Bitcoin bears could sleepwalk into a $8.65 billion trap as options max pain expiry nears $90,000

Bitcoin’s next big options gravity well sits on Mar. 27 (260327), and the reason is simple: this is where the market has parked a thick stack of conditional bets that will need to be unwound, rolled forward, or paid out

Bitcoin rocketed up 15% to get back above $70,000 but the options market is currently pricing in a terrifying new floor

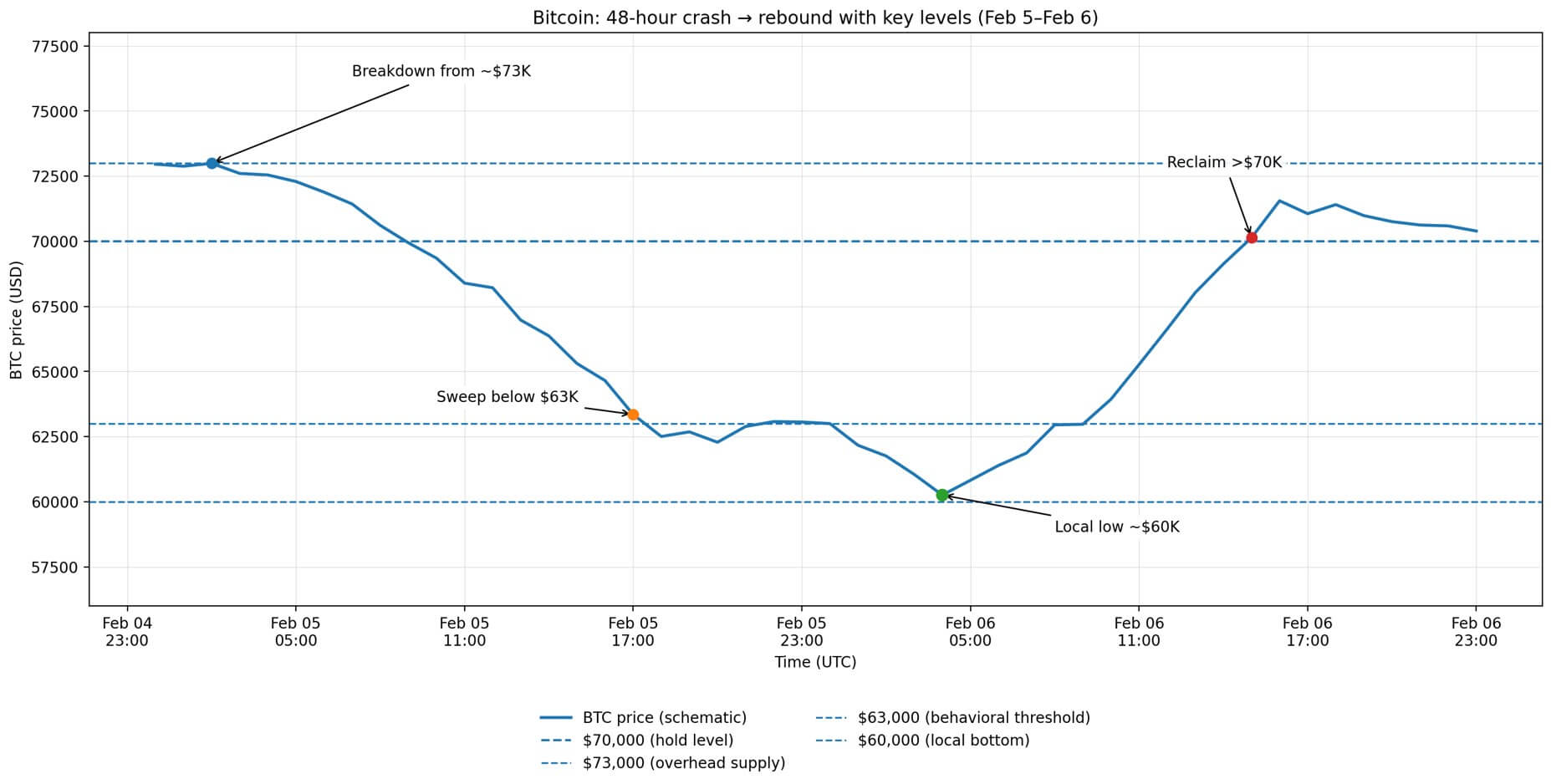

Bitcoin ripped from $60,000 to above $70,000 in less than 24 hours, erasing most of a brutal 14% drawdown that had tested every bottom-calling thesis in the market. The speed of the reversal, 12% in a single session and 17% off

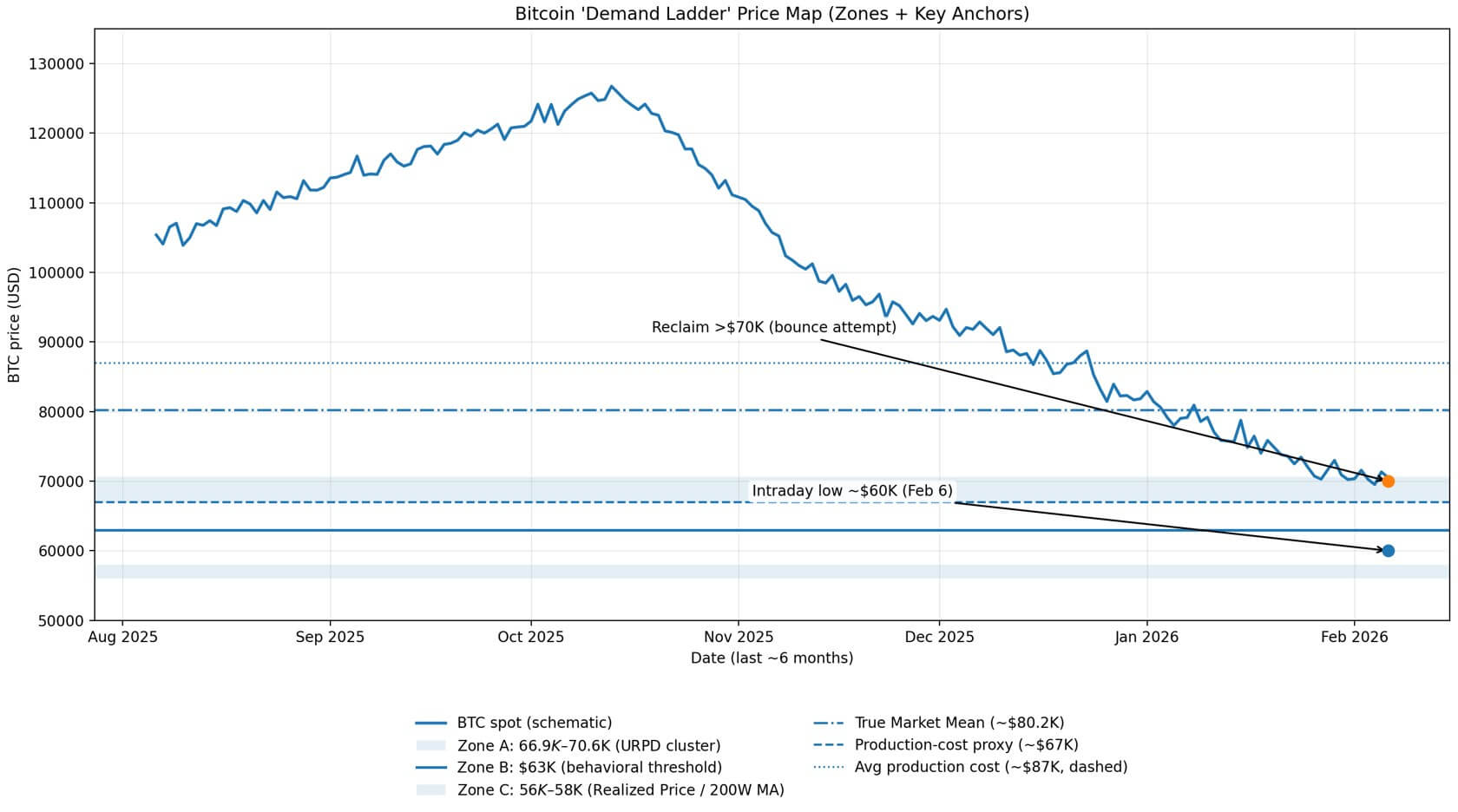

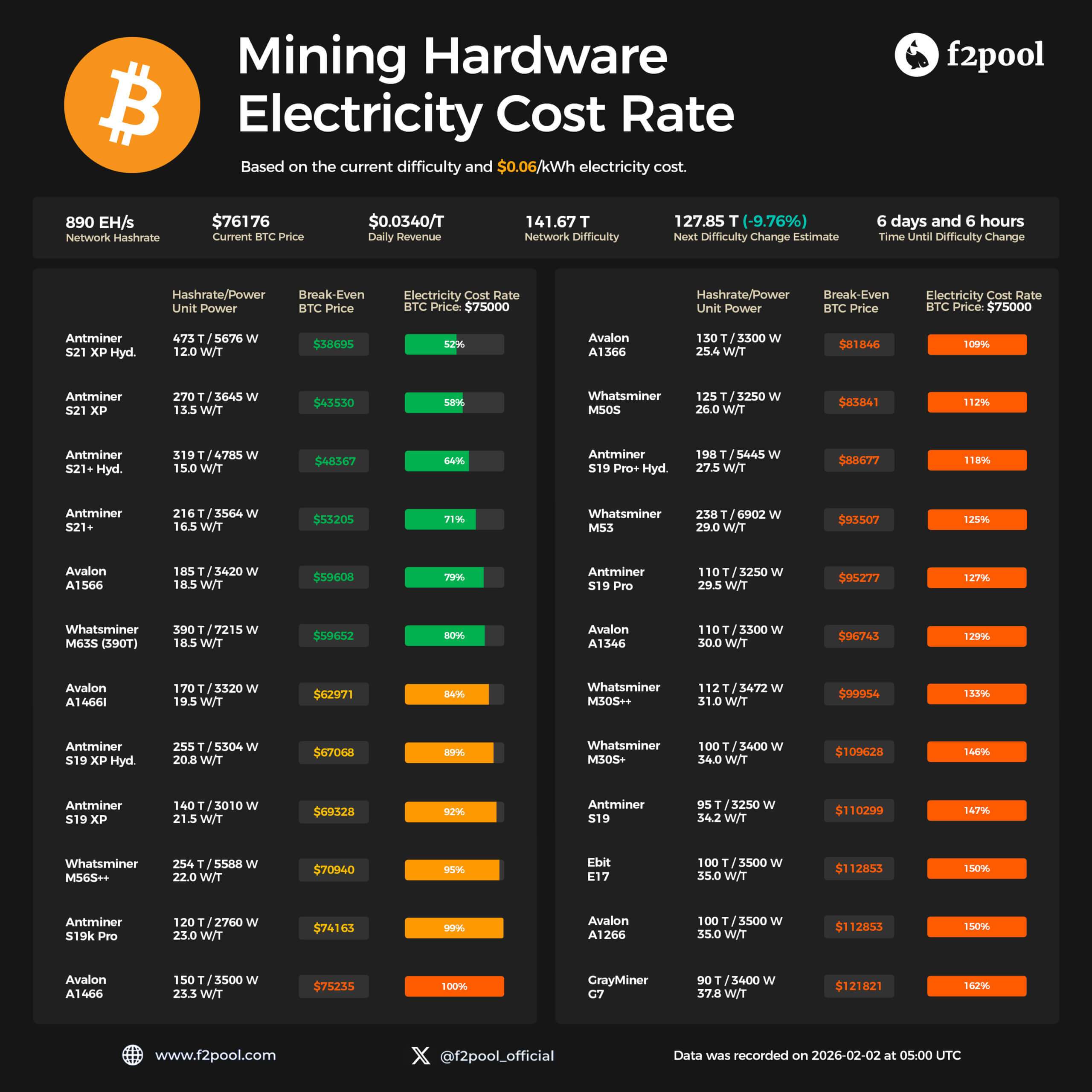

Bitcoin now at a price level it has always defended and the current $67,000 BTC mining cost matters

Trader Plan C recently surfaced a chart indicating a production-cost model placing Bitcoin's marginal mining expense at approximately $67,000, with historical price action showing repeated bounces off that red line. He added that “commodities rarely trade below their cost of production.”

Bitcoin miners have the one thing AI still needs and Big Tech has $500 billion to buy it

Big Tech companies' planned $500 billion war chest to dominate artificial intelligence could offer a lifeline to a Bitcoin mining industry teetering on the edge of capitulation. The headline numbers are eye-watering. Alphabet, Google’s parent, alone plans to spend as much

Ethereum collapses below $2,000 after Vitalik Buterin and insiders moved millions to exchanges into thin liquidity

Ethereum co-founder Vitalik Buterin and other prominent “whales” have offloaded millions of dollars in ETH since the beginning of February, adding narrative fuel to a market rout that saw the world's second-largest cryptocurrency tumble below $2,000. While the high-profile sales by

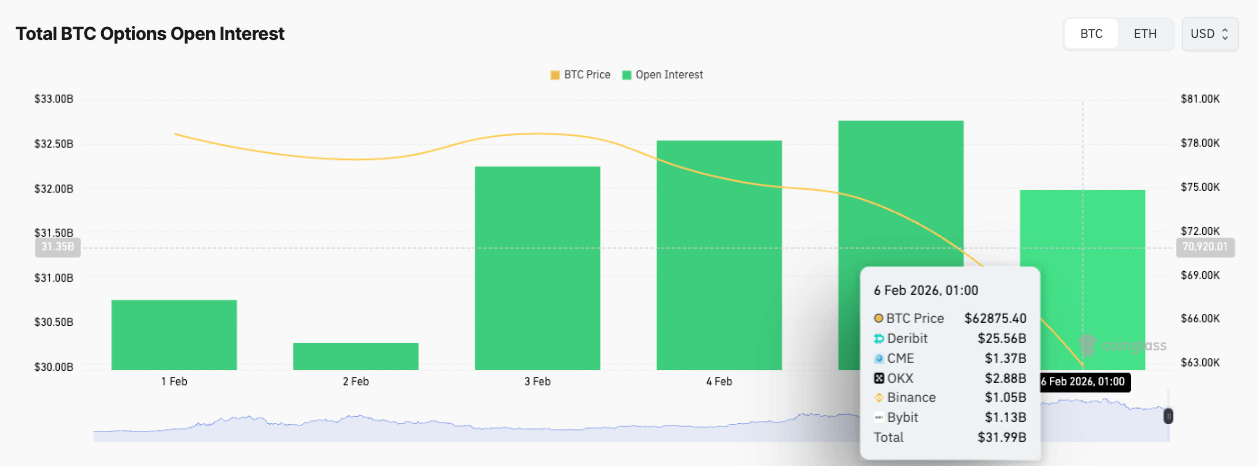

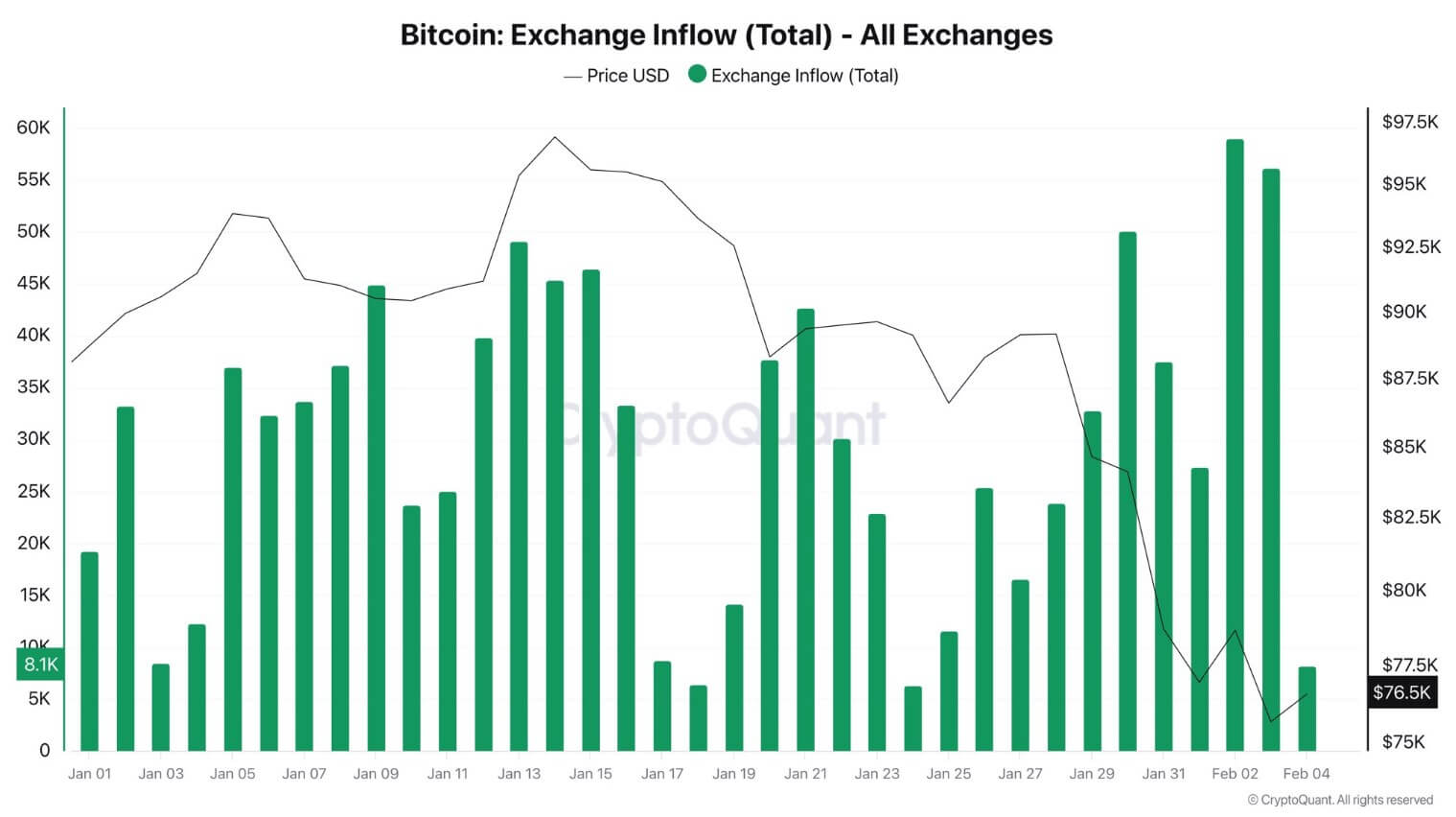

Bitcoin whales are dumping massive amounts of supply on exchanges as liquidations mirror the 2022 FTX market collapse

Bitcoin experienced a steep decline over the last 24 hours, pushing its price to approximately $60,000 amid an accelerated selloff comparable to the 2022 FTX collapse. BTC had recovered to $69,800 as of press time, according to CryptoSlate data. Still, Glassnode data

Bitcoin in critical warning zone threatening a 42% drop before the new bull run can start

Bitcoin is back in that familiar place where the chart looks ugly, the timeline feels loud, and everyone is trying to guess whether the next move is the one that finally breaks the mood. Today, Bitcoin fell below $70,000 for the

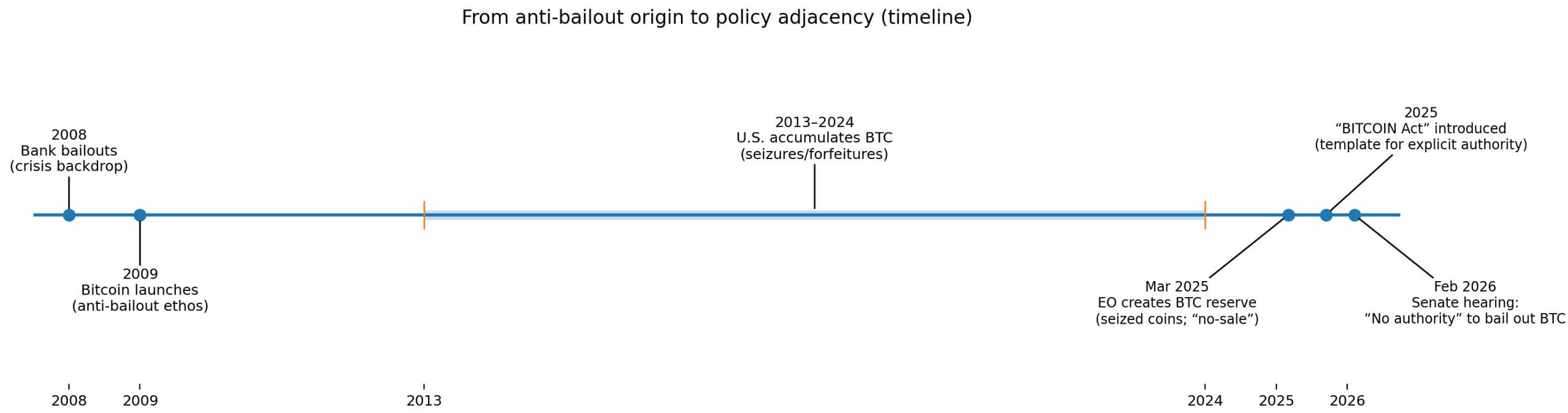

Bitcoin faces a brutal irony as the Treasury refuses to save BTC from its own political success

Treasury Secretary Scott Bessent told Congress he has no authority to bail out Bitcoin. The exchange came during a Senate Banking Committee hearing, when Senator Brad Sherman asked whether the Treasury could intervene to support cryptocurrency prices. Bessent's answer was direct:

Markets plunge as Bitcoin and silver just triggered a global margin call after inflation warnings made a recovery look impossible

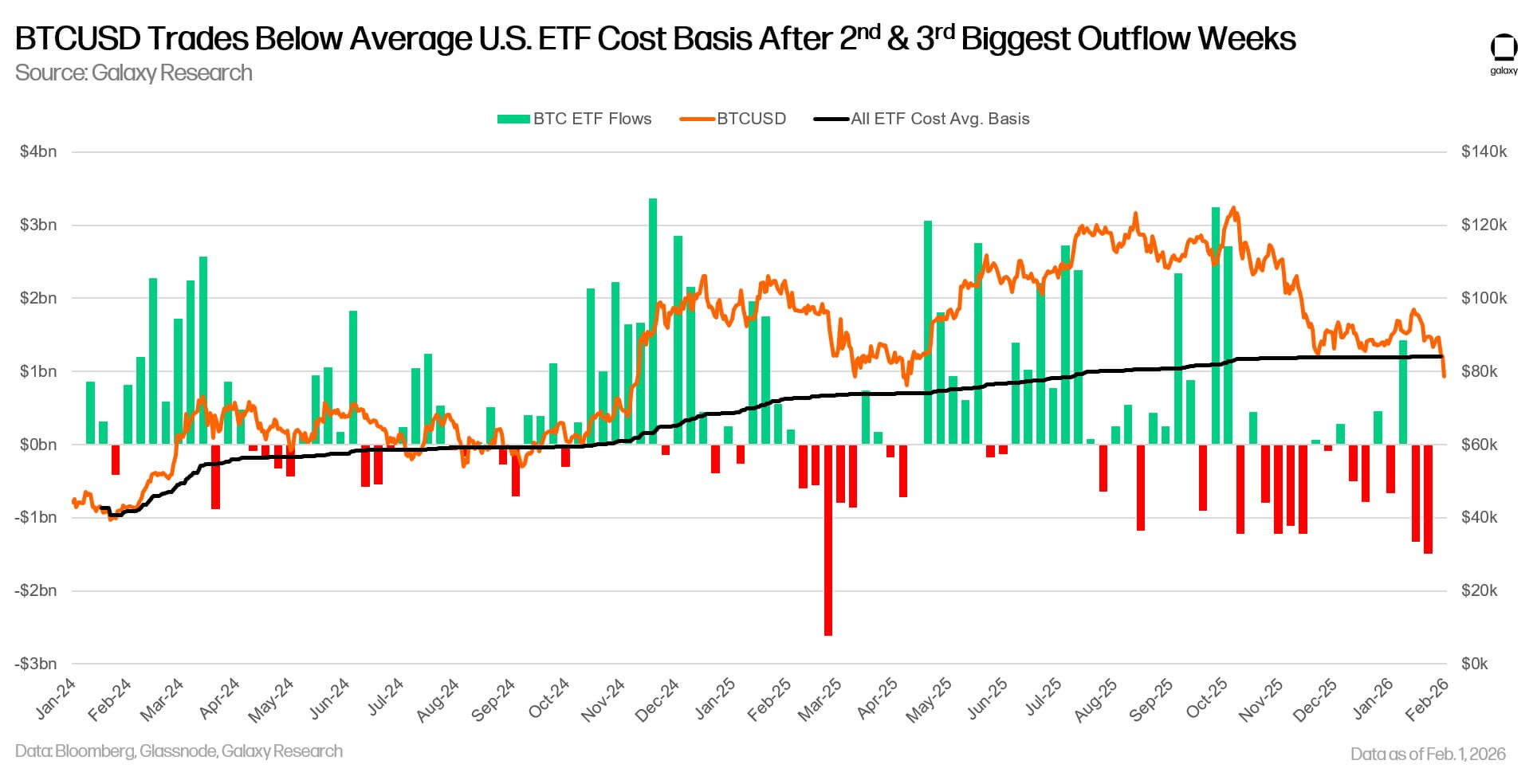

Bitcoin is plummeting toward a dangerous $56,100 price floor as massive ETF outflows signal a demand crisis At some point every cycle has the same moment, the one where the story stops being about charts and starts being about cash. You can

XRP defiant amid Bitcoin collapse as a massive institutional migration quietly shifts billions into Ripple

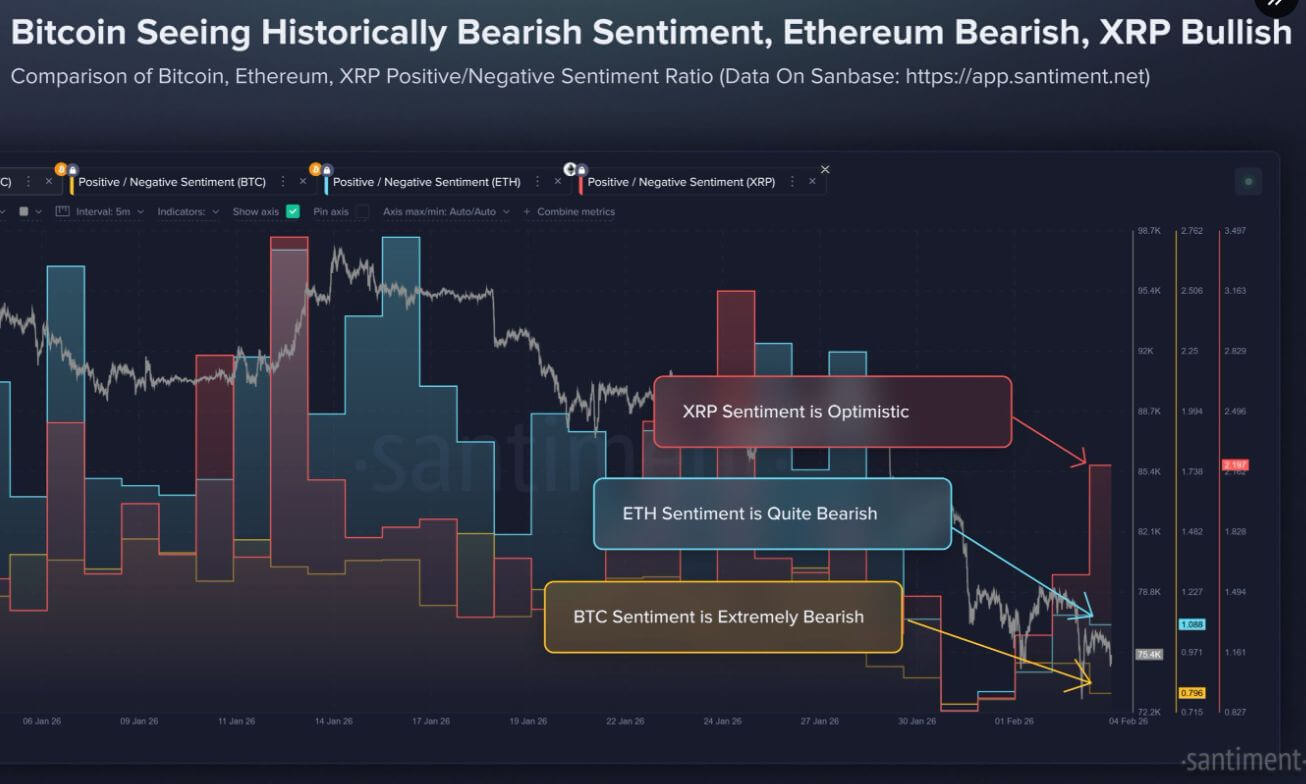

Bitcoin, Ethereum, and XRP have all retreated to deep cycle lows, dragging the broader crypto market back to valuation levels not seen since late 2024, according to CryptoSlate's data. While price action across the board appears uniformly grim, with BTC heading

Traders dump $4.3 billion BTC on Binance as exchange sells more Bitcoin than other exchanges combined

Binance moved 42.8% of total spot volume over the past week but absorbed 79.7% of net selling pressure across five major exchanges, according to data from Traderview. The imbalance raises the question of whether a venue needs to handle “most of

The scorecard for an XRP investment thesis that separates Ripple licensing from XRPL utility signals

Ripple enters 2026 with new permissions in the UK and the EU. In January, Ripple said it received UK Financial Conduct Authority permissions covering an Electronic Money Institution (EMI) license and cryptoasset registration. On Feb. 2, it said it received full EMI

Bitcoin trapped below $80,000 as the strongest US factory signal since 2022 threatens further liquidations

The United States factory engine just delivered its loudest “risk on” signal in years, and it is landing at a brutally awkward time for Bitcoin. On Feb. 2, Howard Lutnick, the United States Secretary of Commerce, announced that: “The United States has

Bitcoin supply guide: When holders sell, miners strain, and ETFs add pressure

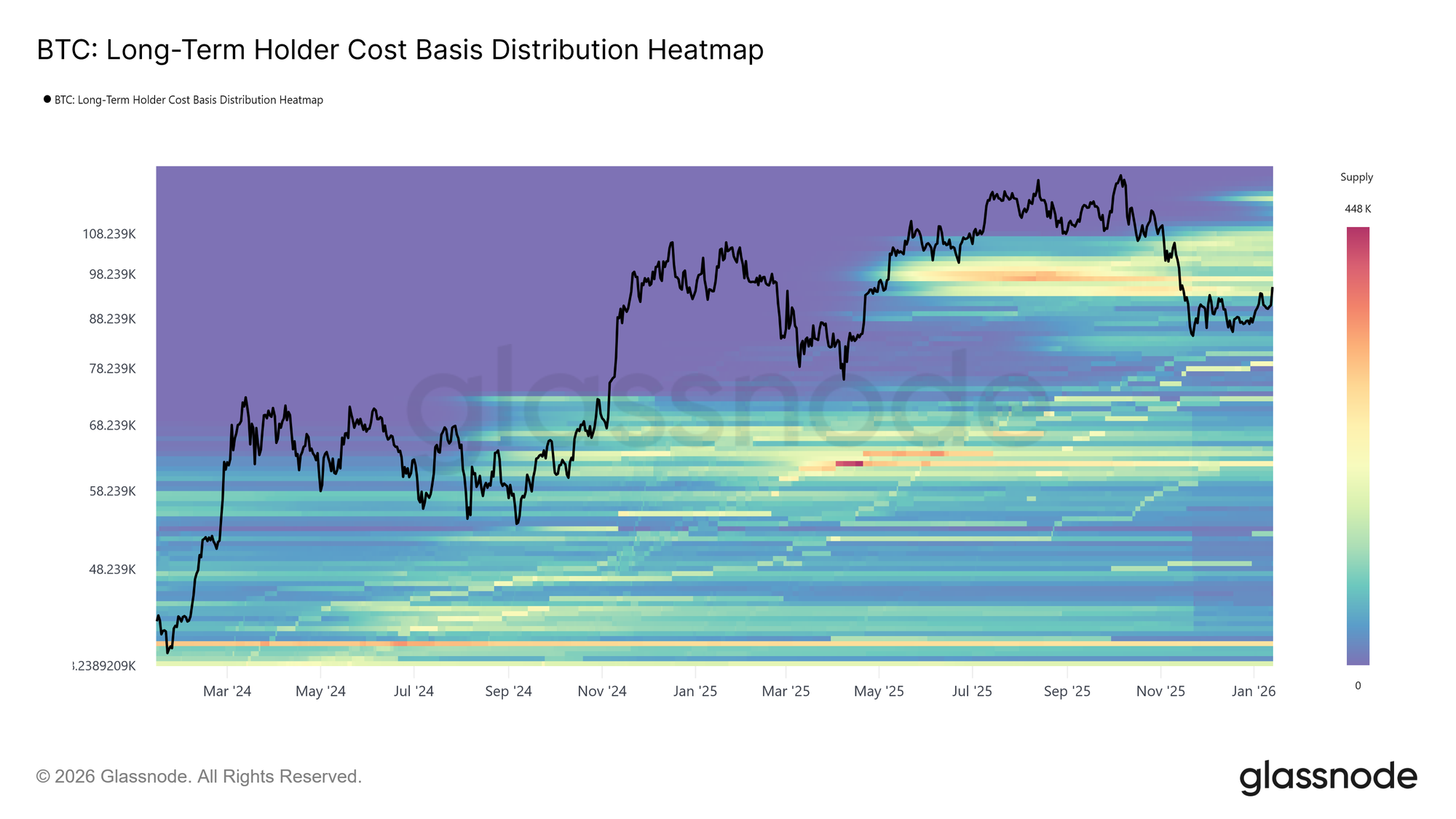

Bitcoin supply guide: cost-basis bands, miner stress, and ETF flow signals Bitcoin is currently trading outside a $93,000–$110,000 cost-basis band that Glassnode frames as an “overhead supply” zone. BTC long term holder cost basis distribution heatmap (Source: Glassnode) That setup puts the next

Bitcoin mining revenue hits historic low as infrastructure is sold to AI giants permanently altering the network’s security

The euphoria of October’s record highs has evaporated, leaving the industrial backbone of the Bitcoin network facing a brutal reality check. According to CryptoSlate's data, Bitcoin is currently trading near $78,000, a level that represents a punishing decline of more than

Bitcoin in freefall hitting lowest price since Trump took office as leverage turns a macro wobble into a brutal cascade

Bitcoin fell around 8% on Feb. 3, briefly losing the $73,000 level. A quick rebound took prices to $74,500 as of press time, dampening the intraday correction to 5.8%. The decline marks the lowest price point in the President Donald Trump

Bitcoin price today jumps after 11% weekend dump as global markets open with bullish intent

Bitcoin just erased over $9,000 in a weekend liquidity trap and the Monday recovery is missing one thing By the time London desks started lighting up this morning, Bitcoin had already moved sharply in off-hours trading. Over the weekend, while most of

Bitcoin triggers $7B loss for ETF holders as price could drop to $65,000 while Strategy (MSTR) sits on billion dollar cushion

Bitcoin’s slide below $80,000 has pushed a significant portion of US spot BTC exchange-traded fund (ETF) buyers into $7 billion in paper losses. According to CryptoSlate's data, the world’s largest digital asset fell to as low as $74,609 over the weekend amid