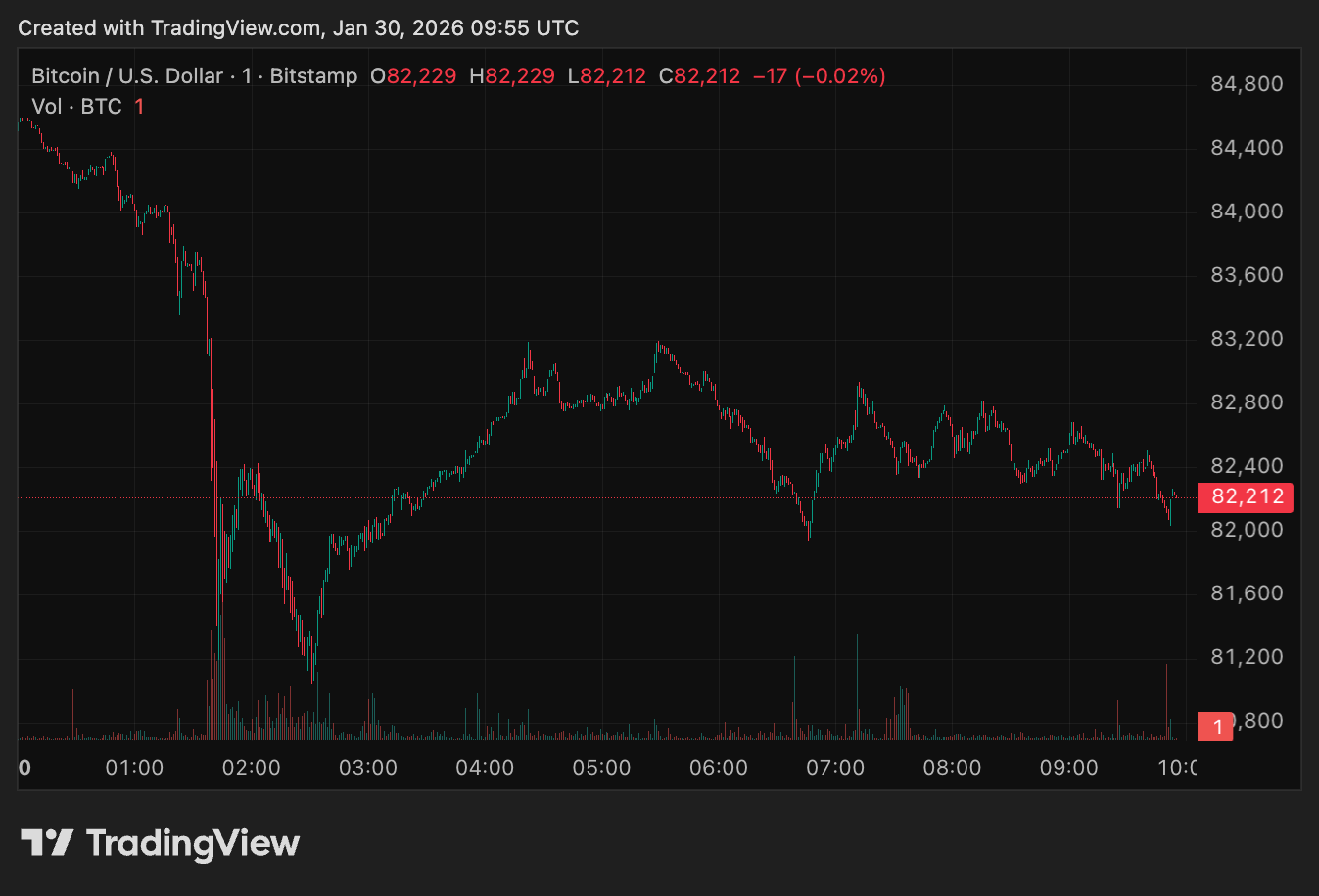

Groundhog Day for Bitcoin means six more weeks of macro winter if core flows stay deep red

Groundhog Day for Bitcoin: six more weeks of macro winter? Bitcoin got its own Groundhog Day moment today as Punxsutawney Phil “saw his shadow” on the 140th Anniversary of the celebration and signaled six more weeks of winter, just after BTC

UAE royal bought Trump influence through reported $500M investment in WLFI digital dollar

New reports says Abu Dhabi royal Sheikh Tahnoon bin Zayed al-Nahyan, or investors tied to him, agreed in January 2025 to invest $500 million into Trump-linked World Liberty Financial for about a 49% stake. WLFI, the governance token of World Liberty

Japan bond market chaos threatens unprecedented Bitcoin liquidations as the era of free money ends

Japan spent decades as the world’s best destination for the world's easiest funding trade. You could borrow yen at very low rates, buy almost anything with a higher yield, hedge just enough to feel responsible, and assume the Bank of

Bitcoin institutions finally admit this is a bear market – so why do 70% say the price is still undervalued?

In a global investor survey from Coinbase Institutional and Glassnode, 1 in 4 institutions agreed that crypto has now entered a bear market. Yet the majority of institutions still said Bitcoin was undervalued, and most said they had held or

A sudden shift in Ethereum staking is draining billions from exchanges toward a new corporate elite

By the end of 2025, a corner of the market most Ethereum traders rarely watch had built a position large enough to matter for everyone else. Everstake’s annual Ethereum staking report estimates that public companies’ “digital asset treasuries” collectively held roughly

As global “Bye America” investors ditch US risk, Bitcoin is finally ready to be the macro alternative

The “Bye America” trade has a habit of returning when markets stop debating whether the US is still the safest house on the block and start debating the price of living in it. Over the past week, that debate has shown

Shock surge in inflation destroys hopes for early rate cuts as Bitcoin price sinks

The December Producer Price Index didn't just beat expectations, but it also revealed a persistent problem that forces markets to rethink the entire 2026 rate path. Final demand PPI rose 0.5% month-over-month, the sharpest jump since July, driven almost entirely by

Crypto market crashes erasing $220B as Israel strikes Gaza with ETH and XRP leading weekend losses

Ethereum and XRP just fell off a cliff in weekend trading, Bitcoin barely flinched, and the timing might matter Crypto has a habit of saving its worst moves for the hours when people are least prepared to deal with them. That was

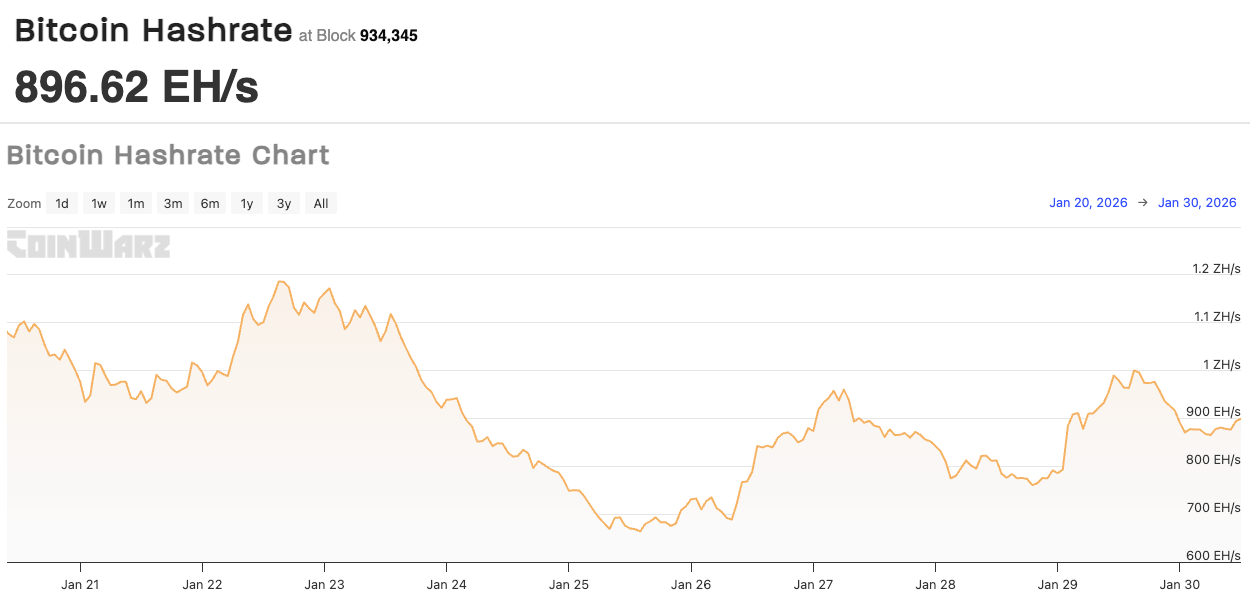

Bitcoin miners are making millions by shutting down because of a massive US winter storm

Earlier this week, a sweeping US winter storm pushed Bitcoin miners to curtail, pulling a noticeable chunk of computing power off the network in a short window. Data shows a 40% dip in hashrate between Jan. 23 and Jan. 25, with

Trump’s Fed pick Kevin Warsh is “not nervous” about Bitcoin while plotting a digital dollar takeover

President Donald Trump announced he will nominate former Federal Reserve Governor Kevin Warsh to lead the US central bank. In a Jan. 30 post on Truth Social, the president confirmed the selection, writing:

First US bank collapse of 2026 adds to gold, silver, and Bitcoin chaos while $337B in unrealized contagion looms

Late on Friday, Illinois regulators shut down Metropolitan Capital Bank and Trust, a little-known institution with just $261 million in assets, handing control to the FDIC in what was officially a routine resolution. But it landed in the middle of a

Bitcoin reversal on the cards after $1.7 billion liquidation wave flushed out overleveraged traders

Bitcoin’s Thursday slide was a perfect illustration of a market that lost its marginal buyer and then discovered, in real time, how much leverage was sitting on top of that demand. The move wasn't a smooth ride lower; it came in

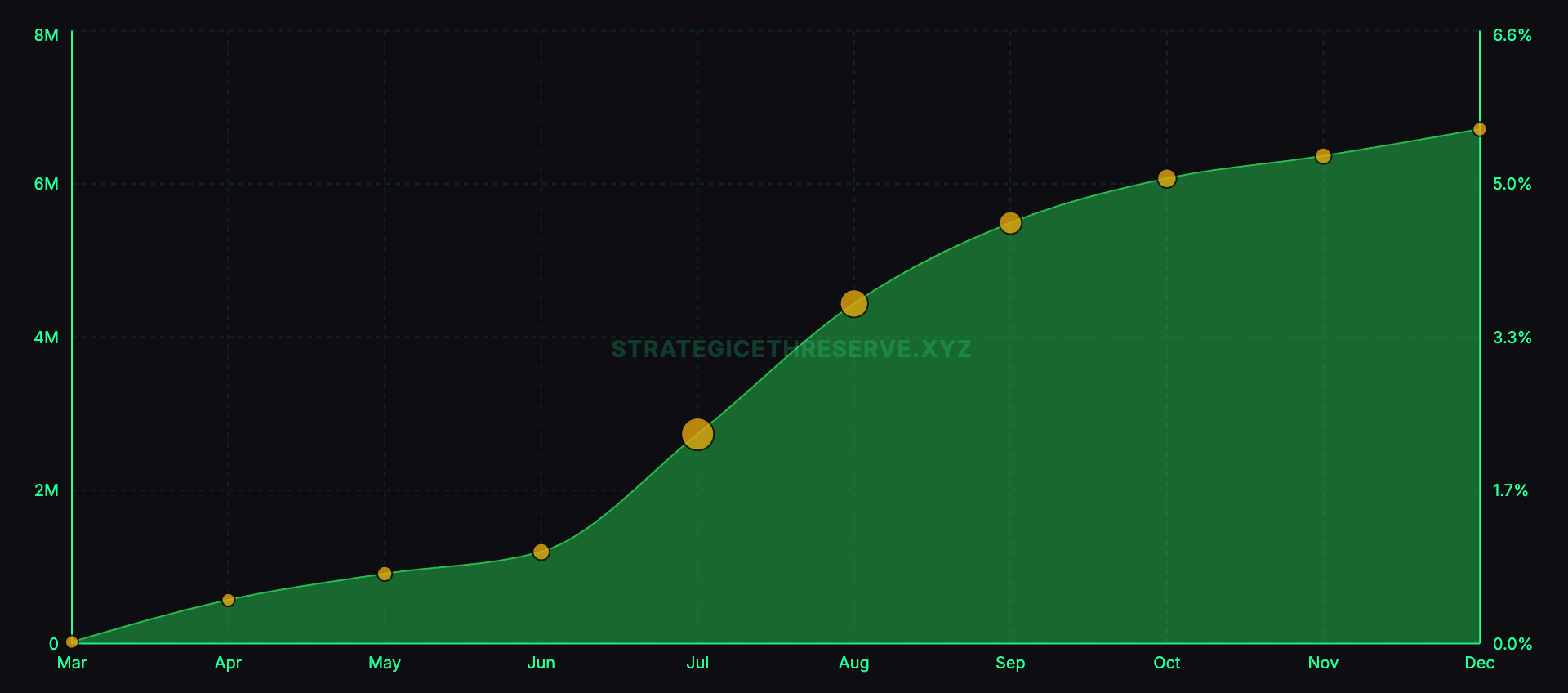

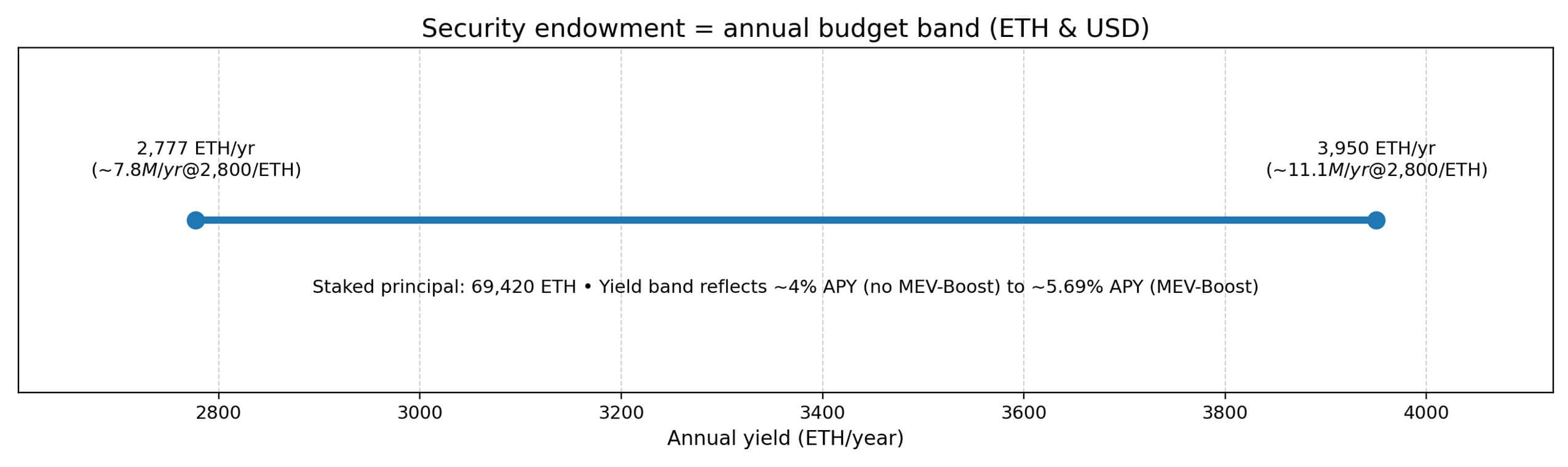

TheDAO’s leftover rescue money sat for a decade now it’s becoming Ethereum’s permanent $220M security budget

Ethereum's most infamous experiment is back. Not as a venture fund, but as something the ecosystem arguably needs more: a permanent security budget. On Jan. 29, a group of Ethereum veterans announced plans to convert roughly 75,000 ETH in decade-old recovery

October Trump tariff trader loses $100M erasing all 10/10 gains after price dip

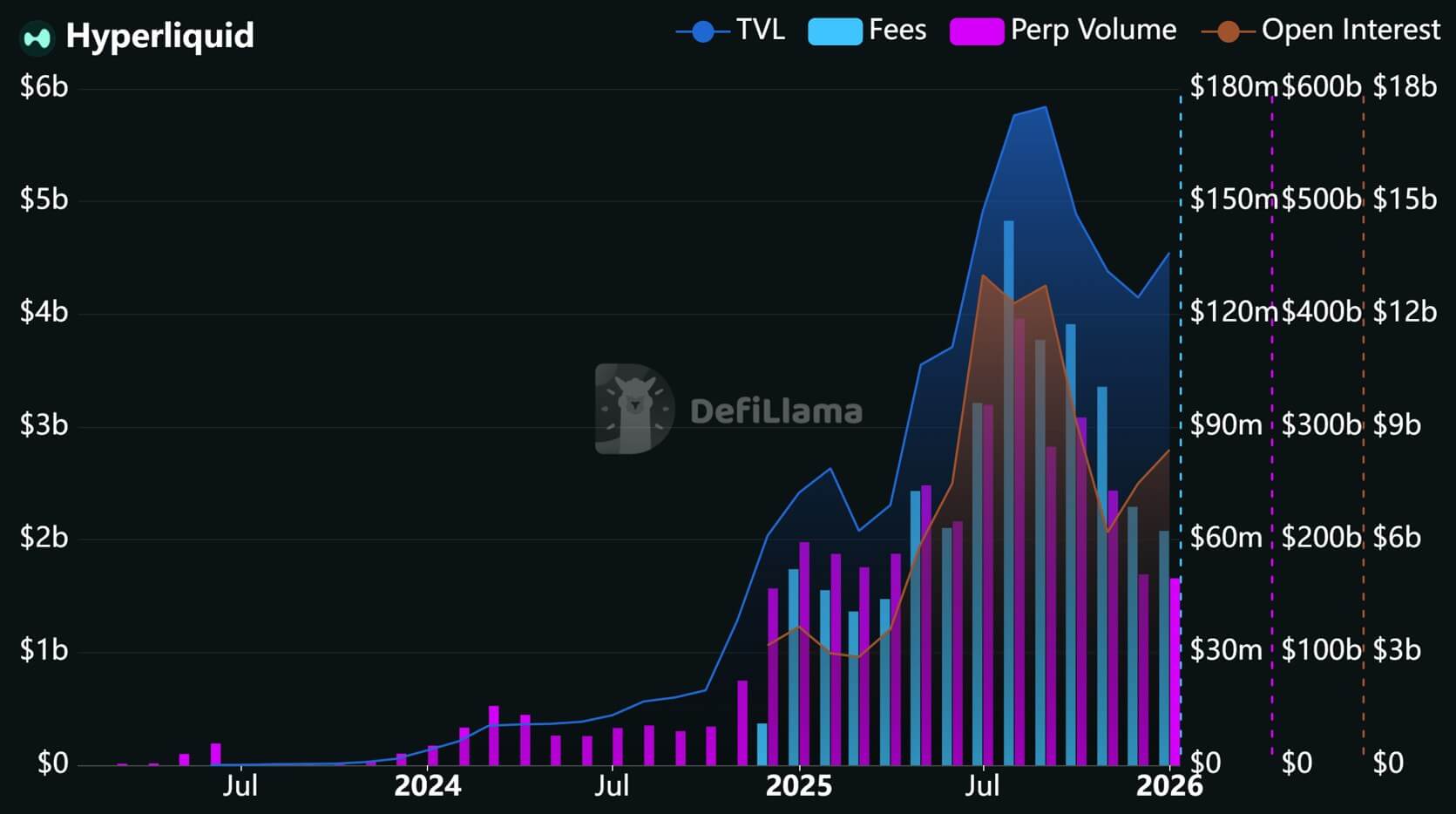

A single wallet roundtripped $142.5 million in unrealized profit on Hyperliquid, peaking on Jan. 13 before collapsing to a negative $8.76 million loss as of Jan. 29. Meanwhile, all of this was visible in real time through public dashboards. The trader

Gold just erased $5.5 trillion in value and Bitcoin bulls see one huge opening ahead

Gold’s record-breaking rally finally blinked this week, and Bitcoin’s traders are watching what comes next. After sprinting to an all-time high of $5,594.82 per ounce, spot gold slid to around $5,330 as investors took profits, a pullback of roughly 4.7% from

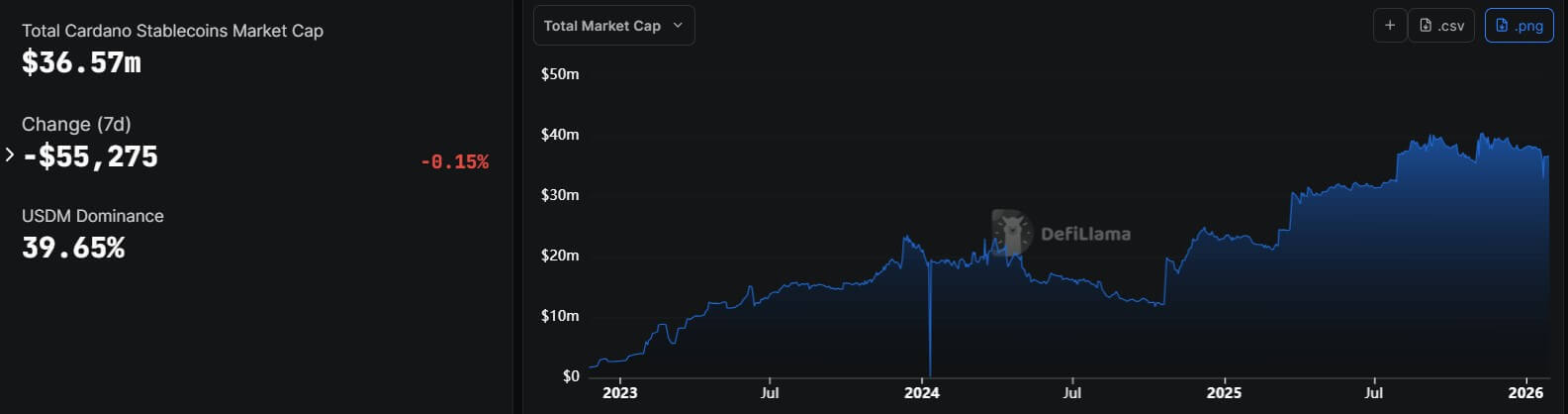

Cardano secures $70B liquidity injection that finally solves the network’s biggest missing piece for investors

On Jan. 30, Cardano founder Charles Hoskinson announced that he has signed an integration agreement to bring USDCx, a Circle-linked stablecoin product, to the Cardano ecosystem. The infrastructure move represents a strategic effort to lower the network’s DeFi growth ceiling by

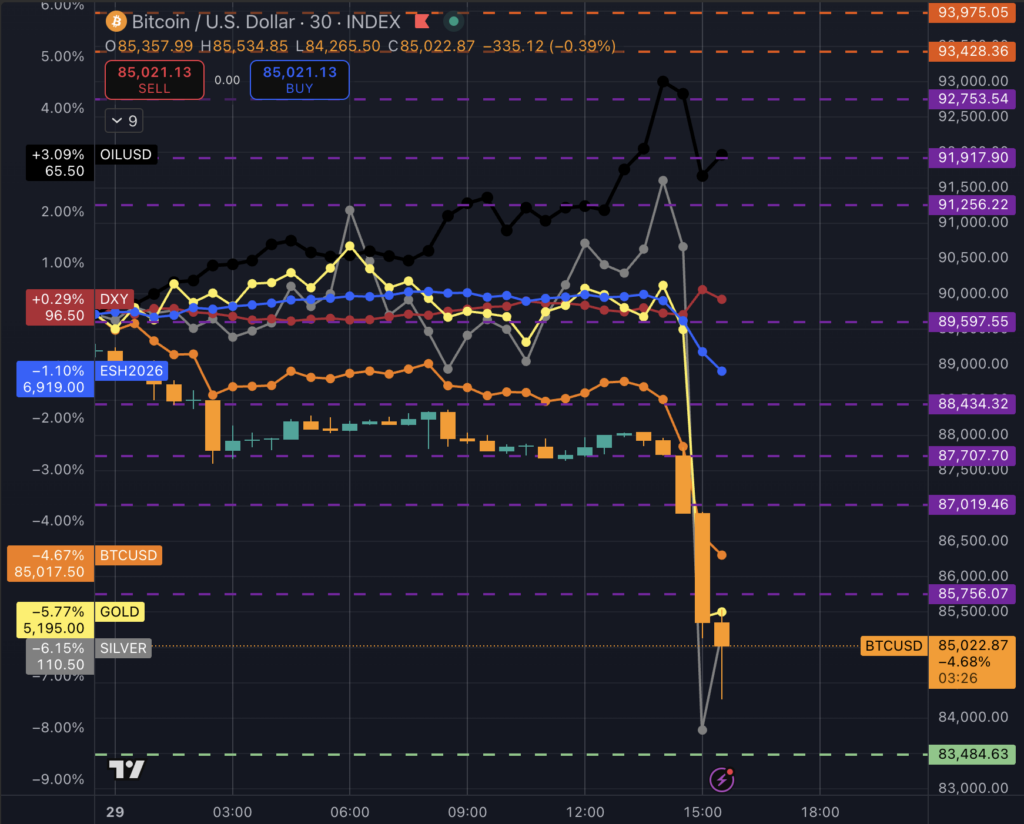

Global markets crash as everything including Bitcoin sells off at once erasing trillions

Markets dumped into the US open, Bitcoin fell through $85k, gold slipped too At 09:30 EST the tape changed in a way traders can feel in their stomach, the kind of flip where you stop looking for clever explanations and start

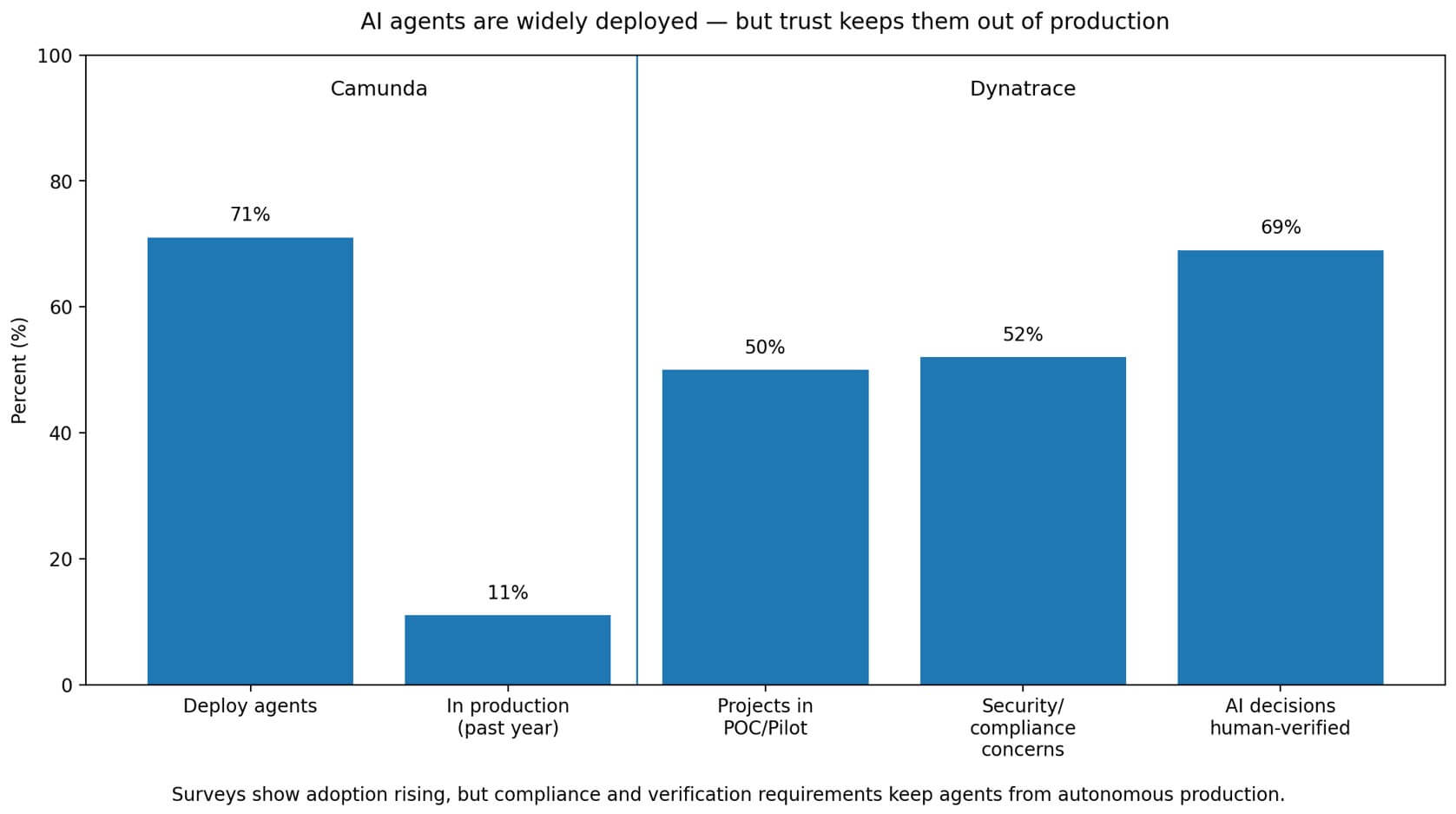

Ethereum aims to stop rogue AI agents from stealing trust with new ERC-8004 – but will it?

Ethereum (ETH) announced ERC-8004 is heading to mainnet, positioning the network as a neutral infrastructure for a problem the AI industry can't yet solve: how agents prove they're trustworthy when no single platform controls the reputation layer. The timing reveals the