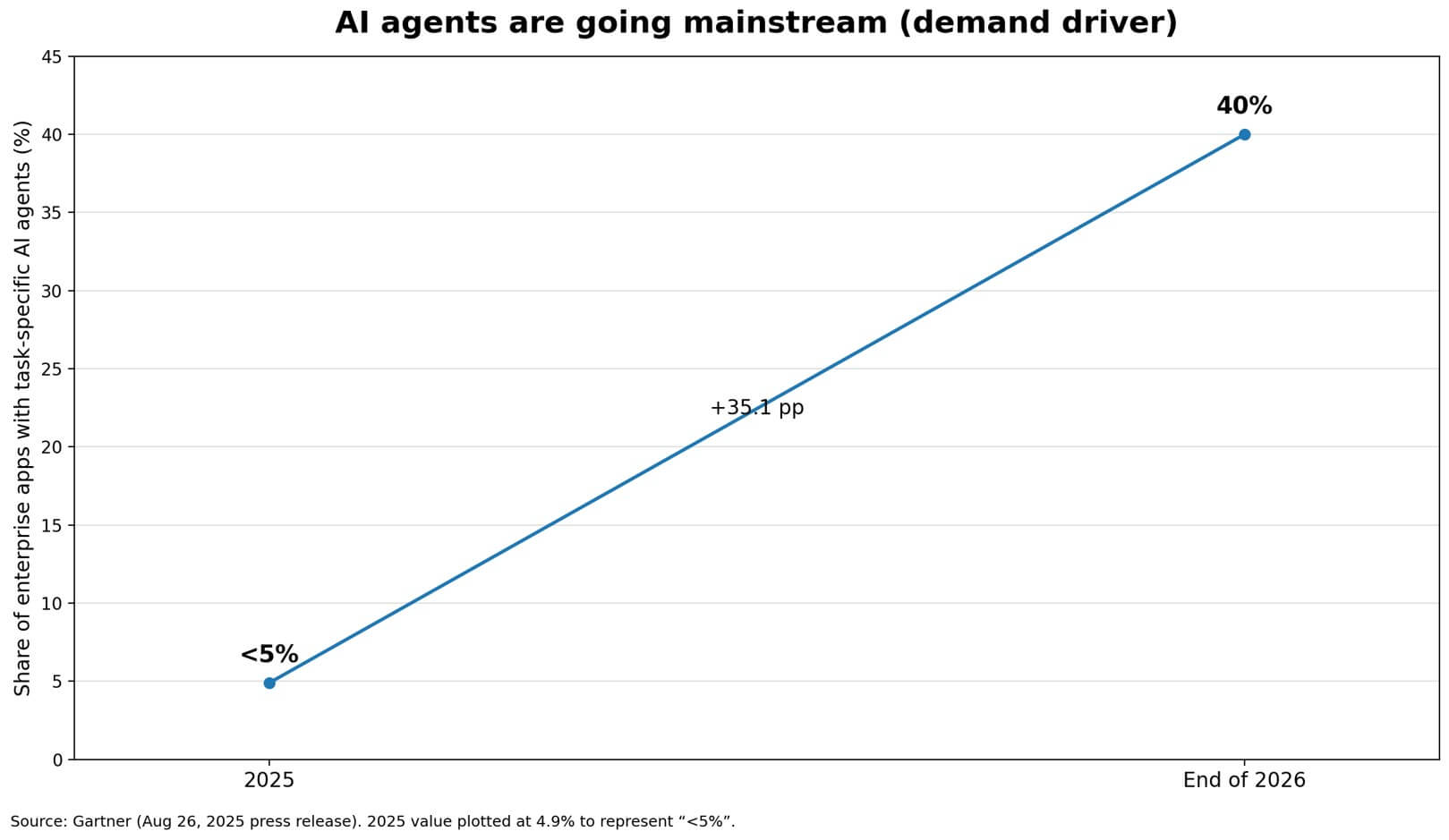

Crypto enters a “16-day danger zone” as senior crypto talent rotates into AI

Within a span of weeks in early 2026, a cluster of senior crypto operators announced they were stepping back or switching domains. Akshay BD, who spent five years building Solana's ecosystem, posted a “life update” saying he was “grateful to pass

This is what “Wall Street crypto” looks like: IBIT options went vertical as Bitcoin hit $60k intraday

Bitcoin’s slide toward $60,000 came with the usual noise from exchanges, but the sheer size of the panic was evident somewhere else. Options tied to BlackRock’s iShares Bitcoin Trust (IBIT) traded about 2.33 million contracts in a single trading day,

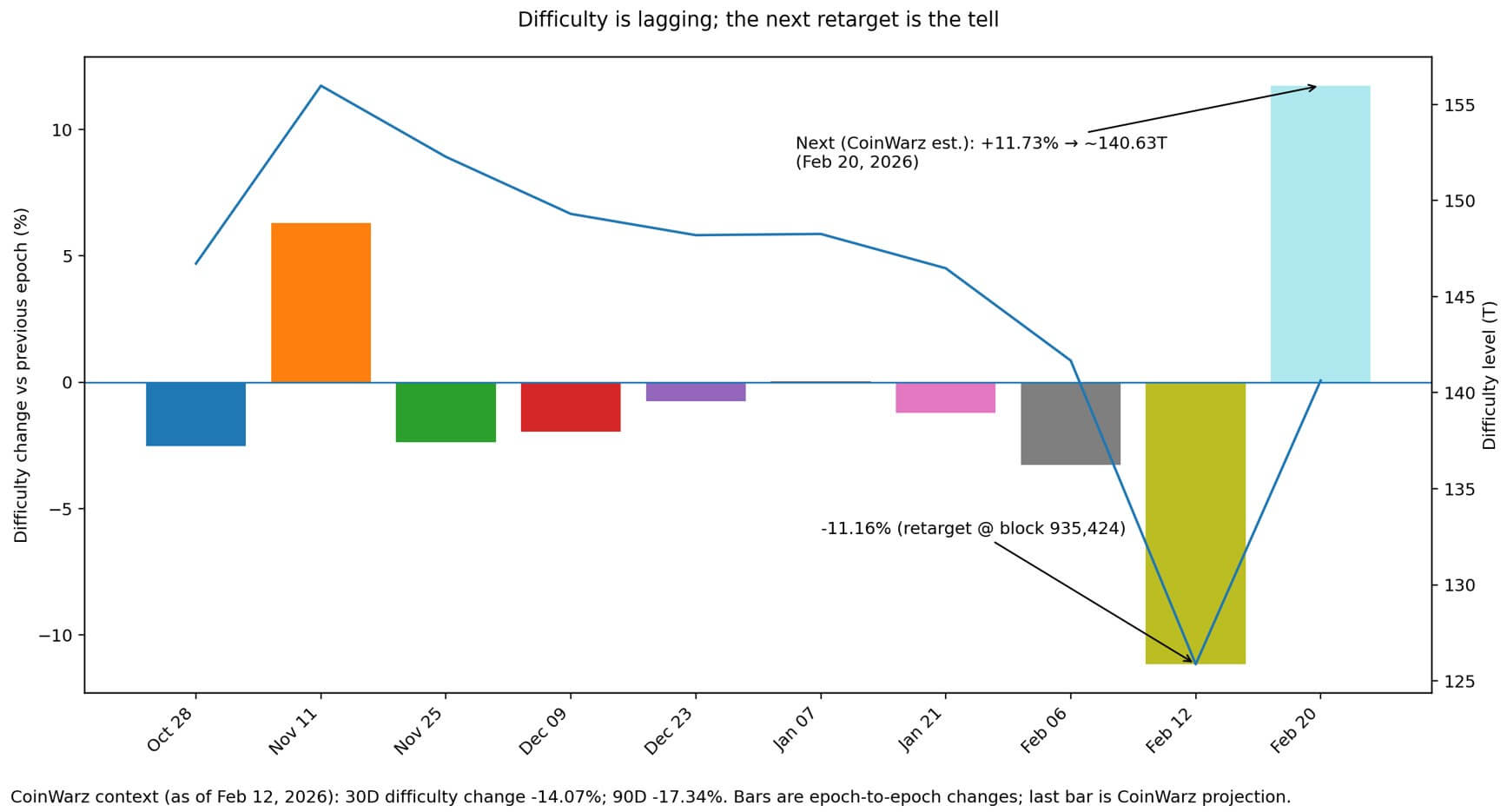

Bitcoin difficulty just printed a historic -11.16% — if the next epoch stays red, miners are in trouble

Bitcoin's mining difficulty decreased by 11.16% to approximately 125.86 trillion at the most recent retarget boundary around block 935,424. That marks the largest negative adjustment since the 2021 China mining ban, the sixth consecutive downward retarget, and the tenth largest negative

Bitcoin price recovery dream meets $18.8 trillion household debt, and one Fed decision could flip everything

The US economy is starting 2026 with an uncomfortable split-screen scenario that is complicating the outlook for Bitcoin's recovery towards $100,000. While Wall Street credit pricing still looks calm, the “real economy” stress gauges are flashing late-cycle warning lights. This disconnect matters

Coinbase lost $667M but one boring custody detail decides whether crypto ETF holders should worry

Coinbase just posted the kind of earnings report that makes two groups of people sweat at the same time. The first group is obvious, COIN shareholders who saw the company swing into a loss while crypto prices and activity cooled. Coinbase

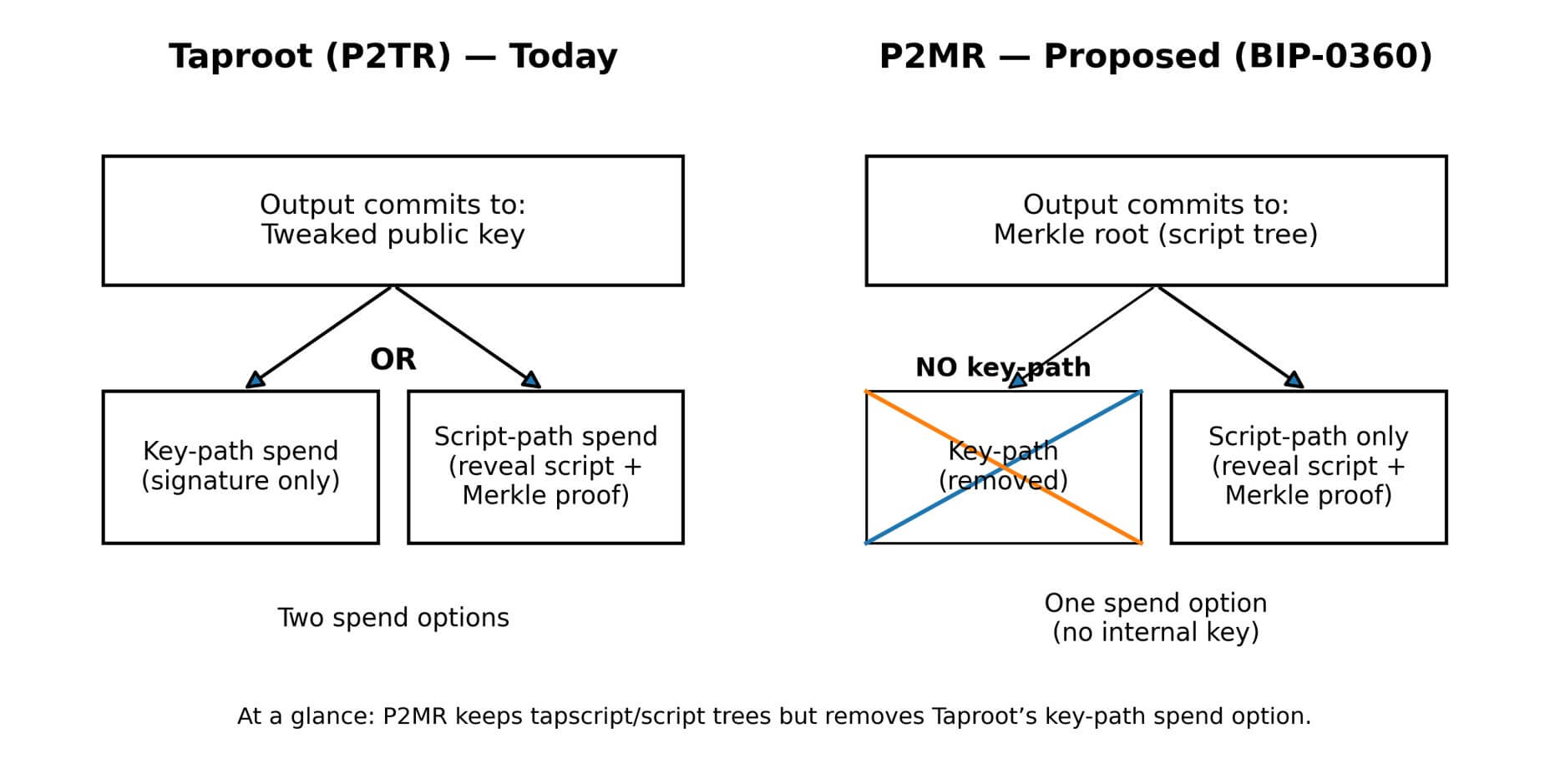

This “quantum-safe” Bitcoin idea removes Taproot’s key-path — and raises fees on purpose

Bitcoin developer contributors just cleared a documentation hurdle that crypto Twitter treated like an emergency quantum patch. It wasn't. On Feb. 11, a proposal for a new output type, Pay-to-Merkle-Root (BIP-0360), was merged into the official Bitcoin Improvement Proposals repository. No

CFTC chair just built a 35-seat crypto mega-panel, and it changes the SEC vs CFTC fight

CFTC Chair forms a new Innovation Advisory Committee packed with crypto, exchange, and prediction-market CEOs Most crypto traders barely think about the Commodity Futures Trading Commission until something breaks, a lawsuit hits, or a Bitcoin futures headline crosses their feed. In the

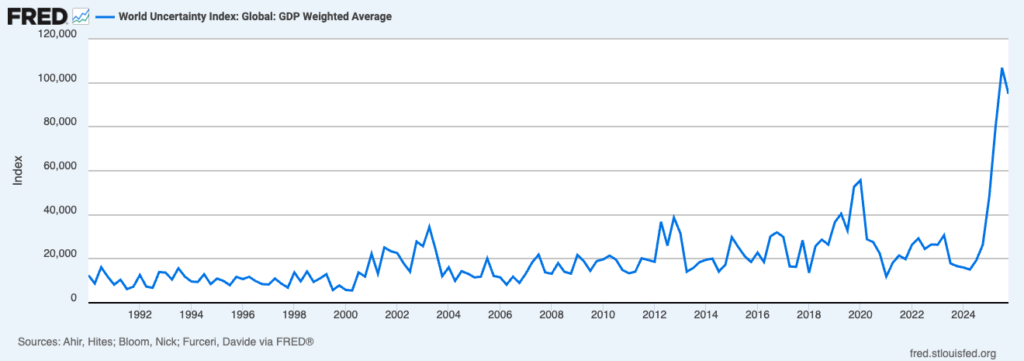

Can Bitcoin handle global economic uncertainty being worse than ever as it now doubles 2008 recession levels?

The World Uncertainty Index, a GDP-weighted measure constructed from the frequency with which “uncertainty” appears in Economist Intelligence Unit country reports, reached 106,862.2 in the third quarter of 2025 and remained elevated at 94,947.1 in the fourth quarter. WUI all-time record

Vitalik Buterin pitches Ethereum as the AI settlement layer, but one hidden leak could ruin it

Vitalik Buterin just published a research proposal that sidesteps the question everyone keeps asking: can blockchains run AI models? Instead, the research claims Ethereum as the privacy-preserving settlement layer for metered AI and API usage. The post, co-authored with Davide Crapis